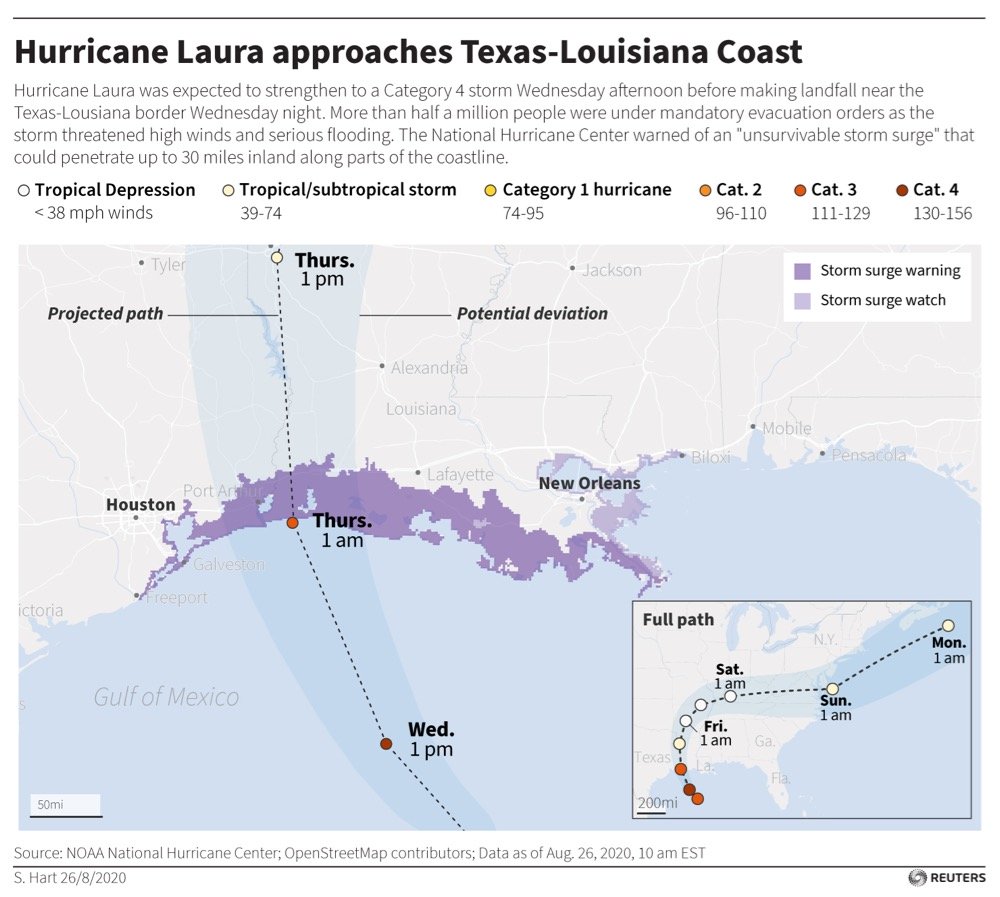

MarketsFarm — Hurricane Laura, currently a Category 3 hurricane, is expected to hit the U.S. Gulf Coast late Wednesday or early Thursday but the Chicago Board of Trade is already feeling its effects.

“It’s going to bring widespread rain and flooding to the Delta region, where unharvested rice, corn and soybean crops may feel a strain,” Terry Reilly of Futures International said.

Grain shipments will also be delayed due to the storm, as many shipping ports in Texas have shuttered in preparation. However, the ports are expected to be operational within a few days.

Read Also

More canola, spring wheat likely to be seeded this spring

As spring planting approaches, farmers are busy planning which crops to seed this year and how much. With that, market thoughts have turned toward planted area projections, as Statistics Canada is set to issue its report on Thursday.

Reilly expected nearby corn contracts to test the US$3.60-$3.65 per bushel if crop conditions continued to deteriorate over the next week.

As parts of the U.S. Midwest have experienced significant dryness over the past few weeks, Laura and other storms may bring welcome rain to some regions.

“Short-term, we might see a bit of a setback in soybean prices if we get widespread rains from these storms,” Reilly said.

Wheat prices are likely to remain firm as countries continue to stockpile due to the COVID-19 pandemic.

“A lot of traditional buyers are coming to the market,” Reilly said, noting large purchases of Russian wheat this week.

Earlier this week, China and the U.S. reaffirmed their commitment to the Phase One trade agreement made in January. Reports show China is expected to purchase 40 million tons of soybeans in 2020.

“That’s been propping up prices too,” Reilly said.

— Marlo Glass reports for MarketsFarm from Winnipeg.