MarketsFarm — The Canadian canola stocks-to-use ratio was over 20 per cent at the end of 2019 — significantly higher than the five-year average of 13.4 per cent.

“That’s part of the reason why we’re seeing downward pressure on canola prices,” Craig Klemmer, chief agriculture economist for Farm Credit Canada (FCC), explained during his presentation at Ag Days in Brandon, Man.

FCC released a report Tuesday detailing the 2020 outlook for Canada’s oilseed sector. The report emphasized improving trade relations with China was integral to reducing the year-end stocks-to-use ratio.

Read Also

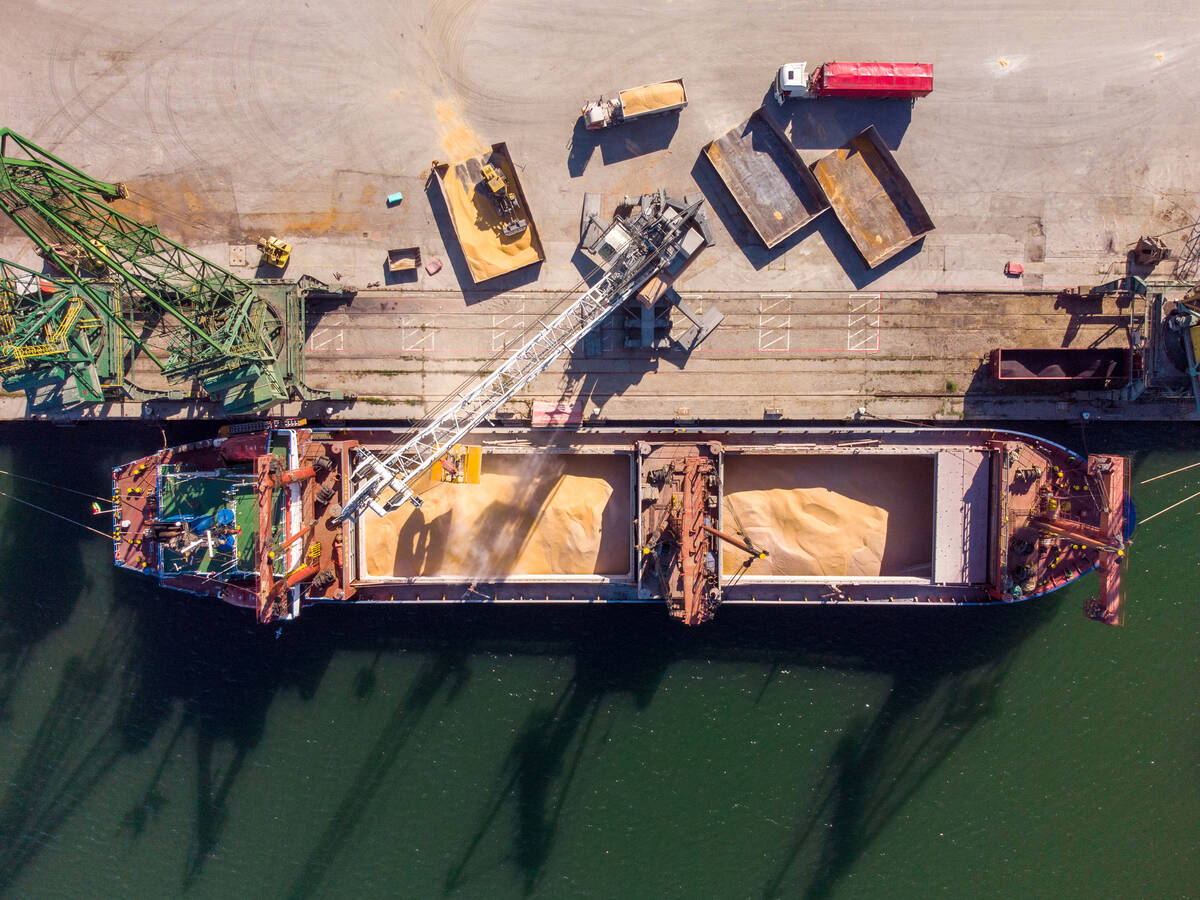

Ukraine wheat exports remain low amid Russian attacks on ports, weak demand

Ukraine’s wheat exports remained relatively low in the first half of January amid Russian attacks on Ukrainian seaports and low external demand, data from the country’s grain traders union UGA showed on Wednesday.

The report projected canola prices to average around $465 per tonne in the year to come. If exports to China were to start up again, farm-gate prices could potentially increase to between $500 and $550 per tonne.

“If you’re locking in prices for the futures market for canola, you’re basically looking at breakeven cost of production,” Klemmer said, noting top-quality crops will be imperative for profitability in the coming year.

“Any discounts on prices could lead to some pretty challenging numbers for producers in 2020.”

Canola production in 2020 is expected to close the stocks-to-use ratio slightly to 18.1 per cent.

— Marlo Glass reports for MarketsFarm, a Glacier FarmMedia division specializing in grain and commodity market analysis and reporting.