Canada Beef and the Canadian Cattle Association have plans for the recently announced boost to marketing budgets, meant to promote Canadian beef around the globe.

In early July, federal agriculture minister Lawrence MacAulay announced more than $6 million for the two industry organizations under the AgriMarketing Program, an initiative of the Sustainable Canadian Agricultural Partnership. Canada Beef and the CCA are getting up to $5,865,110 and $453,364, respectively, for advertising campaigns, trade missions, technical training and educational seminars.

Why it matters: International export markets are key for the Canadian beef sector.

Read Also

How soil fertility management can boost pasture yield by 43 per cent

Learn how soil testing and targeted fertilization can increase pasture biomass by 43%. Expert tips on N, P, and K management for beef cattle producers.

China still bans Canadian beef, so efforts to drive interest in the product couldn’t be more timely, said CCA president Nathan Phinney.

“We’ve been on multiple trade missions with the federal government and being able to open markets is key. We want good trading partners. We want ones that are science- and rules-based,” he said, adding that the new investment is a strong sign of support from government.

One of the beef industry’s big asks is lower South Korean tariffs. The Asian country is a major export destination but it places a 16 per cent tariff on Canadian beef, double what is imposed on U.S. product.

Eric Bienvenue, president of Canada Beef, said the Middle East, including Kuwait, Qatar, Saudi Arabia and the United Arab Emirates, is a priority.

Both Phinney and Bienvenue want to build more relationships in the Indo-Pacific, a region that has attracted considerable trade interest from the Canadian government and other agricultural commodities. Bienvenue is set for a trade mission to the Philippines and Indonesia this winter.

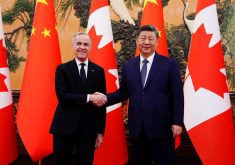

Both also have their eyes on China. That country has blocked Canadian beef shipments since 2021 after a finding of atypical BSE in Alberta. That’s been frustrating for industry, but Phinney said China is a market that Canada cannot afford to ignore.

“It’s 20 per cent of the globe’s population and there’s a large demand there,” he noted.

Added Bienvenue: “China is a market that we are hoping to regain access to very, very soon. And obviously the European market and eventually I think Africa on the southern part (of the globe) will be a market that Canada will have to look into.”

Phinney said China’s reversal of a suspension of Canadian pork in the late 2010s following claims of invalid export paperwork, and that’s a sign that China is open to negotiation.

“Looking at the overall demand and need for protein, we’re well-suited to send some of our product there. I think China’s always been a top priority and a top market for our exporters and for our producers; it’s just getting some of these challenges dealt with.”

Phinney also noted the need to navigate geopolitical uncertainty.

“There’s going to be 50 per cent of the countries that hold an election in the next couple of years and everybody comes in with different mandates,” he said.

Closer to home, market expansion is “somewhat urgent” after years of drought, low cattle prices and producers leaving the industry, said Bienvenue. Exports provide an additional $1,295-per-head carcass value over a five-year average.

At least one of those factors is starting to ease, according to Phinney, who runs a backgrounding operation in New Brunswick.

“I’ve been out the last couple weeks in the West and I know there are still some pockets dealing with some drought, but overall there’s smiling faces again,” he said. “It’s amazing what some strong prices and rainfall will do to producers’ optimism.”

Much could happen over the next few months, “but we’re in a lot better shape and there looks to be a lot better forage inventory this year for cattle, so we can see hopefully that with some of the strong numbers and demand, there’ll be some heifer retention in this and we’ll get (the industry) back into a build cycle.”

International markets are also a key destination for cuts that are less desired in North America. Asia uses mid-grade meats that would struggle to find a market here, Phinney noted.