By Phil Franz-Warkentin, Commodity News Service Canada

February 13, 2015

Winnipeg – Canola contracts on the ICE Futures Canada platform were stronger at midday Friday, as gains in the US soy complex provided some spillover support.

Solid export demand contributed to the firmer tone, with both China and Pakistan said to be in the market for canola recently.

A lack of farmer selling was also supportive, according to an analyst, as widening basis levels in Western Canada were discouraging some country movement.

Canola futures were trading at their highest levels in over six months, with a close at these levels likely setting the stage for some more speculative buying when activity resumes next week.

Read Also

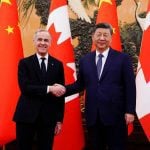

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

Canadian and US markets will be closed on Monday, and positioning ahead of the long weekend could lead to some volatility heading into the close.

The Canadian dollar was stronger on Friday, which tempered the advances to some extent. Ideas that canola was looking overbought also put some pressure on values.

About 19,000 canola contracts had traded as of 10:58 CST.

Milling wheat, durum and barley were all untraded.

Prices in Canadian dollars per metric ton at 10:58 CST: