CNS Canada — As Friday’s deadline nears for Chinese tariffs to be imposed on imports of U.S. soybeans, so too does the idea that eastern crushers could soon be bringing those unwanted beans into Canada.

“Soybeans have become so cheap we’re going to find them leaking across the border, especially into Ontario,” said Mike Jubinville of ProFarmer Canada in Winnipeg.

He estimated canola is running a $100 per tonne premium over U.S. soybeans right now, which makes the cheaper beans more enticing to process.

Read Also

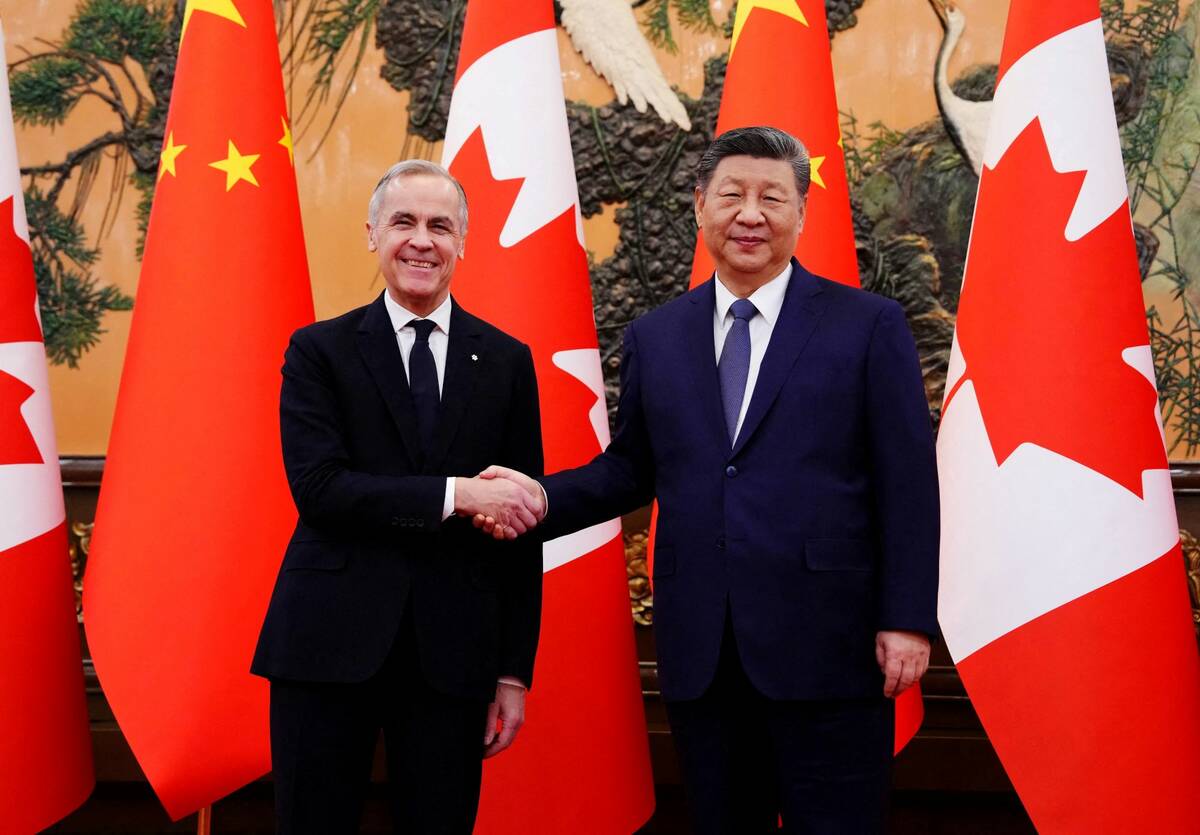

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

This should keep a cap on any aggressive moves higher by the canola market, he said, though China will undoubtedly be scrambling to find enough oilseeds to satisfy its domestic demand.

“If these tariffs do come into play and as Chicago remains in the dump, there will be a challenge to rally,” he added.

The turmoil in international trade markets is also keeping speculative traders from being active participants on the long side of the market, according to Jubinville.

The dominant November contract on the canola market fell $8.80, to $504.10 a tonne, during the week ended Thursday.

The damage could have been more, except that China seems to be buying canola ahead of time.

“I think they’ve been aggressive buyers the last few weeks,” said Jubinville.

He pegged immediate support for canola at the $504 per tonne mark, with the next rung down at $500.

Generally favourable weather has sped up this year’s crop, with some harvesting likely to begin in August.

Weather issues during July will have a lot to say about the yield, Jubinville said.

— Dave Sims writes for Commodity News Service Canada, a Glacier FarmMedia company specializing in grain and commodity market reporting.