The U.S. agricultural economy is the healthiest in years as rising farm income allows farmers to pay off debt and buy land and machinery to meet booming demand for crops and livestock.

So why worry?

Because historically low interest rates and rising land values heighten concern about speculative bubbles, a debt binge and all the risks associated with seesawing commodity prices, according to one federal official.

“It’s not an issue right now,” Jason Henderson, vice-president and chief economist at the Kansas City Federal Reserve Bank, said in an interview. “But going forward, we are going to be watching those debt levels and leverage ratios.”

Read Also

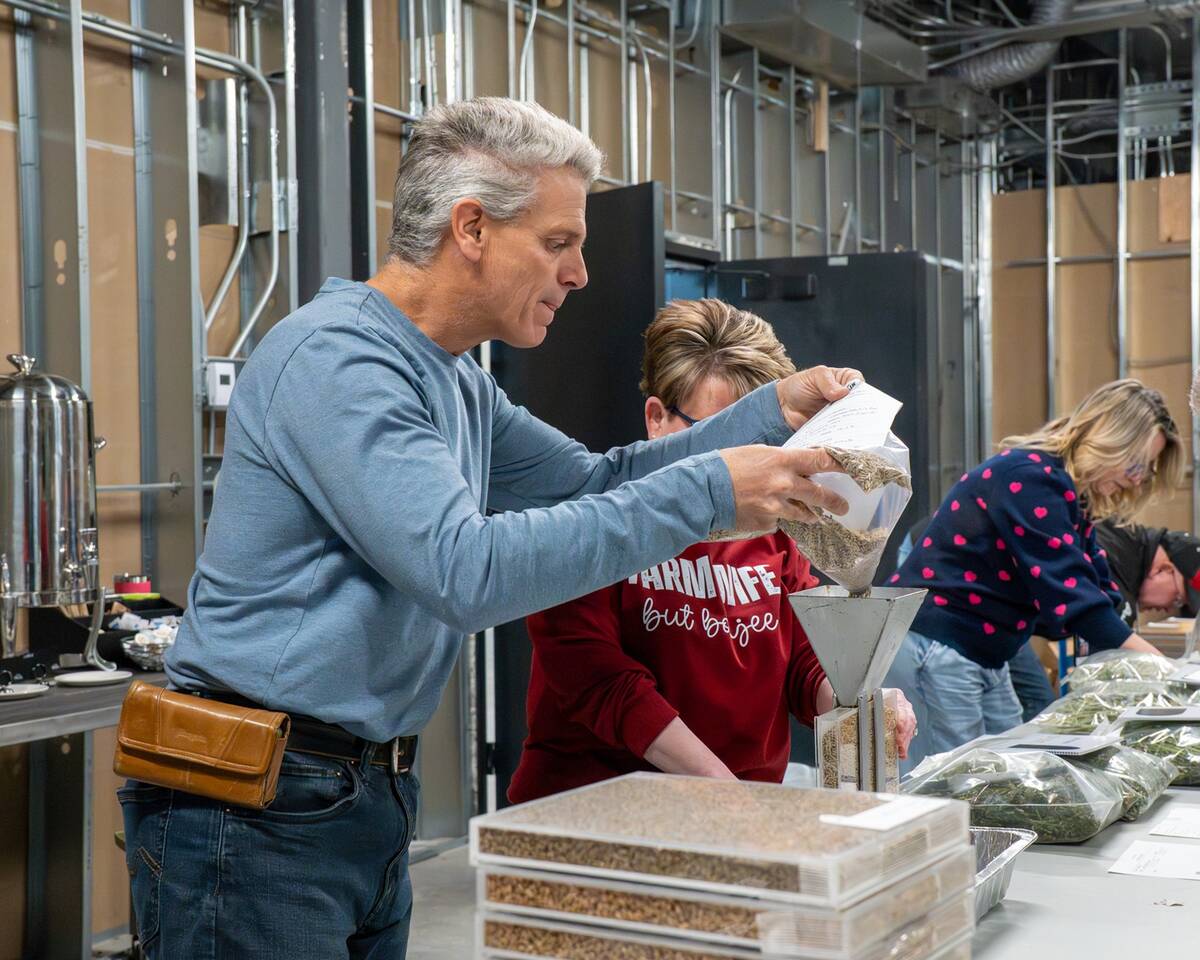

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

Rural bankers remember well the 1980s Farm Crisis when overleveraged farmers across the country lost their farms, driving land values lower in a vicious spiral of sales as credit tightened, payments were missed and assets were lost.

Right now, Henderson said, U.S. farmer debt is the lowest it has been in 50 years, helped by record incomes as row-crop producers benefited from surging commodity prices, especially for corn, soybeans and wheat.

In the the first quarter of 2011 farmers continued to ease their loads, Henderson said.

“With strong profits farmers will make some investments, so are they going to be using cash or are they going to start leveraging up?” Henderson said.

“That in the past is when agriculture has gotten into trouble – when they start leveraging up.”

Nevertheless, the rush is on by farmers to upgrade and expand – the mantra of the Midwest corn belt since the Second World War.

Top equipment producer Deere &Co., for example, said on Feb. 16 its first quarter 2011 net profit doubled from a year earlier as its sales of tractors and harvesters and other equipment rose 27 per cent. It lifted its full-year outlook.

Meanwhile, prices of prime cropland in the central corn belt and northern Plains rose as much as 20 per cent in 2010, the Kansas City Fed said in its quarterly Databookthis week.

Henderson, in testimony to a U.S. House Subcommittee on Agriculture, said U.S. ag banks have recently seen a shift in lending – less on the operating expenses side and more aimed at intermediary and longer-term loans. U.S. farm machinery and equipment loans jumped 73 per cent in the first quarter, the Fed said.

In contrast, livestock loans fell nine per cent in quarter amid a welcome rise in feeder cattle prices. Livestock loans had risen substantially during the last half of 2010. Cattle and hog producers were under huge pressure on margins during the recession, as consumers tightened spending on meats but feed grain prices kept rising.

Even that pressure is easing a bit as economic growth and jobs begin to revive, Henderson said.

USDA is projecting 2011 to be a near-record-income year, but the longer-term outlook is making some bankers nervous. Even USDA is estimating net returns will fall by 2013, projecting net return on corn to be down as much as 30 per cent from 2010.

“That’s a risk of lower returns going forward. The other thing is going to be higher interest rates,” he added. “Higher interest rates tend to pull down farmland values.”

———

“Thatinthepastiswhenagriculturehasgottenintotrouble–whentheystartleveragingup.”

Jason Henderson

Kansas City Federal Reserve Bank