MarketsFarm — After starting this week with losses, canola bounced back with back-to-back gains, raising prices by more than $20 per tonne for old-crop after falling back $4-$5 on Monday.

Errol Anderson, an analyst with ProMarket Communications in Calgary, emphasized there will be a good amount of volatility in the markets, with wide swings possible from day to day.

“Part of it is the amount of liquidity that’s pouring into these markets,” he said, as funds awash in money are “looking for a home.”

Read Also

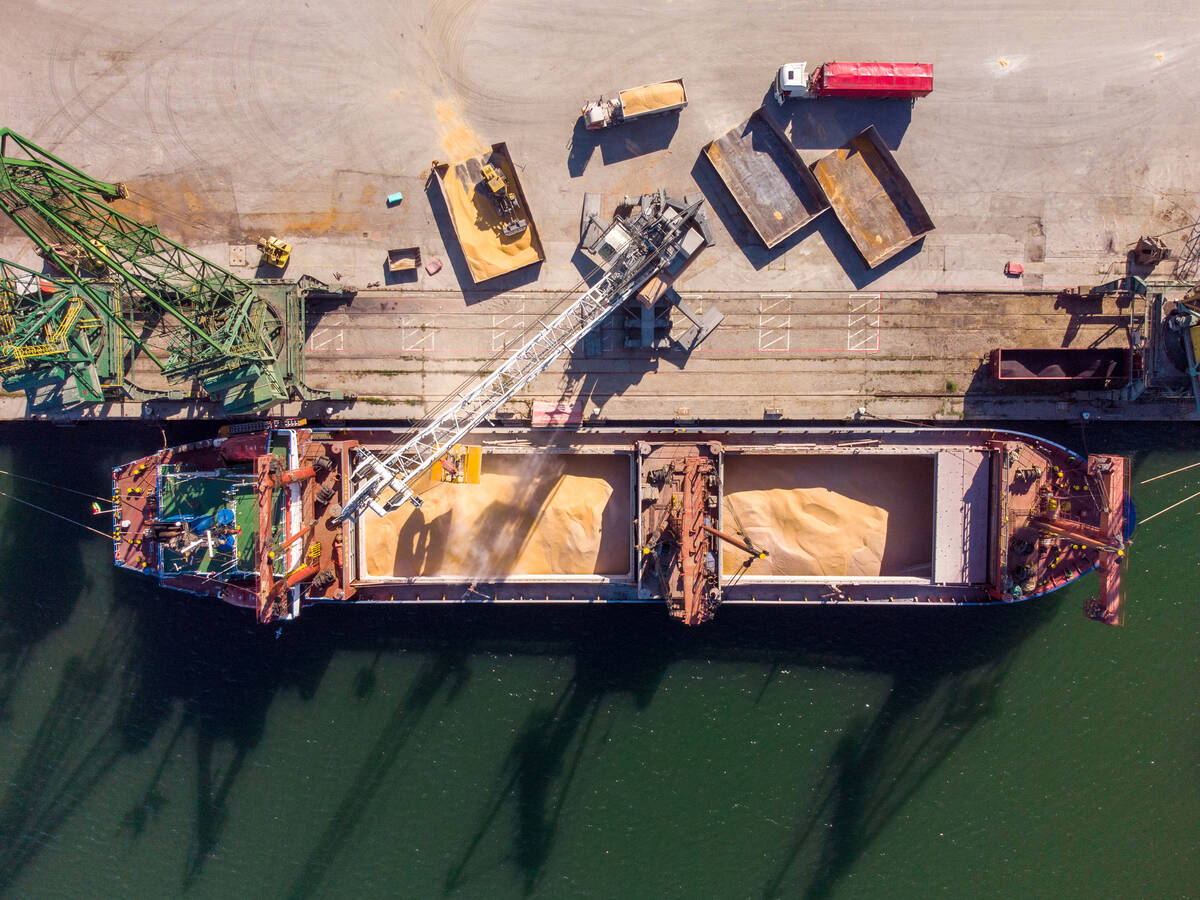

Ukraine wheat exports remain low amid Russian attacks on ports, weak demand

Ukraine’s wheat exports remained relatively low in the first half of January amid Russian attacks on Ukrainian seaports and low external demand, data from the country’s grain traders union UGA showed on Wednesday.

Anderson pointed to the wheat market as an example.

“Wheat is rallying as well, yet we just got a pretty good shot of moisture and the Black Sea export prices are coming down. To me, this is a movement of the funds,” he said.

“It puts my antenna up that we are going to be in for some choppiness. As strong as we are today, we can be down tomorrow.”

Other supportive influences for the Canadian oilseed include tight old-crop supplies and persisting dryness across much of the Prairies. While the region received varied amounts of snow, with some areas getting upward of 10 inches, Anderson said it’s simply not enough on the whole to make a significant impact on dry conditions.

Meanwhile, he spotted signals that point to prices turning about-face, such as the easing of soybean and corn prices in China, as the import giant begins to turn away from the United States and eyes fresh supplies in Brazil and Argentina.

Another element that has been a concern to Anderson is the price of the July canola contract. Although July exceeded $755 per tonne on Wednesday, Anderson stressed that its major support is way down at $660.

“Can we drop $100? The crazy thing about this is we could.”

Furthermore, predicting the market over the coming weeks and months will be more difficult than it recently has been, according to Anderson.

“The market has to feel comfortable there’s a crop on the way,” he said, noting until then, volatility will remain.

There will be some sort of semblance for calmer waters when Statistics Canada issues its first survey-based crop projections for 2021 at the end of this month.

While Agriculture and Agri-Food Canada projected 20.1 million acres of canola to be seeded this spring, Anderson believes there can easily be more than 22 million acres going into the ground.

Also, he predicted more acres for flax and barley, while those for lentils, peas and wheat are likely to be reduced.

— Glen Hallick reports for MarketsFarm from Winnipeg.