Manitoba farmland values led the way with the highest average percentage increase in Canada last year, says Farm Credit Canada (FCC).

But the pace of increases the last few years here and across Canada is slowing in step with the plateauing of farm cash receipts, and slower drop in interest rates, J.P. Gervais, FCC’s chief agricultural economist, told reporters in a briefing ahead of the release of FCC’s annual Farmland Values Report April 11.

“Producers should prepare for a possible easing of farmland values, although the latest Farm Credit Canada Farmland Values Report indicates average values continued to increase in Canada in 2015,” FCC said in an news release.

Gervais said he expects Canadian farmland prices this year to increase, on average, two to four per cent in contrast to American corn belt prices, which have fallen five to six per cent.

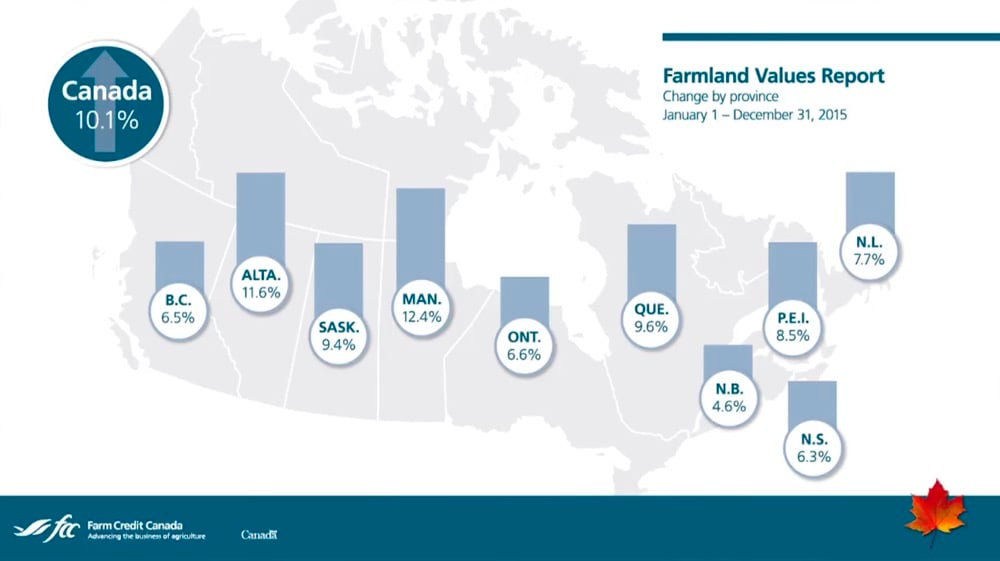

On average, Manitoba farmland values increased 12.4 per cent in 2015 versus a 12.2. Alberta, Quebec and Saskatchewan followed up 11.6, 9.6 and 9.4 per cent, respectively from 2014 (see graphic below).

The national average increase in farmland value was 10.1 per cent.

Gervais stressed FCC’s averages are weighted by a province’s acres.

And he added just because, on average farmland prices went up in Canada, it doesn’t mean the value of every acre increased.

For example, 50 per cent of FCC’s benchmark acres in Saskatchewan saw little or no increase or even a slight decrease in value in 2015, Gervais said.

“Nobody knows what farmland values are going to look like in 2016.” he said. “For me it’s about giving the message that from a risk management stand point make sure if you’re looking at buying some land it makes sense at the margin… that you can cash flow it… and have a strong ability to repay the loan you’re going to buy that land,” Gervais said.

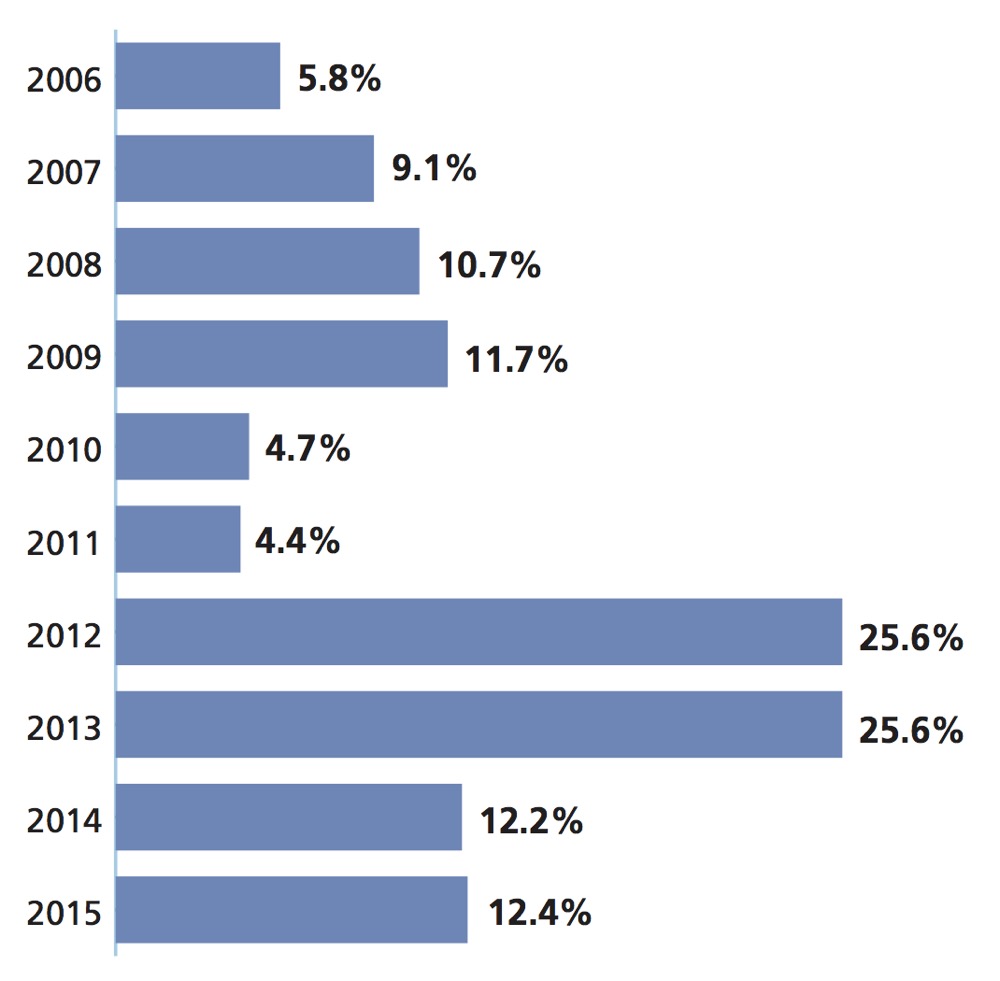

Manitoba farmland values have been rising since 1992. But FCC figures show over the last four years, on average, Manitoba farmland values have doubled. In 2012 they jumped 25.6 per cent and did the same in 2013. The pace of the increase fell to 12.2 and 12.4 per cent in 2014 and 2015, respectively.

“Crop production land (in Manitoba in 2015) was purchased mainly by local producers expanding their farming operations as the next generation enters the industry,” the FCC report says. “The majority of the province experienced normal to good yields along with average commodity prices, which supported the increase in farmland values. Southeast Manitoba saw many livestock producers expanding and purchasing cultivated land and additional land to facilitate manure management. While the slump in the oil industry has not yet affected land prices in the southwest of the province, market activity was quiet and limited to primarily estate sales.”

Bountiful farm cash receipts and low interest rates are the primary driver behind the rise in Canadian farmland values in recent years, Gervais said.

Read Also

Irrigators jumping with joy over Alberta snowpack predictions

Alberta irrigated farmers gets good news with snowpack shaping up to be the best the area has seen in a decade to fill the reservoirs for the thirsty crops for the growing season.

And while FCC had predicted lower farm cash receipts in 2015 in the wake of growing world grain and oilseed stocks, farm revenues were a “pleasant surprise,” and could turn out to be a record once all the data is in, he said.

Canada’s weaker dollar has been the saving grace.

“I think the key for us is to see a dollar that’s not going to move up too fast,” Gervais said. “I think that producers are still able to produce a profit, on average, (and) that really relies on the Canadian dollar staying in that 75 to 80 cent range. If there’s a risk out there I would say it’s with respect to the Canadian dollar and the ability for producers to produce a positive profit.”

Some observers have worried the recent rapid rise in Canadian farmland prices is a bubble that could burst. But Gervais said the ratio of farmland values to farm cash receipts is close to those of the last 50 years.

“What this suggests to me given the (cash) receipts, given where interest rates are, farmland valuations rest on sound, economic arguments.,” he said.

“Over all I think valuations are in line with what we find for economic trends in the marketplace, but definitely there are areas to monitor in terms of risk and income coming down is one of them and interest rates — not in 2016 but down the road — are something we are monitoring.”