Chicago | Reuters — The U.S. Department of Agriculture unexpectedly revised its global coarse grain supply estimate on Tuesday, saying Chinese feed millers were using feeds other than corn at a higher rate than previously thought over the past three years.

Along with an increase in USDA’s 2015 U.S. corn production forecast and cuts to U.S. exports and use by ethanol makers, the revision lifted the agency’s global end-of-season corn stocks outlook to the highest on record at nearly 212 million tonnes, with more than 50 per cent of it in China.

Read Also

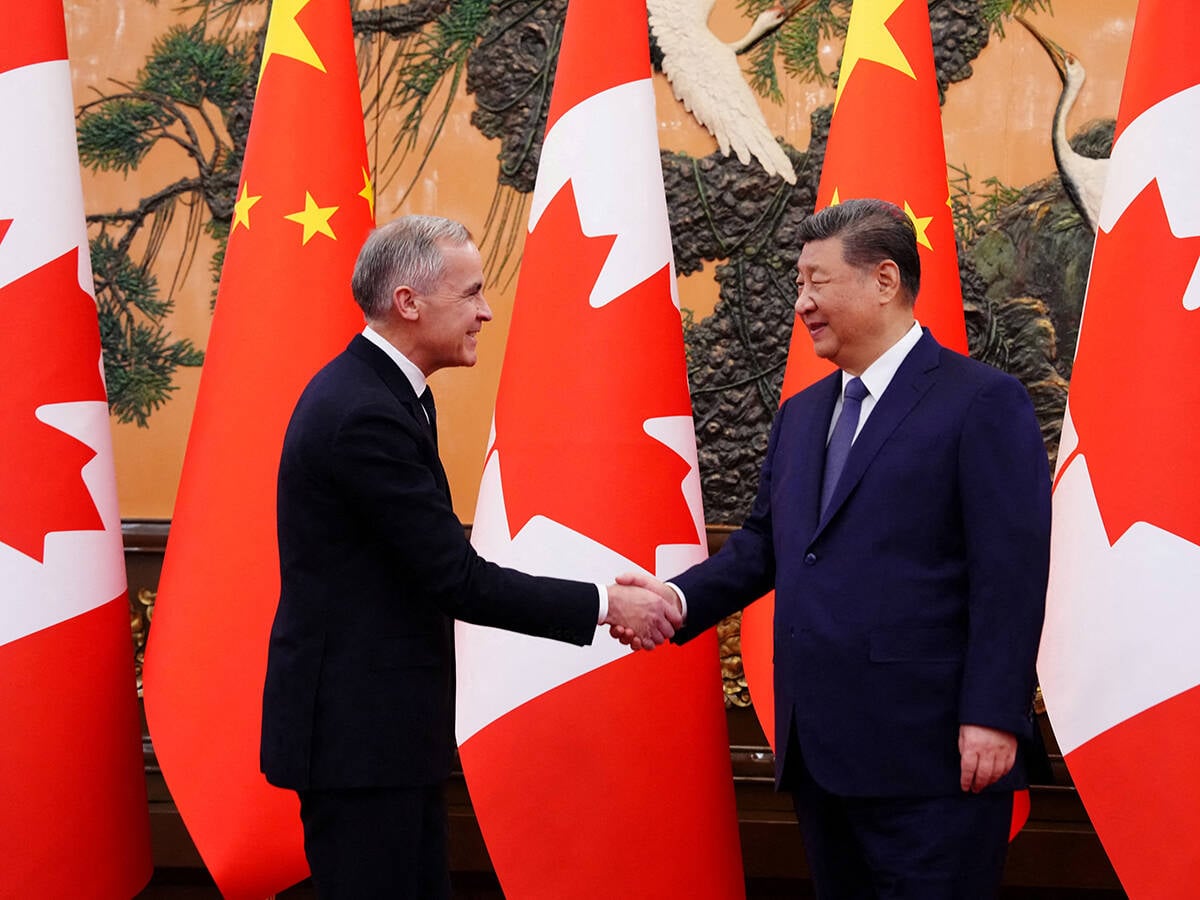

Opinion: Is a closer trade relationship with China a security risk?

Is a closer trade relationship with China a security risk?

Chinese corn stocks at the beginning of the 2015-16 marketing year that ends on Sept. 30 were increased by 18.8 million tonnes, USDA said in a monthly report.

Only partly offsetting the supply gain was a cut to corn stocks in Brazil due to greater use by the livestock sector than previously thought.

“There’s no shortage of grain in the U.S. or the world,” said Don Roose, president of U.S. Commodities.

The adjustments dragged benchmark corn futures on the Chicago Board of Trade to their lowest in two months. The move to adjust several years of global consumption data also sparked renewed criticism of how the USDA releases data.

As the price of corn hovered near historic highs in recent years, Chinese feed importers increasingly turned to cheaper alternatives such as wheat, sorghum and distillers dried grains (DDGs), a byproduct of corn ethanol production, for their feed needs.

The revisions also suggest that China’s livestock herd might not be as large as previously thought, which could keep a lid on its imports of U.S. corn, said Jack Scoville, vice-president for Price Futures Group in Chicago.

“They don’t seem to have the animal numbers there,” Scoville said. “Don’t expect them in the market anytime soon, not for corn.”

Corn use by China’s domestic feed sector in 2015-16 was projected at 150 million tonnes, down seven million from the USDA’s prior-month forecast, although imports of the grain were left unchanged at three million tonnes.

Meanwhile, USDA said Chinese imports of barley and sorghum feeds would drop from record highs in the 2014-15 season as more domestically-produced corn is used amid changes to crop support prices and other policy moves by Beijing aimed at reducing massive state stocks.

— Karl Plume reports on agriculture and ag commodity markets for Reuters from Chicago. Additional reporting for Reuters by Tom Polansek in Chicago.