Chicago | Reuters — Chicago Mercantile Exchange (CME) hog futures rose 2.1 per cent to their highest in more than three weeks on Wednesday.

Cattle futures were weaker, pressured by profit-taking after the front-month February live-cattle contract hit an all-time high on Tuesday.

“There was no fundamental line item to go with it yesterday so today was a pause or a back-and-fill session,” said Dennis Smith, a broker with Archer Financial Services. “People squared things up a bit, maybe took some profits.”

Hog contracts received support from optimism about U.S.-China trade talks.

Read Also

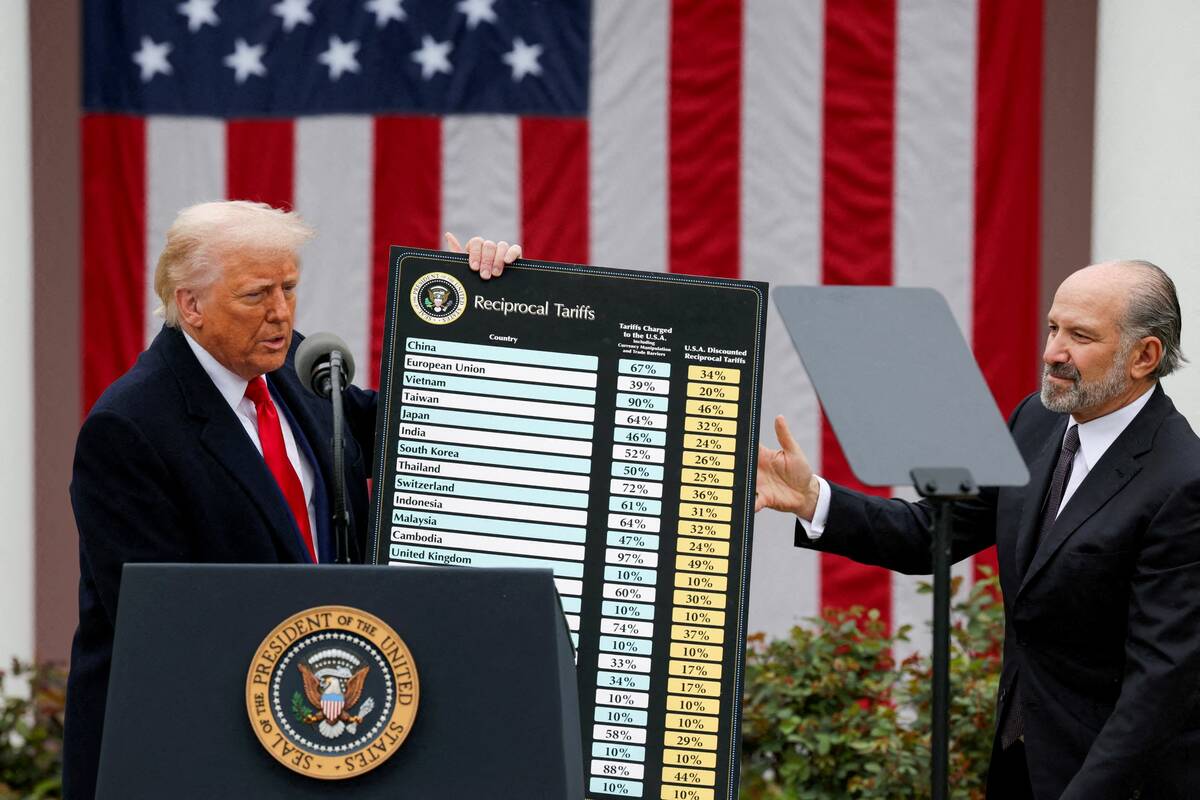

U.S. Supreme Court rejects Trump’s global tariffs

The U.S. Supreme Court struck down on Friday President Donald Trump’s sweeping tariffs that he pursued under a law meant for use in national emergencies.

CME February hog futures settled up 1.175 cent at 63.775 cents/lb. (all figures US$). Prices peaked at 64.1 cents, their highest since Dec. 17.

U.S.-China trade talks ended on Wednesday with negotiators focused on Beijing’s pledge to buy “a substantial amount” of agricultural, energy and manufactured goods and services from the United States, the U.S. Trade Representative’s office said.

CME February live cattle dropped 0.5 cent, to 124.8 cents/lb.

CME March feeder cattle was 0.55 cent lower at 144.9 cents/lb.

— Mark Weinraub is a Reuters commodities correspondent in Chicago.