We asked the Hedging Edge experts for their No. 1 marketing tip for this fall. Here’s what they had to say.

Neil Blue

Provincial crop market analyst

“My No. 1 tip — and this isn’t an earth-shaking one — is shop around. That means knowing your product first — getting a grade from potential buyers, including from the Canadian Grain Commission — and then shopping around widely to try and find the best price for your circumstance. That might involve a local market. It might involve selling to a neighbour who has livestock or to a processing plant nearby. Or it may involve shipping that product quite a distance with assistance from a grain company or broker. It’s just a matter of knowing the players in the market and being able to shop around to get the best price for the product a person has. That involves knowing exactly what that product is and knowing how it fits into the marketplace.”

David Derwin

Commodities portfolio manager

“Make sure you understand all the marketing tools that are out there. Get more comfortable with and learn about how exchange traded options work and how they can fit into and benefit your existing marketing plan. The nice thing about options is there’s no production risk or delivery commitments. It acts like insurance, basically. It gives you downside protection if prices fall, but because you’re not locking in a price, it doesn’t prevent you from benefiting if prices go higher. It offers flexibility. Producers tend to be a little cautious about hedging because of that — they don’t want to lock in. We’re all human. If we’re not aware about something or unsure of it, we’re going to shy away from it. You’ve got to get more comfortable with using them and learn how to use them properly.”

Jonathon Driedger

Market analyst

“My tip is going to vary a little bit by crop. In terms of your cereals, it’s going to be critical that growers know the exact quality of their grain, given how variable it is out there this year. It would be well worth their while to get a good independent sample of what they have. In a given year, you can get a lot of variability between grades and what one buyer is willing to pay compared to the next for a certain grade. This year, that’s likely even more the case. In cereals, it’s really a quality story, and growers better know exactly what they have so that they can shop around and find the best home for it.

Read Also

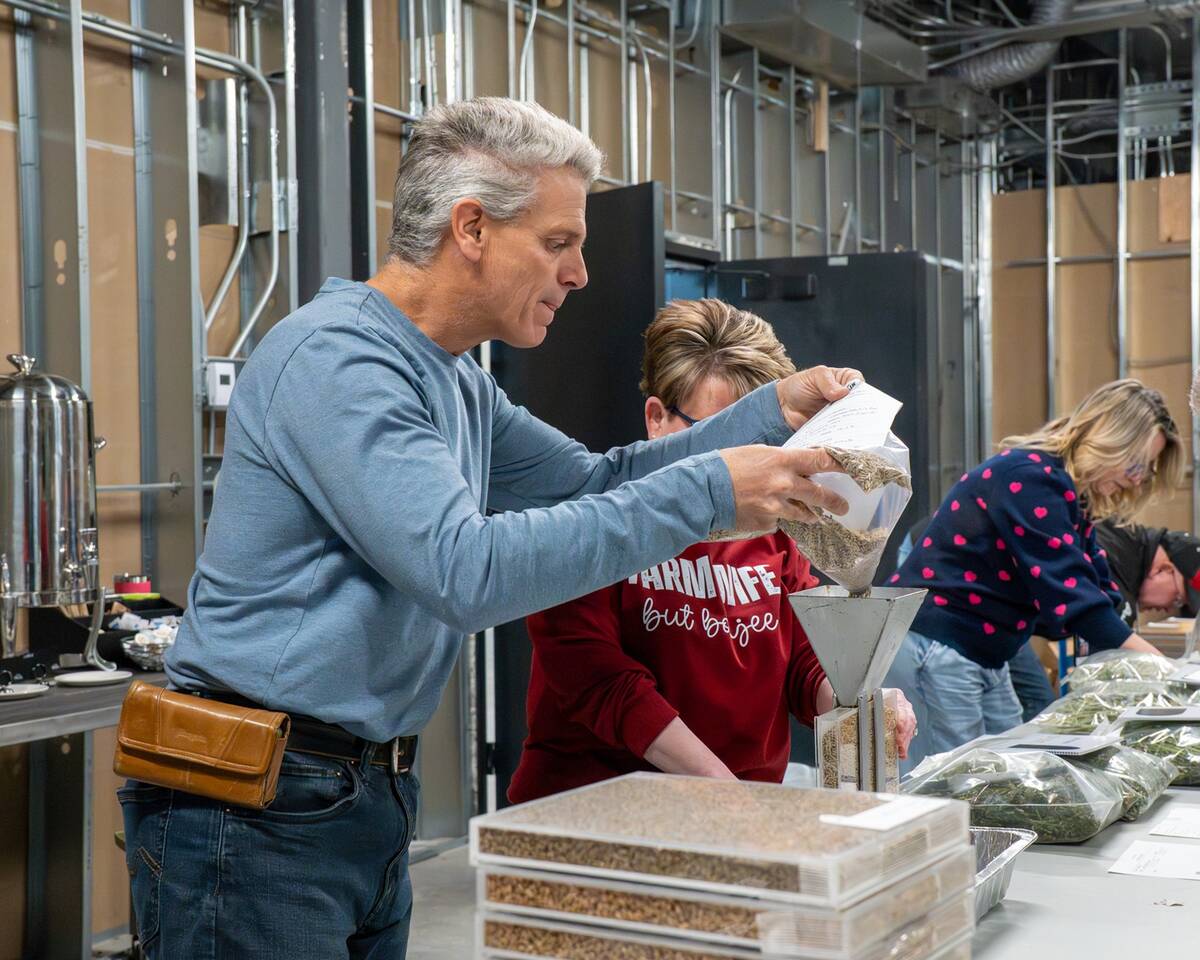

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

“In canola, we have a reasonably steady to firmer outlook, but growers will want to make sure they’re taking advantage of opportunities, whether it’s local basis premiums or a crusher that has a special premium on. We see some exceptionally wide basis levels now, but that’s not always going to be the case. Somewhere along the line, premiums will start to show up.

“In the case of pulses, that’s a bit of an interesting animal. Growers should be reasonably aggressive fairly early to meet this big, huge wave of initial demand that we’ve had at harvest. As the market is sorting through some quality issues, for the most part I don’t think growers want to be sitting on too large of an inventory of pulses. There’s real strong demand early in the year, but the expectation is that India will harvest a large crop shortly and then its winter crop on the back side of Christmas.”