MarketsFarm — Growing strength in the U.S. dollar has hurt commodity prices on the Chicago Board of Trade (CBOT), according to Terry Reilly, grains analyst for Futures International in Chicago.

The impetus for the gain was comments from U.S. President Donald Trump, who remarked a trade deal with China could come sooner rather than later. Trump’s comments came a day after he scorned China for its trade practices.

“It’s one of the largest one-day rallies we’ve seen since Aug. 26,” Reilly said of the greenback’s strength.

Read Also

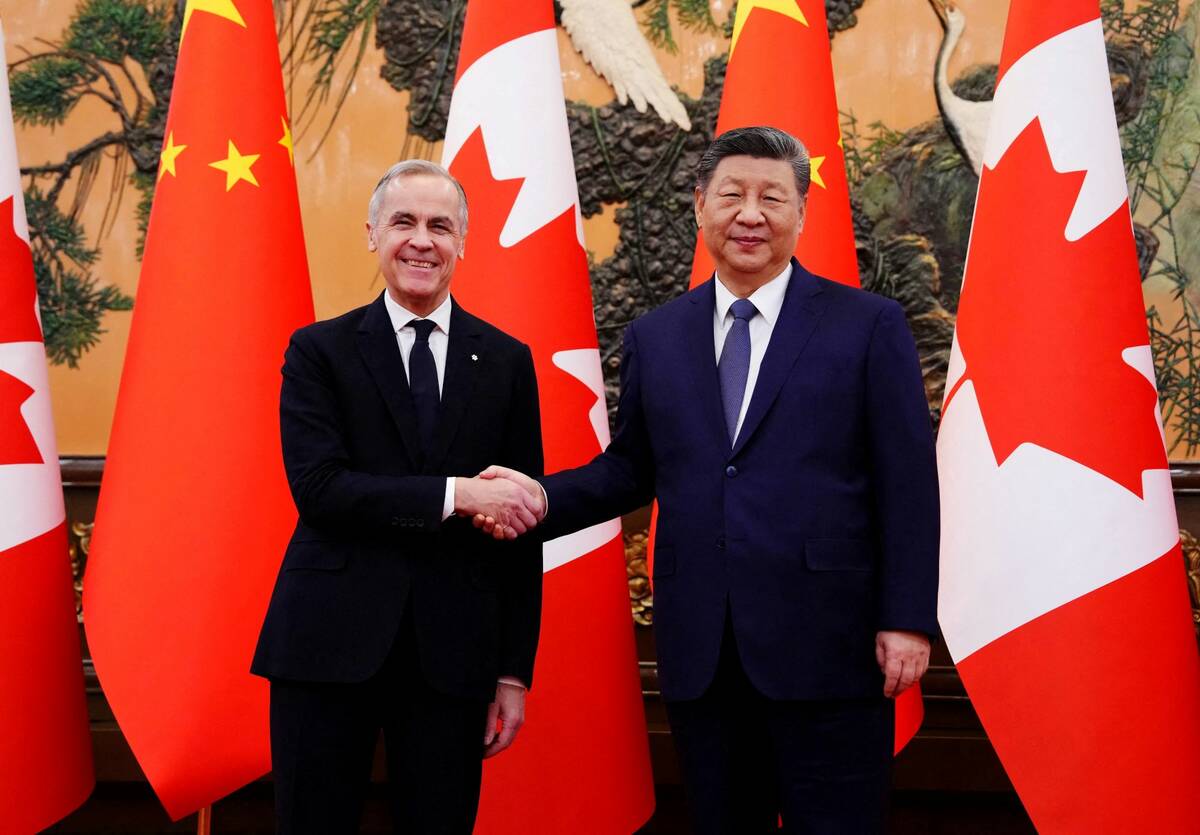

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

Prices for the CBOT soy complex have been lower because traders are disappointed in the lack of confirmation regarding soybean sales to China, he stated.

Weather as well has affected the Chicago market, as most of the continental U.S. is experiencing its second-warmest September on record, Reilly said. In turn, that’s left farmers with good conditions for their crops.

However “Minneapolis wheat is rallying on unfavourable weather for spring wheat in Canada and the U.S.,” the analyst said.

Reilly also commented that corn has struggled of late because of concerns for its demand, as ethanol production is down at its lowest levels in two years.

— Glen Hallick reports for MarketsFarm, a Glacier FarmMedia division specializing in grain and commodity market analysis and reporting.