Glacier FarmMedia — The ICE Futures canola market continued to trend lower on Tuesday, hitting its lowest levels since March 2025.

- Sharp losses in crude oil spilled into the world vegetable oil markets, with Chicago soyoil, European rapeseed and Malaysian palm oil all lower on the day.

- The move below C$600 per tonne in the nearby January contract was bearish from a technical standpoint, encouraging additional speculative selling.

- Large supplies and a lack of export demand from China continued to overhang the canola market.

- Scale down domestic crusher demand and end-user bargain hunting provided some support.

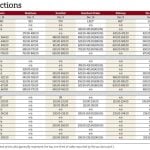

- There were 55,275 contracts traded on Tuesday, down from Monday when 73,766 contracts changed hands. Spreading accounted for 35,004 of the contracts traded.

Read Also

ICE canola dropping with crude, vegetable oils

Glacier FarmMedia — ICE Futures canola contracts were weaker at midday Tuesday, hitting their lowest levels since March 2025. The…

SOYBEAN futures at the Chicago Board of Trade fell to fresh seven-week lows on Tuesday, pressured by declines in crude oil and uncertainty over Chinese demand.

- Optimism over talks to end the Russia/Ukraine war weighed heavily on crude oil, with the weakness there spilling into the soy market.

- There were no flash export sales announced by the United States Department of Agriculture today, contributing to ideas that the U.S. would not meet its export targets to the country.

- Monthly data from the National Oilseed Processors Association released Monday showed 216 million bushels of soybeans crushed in the U.S. in November. That was down 5.1 per cent from the record monthly level hit in October, but still up 11.8 per cent from a year ago.

WHEAT futures were down across the board, with hitting contract lows in some months.

- Expectations for large wheat crops out of Australia and Argentina weighed on prices, as farmers in the Southern Hemisphere continue to make good harvest progress.

- Ongoing peace talks to end the war between Russia and Ukraine continued to be followed by wheat traders, with no real progress after talks in Berlin over the weekend.

- Bearish chart signals contributed to the declines, with some stops hit on the move lower.

CORN futures were also pressured by the losses in crude oil, hitting three-week lows.

- Spillover from the losses in wheat also weighed on corn, amid ideas love demand from livestock feeders may be filled by cheaper feed wheat.

Access the latest futures prices at https://www.producer.com/markets-futures-prices/

Stay informed with our daily market videos. Each video quickly covers key futures moves, price trends and market signals that matter to Canadian farmers. Get clear, timely insights in just a few minutes. Bookmark https://www.producer.com/markets-futures-prices/videos