MarketsFarm — ICE Futures canola contracts moved lower during the week ended Wednesday and could be due for more weakness as seasonal harvest pressure picks up over the next few weeks.

“That $800 level has been a very important price support point,” said David Derwin, commodities investment advisor with PI Financial in Winnipeg, pointing to the November canola contract that has found support at that level numerous times over the past three months.

“If we don’t hold that, it’s a continuation of the downtrend that started in June.”

Read Also

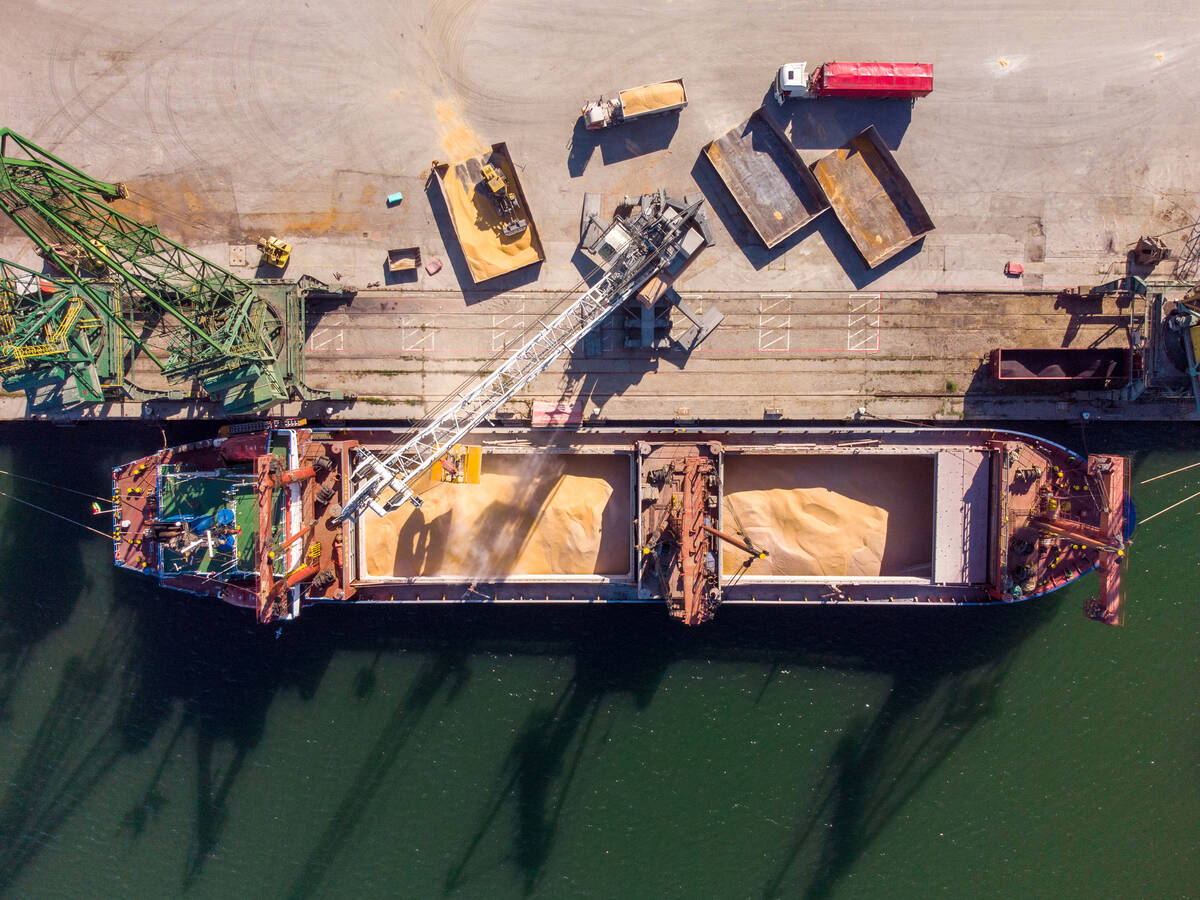

Ukraine wheat exports remain low amid Russian attacks on ports, weak demand

Ukraine’s wheat exports remained relatively low in the first half of January amid Russian attacks on Ukrainian seaports and low external demand, data from the country’s grain traders union UGA showed on Wednesday.

November canola settled Wednesday at $786.50 per tonne, its lowest close since January.

Harvest pressure will also be coming forward, said Derwin. “People are realizing what they have in the field and are more comfortable pricing… now that they know what they have, they are a little more confident in making some sales.”

It’s also hard to say where the next level of support could be, Derwin added, as “a $50 move in canola is not a lot.”

With prices still historically high, “there’s a lot of ground for canola to potentially give back.”

— Phil Franz-Warkentin reports for MarketsFarm from Winnipeg.