MarketsFarm — To some who follow commodities markets, it was clear some other participants had overreacted to the news of China banning canola imports from Viterra.

Bruce Burnett of MarketsFarm was one of those who saw Canadian exports of canola to China have pretty much dried up since January.

That came a few weeks after Huawei executive Meng Wanzhou was arrested by Canadian authorities at the behest of U.S. authorities. Meng is facing fraud charges in the U.S. and her extradition hearing is underway.

Read Also

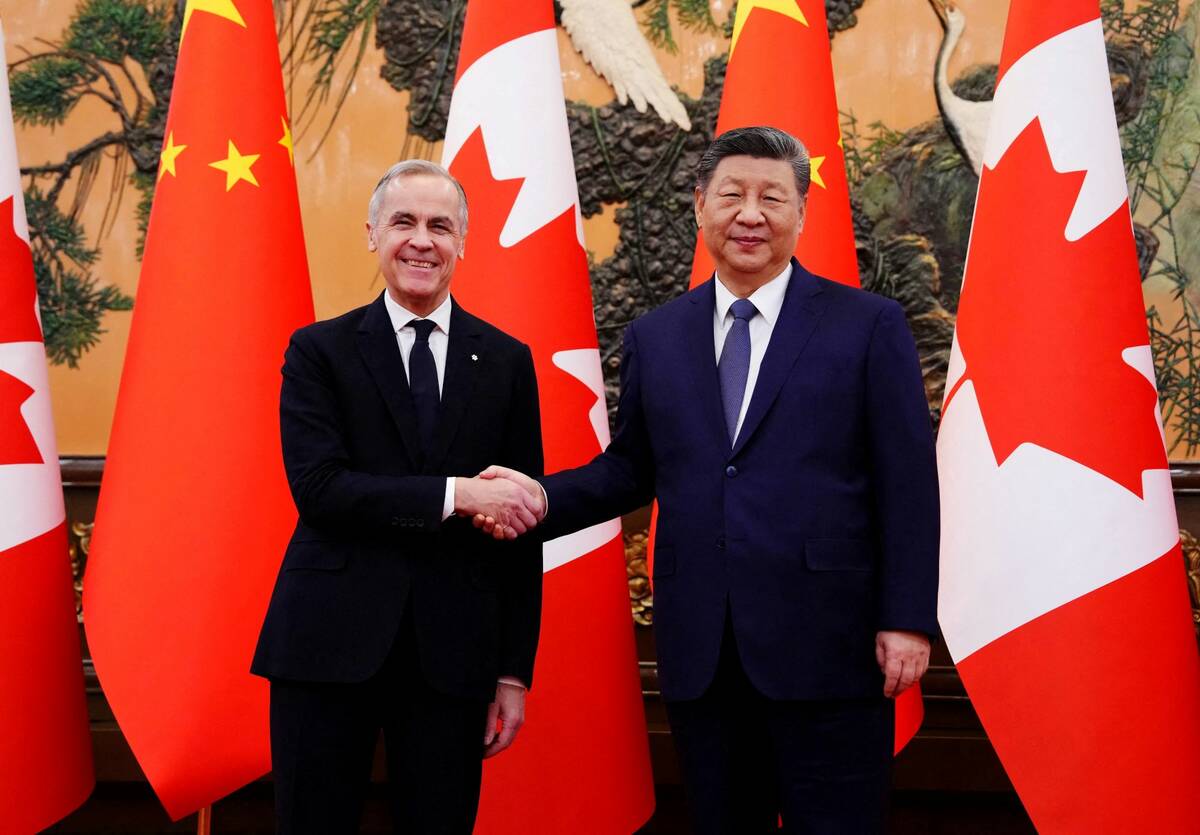

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

China’s bans on canola from Richardson International and now Viterra “attracted attention from fund shorts who move in on the news,” Burnett said.

Those bans, and comments from the Canola Council of Canada, certainly affected the market. Over the past week canola lost $13.30, closing Wednesday at $451.40 per tonne.

“For people who have a short in the marketplace, a non-commercial short, how much downside do you think there is to this? People will probably come to the conclusion it’s a pretty big move and a pretty low price,” Burnett stated.

There are some supports for canola, such as a declining Canadian dollar against the U.S. dollar; canola has also become more competitive with other vegetable oils and its crush margins have improved.

Road bans now in place across the Prairies have made it difficult for farmers to deliver canola to market and there is speculation farmers might seed fewer acres to canola this spring.

A trade deal between the U.S. and China might help canola a little, Burnett said, but what’s really needed is a resolution to the tensions between Canada and China.

Until then, it’s unlikely canola will bounce back in a manner similar to which it fell.

— Glen Hallick writes for MarketsFarm, a Glacier FarmMedia division specializing in grain and commodity market analysis and reporting.