Fertilizer prices dropped over winter but remain a powder keg, and even a slight spark could blow the fallout in either direction.

“There’s so much geopolitical activity in the world these days, it’s hard to know what’s happening on a given day,” said Neil Blue, crops market analyst with Alberta Agriculture and Irrigation.

“Lately there’s been an increase in the tensions between China and United States for a few reasons — this balloon affair (the Chinese high-altitude weather balloon shot down over the U.S.) is one of them and more recently China’s decision to provide non-lethal assistance to Russia in their war efforts.”

Read Also

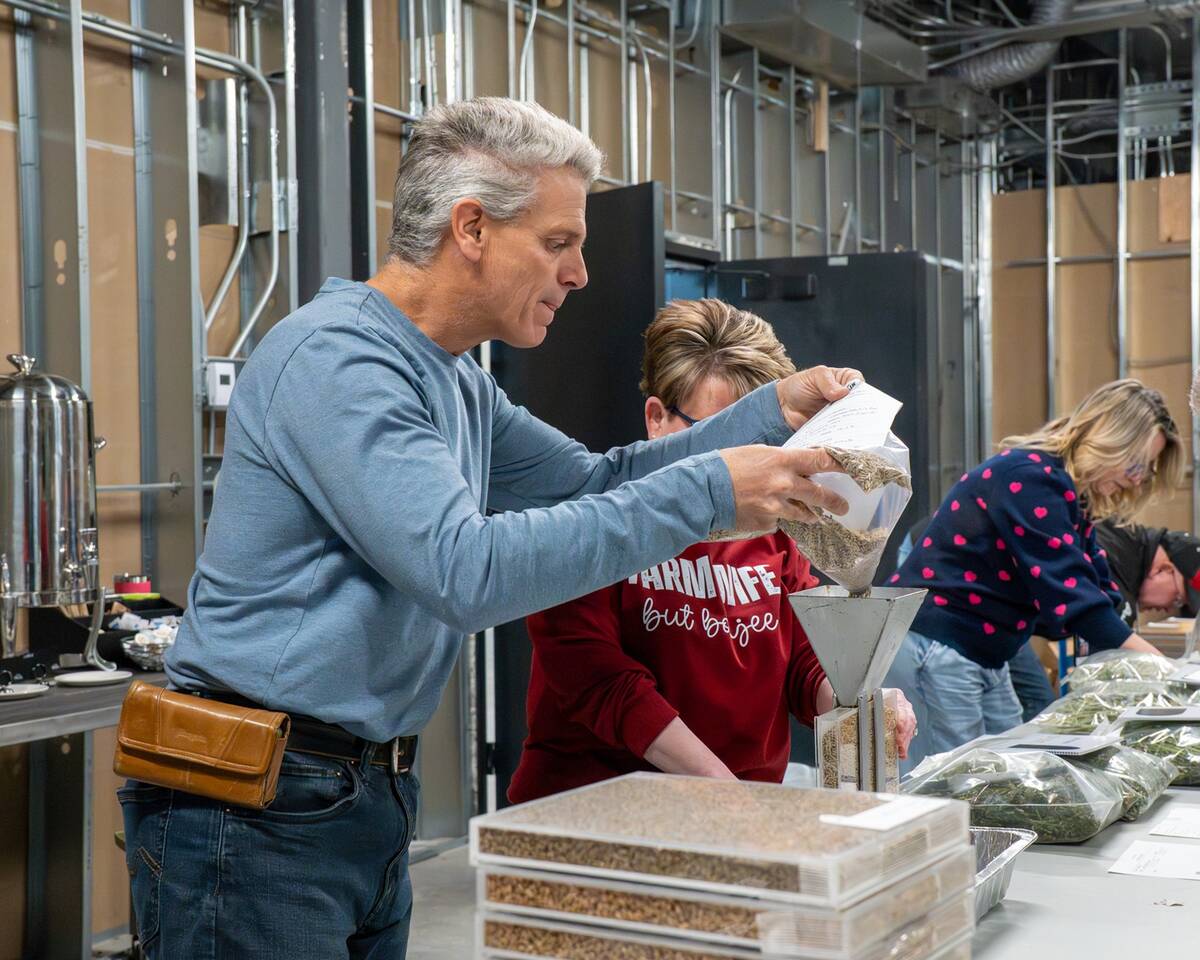

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

Still, there are lots of reasons for optimism, said Blue. One is the easing of natural gas prices, thanks in part to a mild winter in Europe.

“Natural gas prices have dropped dramatically; they’re about a quarter of what they were a year ago,” he said. “(Natural gas) isn’t a huge proportion of fertilizer’s cost but it nonetheless has an influence on the price along with continuing competition within the industry. So that’s a good thing from a fertilizer consumer point of view.”

How long prices stay that way is another question entirely.

“My understanding is Europe has increased its import of liquefied natural gas from Russia but even more from U.S. sources.”

Ocean shipping rates have also dropped over the last year, said Blue.

“That’s provided a bit of relief on transport of all goods, including fertilizer.”

Diesel is another input where prices affect not only fertilizer but virtually everything delivered by truck.

“Diesel prices have come down significantly in fairly up-to-date pricing so that’s good news going into spring,” he said. “How long that will last, I’m not sure, but that will certainly be helpful. Some farmers have the ability and some retailers provide the ability to hold the price so that may be in order.”

The recent closure of a BASF ammonia plant in Germany will be felt at the retail level to some extent, said Blue.

“It’s just one of many fertilizer plants but that’s one factor that could cause prices to increase again eventually. Fertilizer is really a world market so our price here (is affected) despite the fact that we manufacture quite a bit of fertilizer.”

How do producers account for volatility when planning their spring fertilizer needs? Blue recommends a conservative strategy.

“Some are compromising by buying some now and then leaving some open (to buy later). That’s a reasonably good approach,” he said.

He doesn’t recommend chasing a speculative bottom while hoping for ongoing drops. Some predict price hikes going into seeding time, although Blue believes rates are pretty much set.

“Availability doesn’t seem to be a problem this year in Alberta or the Prairies, for that matter,” he said. “From what I gather, the retailers have purchased and probably priced most of the needs they’ve anticipated for spring fertilizer use. So unless competition causes a crack in those prices, we’re likely to be pretty much stable for prices for the balance of the spring and then there may be a typical drop in summer again.”

Josh Linville, vice-president of fertilizer for StoneX Group, has a rule for fertilizer purchases.

While fertilizer prices are elevated, so are grain prices, so he recommends using a ratio of bushels per tonne of fertilizer to evaluate the bottom line more clearly.

Take corn and urea, he said in a late January interview.

“Would you rather spend 140 bushels of your hard-earned, produced corn to pay for one ton of urea (the current ratio)?” he asked. “Or would you rather spend 50 to 55 bushels (the ratio a year earlier)?”

Farmers should keep an eye on the market for all five major fertilizer inputs, said Linville.

— Urea: ”If European production continues to suffer or even drops more than where it is today, prices are going up,” said Linville. “The flip side is if European production continues to rise and natural gas prices continue to fall, it’s going to scare every trader in the world, and they will want to sell. The more China and Russia continue to push out product, the lower the prices go.”

— UAN: “If European production falters and North American producers sold farther into the future than we think, prices are going up,” said Linville. Similarly, if Europe ramps up production, prices will drop. Linville said there could be some carryover inventory from last year that could weaken demand.

— Anhydrous ammonia: Linville said he’s fairly bearish as he doesn’t expect European production to falter. The expected recession on the horizon will cut industrial demand for the product. And prices could be driven down even further if Russian exports return.

— Phosphates: The biggest factor affecting the price of phosphates will be whether the Chinese government stops exports again (prices rise), or if they continue to gain steam (prices drop). Also, if the ratio of bushels per tonne of phosphate improves, demand could rise.

— Potash: Since early April of last year, potash prices have been in freefall. Belarus is the second-largest producer of potash (after Canada), and exports from the landlocked nation were blocked by Lithuania when Russia invaded Ukraine. Should Lithuania reopen that Baltic trade route, it could lower prices further, said Linville.