CNS Canada — News that China would delay its implementation of stricter dockage restrictions on Canadian canola shipments gave ICE Futures Canada contracts a boost on Wednesday, but values are still trending lower overall.

“It’s a bump in a bear market,” said analyst Errol Anderson of Pro Market Communications in Calgary, on the initial reaction to the news that China would not tighten its dockage allowances on canola shipments to one per cent on Sept. 1.

Read Also

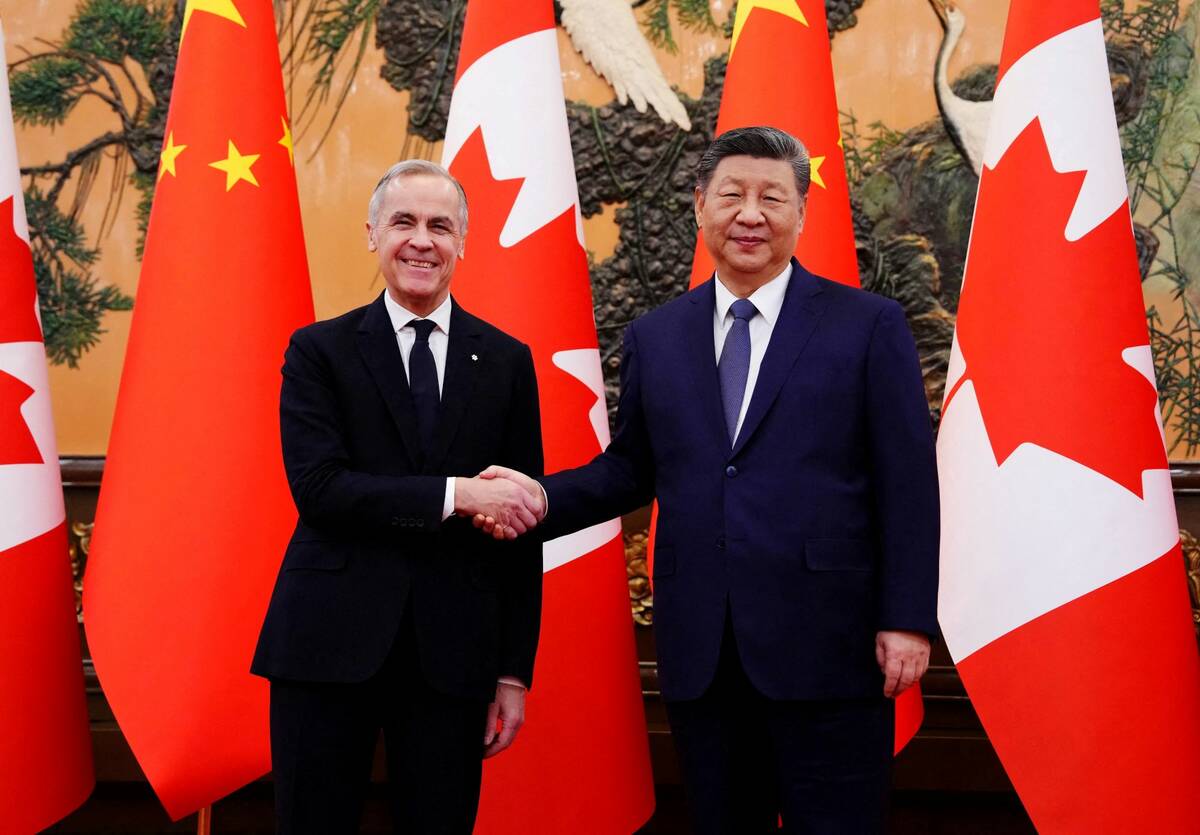

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

Anderson said there was more room to the upside in canola, but added that any gains would likely be short-lived.

Looking at the January contract, he placed firm resistance at $480 per tonne.

While China is a major customer for Canadian canola, “it’s not the market factor that the media is making it out to be,” said Anderson.

The bigger issue facing canola, he said, is the large U.S. soybean crop, which will cast a bearish tone over the market.

Anderson was also of the opinion that the Canadian canola crop currently being harvested was much larger than the 17 million tonnes forecast by Statistics Canada.

— Phil Franz-Warkentin writes for Commodity News Service Canada, a Winnipeg company specializing in grain and commodity market reporting.