Glacier Farmmedia — With interest rates swinging around like apes in the jungle, farmers might feel a lot of pressure to react to their debt and financing situations.

Debt and financing decisions today, however, will have a long-term impact, so farmers should be tying decisions to the strategic vision for their operations, Backswath Management consultant Gavin Betker says.

“Operating without a vision and without goals and a plan could lead to debt management and … financial package management decisions that are, perhaps, sub-optimal,” said Betker in an interview earlier this month.

Read Also

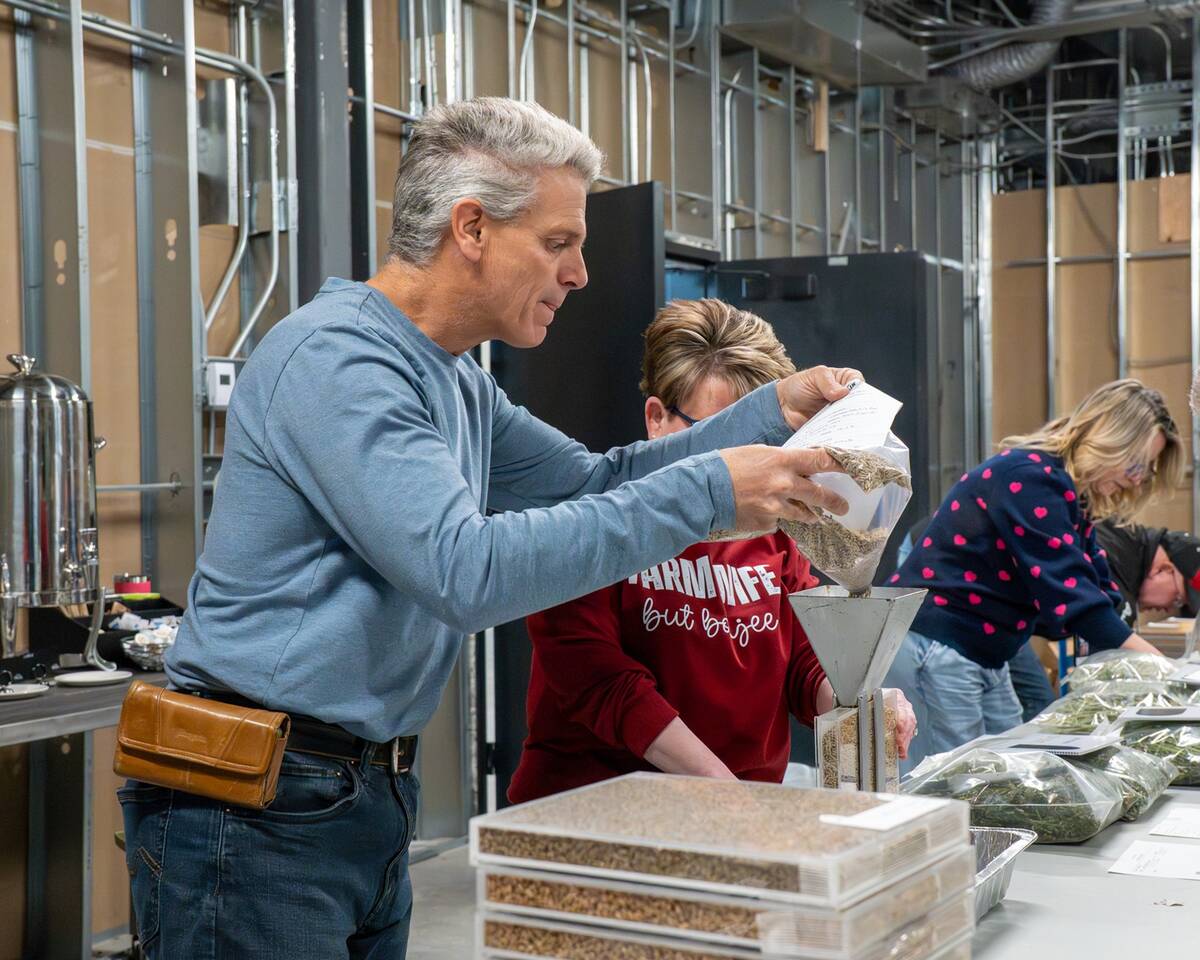

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

Some farmers have a carefully developed strategy and set of goals for where they want to take their farms. However, some have not gone through that process and are just operating year by year.

The problem with that is long-term debt management is difficult if it isn’t matched to a long-term vision. Debt taken on now can affect short- and medium-term decisions for years to come, so they need to fit the farm’s priorities.

The question of “do you need to restructure today? … is a question that should be related to your goals and your vision,” said Betker.

Dealing with debt and financing issues shouldn’t be put off, especially if there’s stress on a farm.

“It’s best to start now,” said Betker.

However, farmers shouldn’t avoid debt just because they grew up believing debt is by nature bad. Debt and other forms of leverage can be vital tools for building and improving a farm if they are used appropriately.

Measures such as the debt servicing ratio can reveal whether a farm has too much debt or if it could comfortably carry more. If the cost of carrying debt is less than the boost to profitability that comes from investing more in the business, then taking on that debt could make sense.

Sometimes farms fall into a “negative liquidity cycle,” which can be hard to crawl out of. Sometimes it takes years. But it’s worth focusing on getting to a positive cash flow situation so that longer-term decisions can be made.

Keeping bankers on-side is essential, and they like to be kept updated on how farmers are doing. They don’t like surprises. Often those lenders can have ideas that farmers haven’t thought of. And Betker suggested that farmers ensure their equity isn’t unnecessarily tied up. Does a lender still have security on some land that’s now paid off? A farmer can ask for that to be dropped.

Long-term debt brings long-term implications. Decisions today can have long-term consequences, but that also means that good decisions today can bear fruit for years to come.

“You can do things today that can help,” said Betker.