By Glen Hallick

Glacier FarmMedia | MarketsFarm – Intercontinental Exchange canola futures were lower on Wednesday morning, getting mixed signals from comparable oils.

Chicago soybeans were narrowly mixed, along with losses in soyoil and upticks in soymeal. Malaysian palm oil was relatively steady and MATIF rapeseed was lower. Crude oil was higher with spillover trying to underpin the vegetable oils.

On Thursday at 7:30 a.m. CST, Statistics Canada will issue its updated production report. Trade expectations project the 2025/26 canola harvest to be 20.08 million to 22.10 million tonnes compared to StatCan’s September estimate of 20.03 million.

Read Also

North American Grain/Oilseed Review: Canola, grains in the red

Glacier FarmMedia -– Canola futures on the Intercontinental Exchange retreated on Wednesday with little support from comparable oils. Statistics…

The January canola contract slipped below its 20-day moving average but was holding slightly above its 50-day average.

The Canadian dollar was improving on Wednesday morning, as the loonie rose to 71.67 U.S. cents, compared to Tuesday’s close of 71.50.

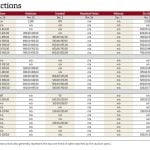

Approximately 15,100 contracts were traded by 8:34 CST and prices in Canadian dollars per metric tonne were:

Price Change

Canola Jan 637.60 dn 7.20

Mar 651.30 dn 7.10

May 662.30 dn 7.50

Jul 668.30 dn 7.60

Stay informed with our daily market videos. Each video quickly covers key futures moves, price trends, and market signals that matter to Canadian farmers. Get clear, timely insights in just a few minutes. Bookmark https://www.producer.com/markets-futures-prices/videos