By Glen Hallick, MarketsFarm

WINNIPEG, March 11 (MarketsFarm) – Intercontinental Exchange (ICE) canola futures “had its dancing shoes back on” at midday Thursday, said a Winnipeg-based trader.

“Strong vegetable oil demand continues to be the overriding story, and the markets have rocketed right back after yesterday’s sell-off,” he said.

There were sharp gains in Chicago soyoil, which was up by well over a U.S. cent per pound. Additionally, there were strong increases in Malaysian palm oil and European rapeseed.

Of note was the rise of the November canola contract, which hit new highs. Volumes for November kept pace with the May and the July contracts, but it pulled ahead by mid-morning to be the most actively traded by a good measure.

Read Also

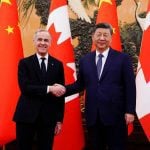

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

“The new crop is going to be the leader going forward,” the trader noted.

A stronger Canadian dollar was having little effect in tempering gains in canola. The loonie was at 79.56 U.S. cents after closing on Wednesday at 79.13.

Approximately 14,700 canola contracts were traded as of 10:38 CST.

Prices in Canadian dollars per metric tonne at 10:38 CST:

Price Change

Canola May 791.90 up 15.20

Jul 748.30 up 13.50

Nov 630.10 up 12.90

Jan 633.40 up 12.90