Glacier FarmMedia -– Canola futures on the Intercontinental Exchange retreated on Wednesday with little support from comparable oils.

Statistics Canada will release its principal field crop estimates on Thursday with many observers anticipating canola production to exceed the agency’s previous estimate of 20.03 million tonnes. The Western Producer Markets Desk spoke to analysts and traders whose estimates ranged from 20.08 million to 22.10 million. In Reuters’s survey, the average estimate was 21.25 million.

An analyst said canola’s downturn could become a “major breakdown in the making” should production be around 22 million tonnes. “In the absence of China buying, that’s going to be problematic,” the analyst warned. However, he also said cash basis remained strong, an indicator of commercial buying interest.

Read Also

ICE Midday: Canola suffers losses

Glacier FarmMedia – Canola futures on the Intercontinental Exchange took a tumble in the middle of Wednesday trading with little…

Chicago soyoil, European rapeseed and Malaysian palm oil were down. Crude oil was higher as little progress is being made towards the end of Russia’s invasion of Ukraine.

At mid-afternoon, the Canadian dollar was up one-tenth of a United States cent compared to Tuesday’s close.

There were 84,112 canola contracts traded on Wednesday, compared to Tuesday when 52,116 contracts changed hands. Spreading accounted for 58,664 of the contracts traded.

WINNIPEG, Dec. 3 (MarketsFarm) – March CORN had its biggest one-day loss in two weeks at the Chicago Board of Trade on Wednesday, ending the day below its 20-day average.

The United States Energy Information Administration reported ethanol production for the week ended Nov. 28, averaged 1.126 million barrels per day, up 13,000 BPD from the previous week. Ethanol stocks rose 543,000 barrels at 22.511 million.

Ukraine’s ag ministry reported 3.7 million tonnes of 2025/26 corn have been exported as of Dec. 1, compared to 6.976 million tonnes the same time last year.

January SOYBEANS had its third consecutive negative trading session, during which the price dropped to their lowest level since Nov. 21.

Russian President Vladimir Putin on Tuesday threatened to target cargo vessels in the Black Sea belonging to countries assisting Ukraine. Earlier in the day, a Russian tanker carrying sunflower oil was hit by Ukrainian drones.

U.S. Treasury Secretary Scott Bessent said China is “on track to keep every part of (its) deal” to purchase 12 million tonnes of U.S. soybeans by the end of February.

Brazil is expected to see normal to above-normal temperatures, as well as normal to above-normal precipitation next week.

Malaysian palm oil stockpiles rose to their highest level in six years at 2.71 million tonnes in November. That’s up 47 per cent from last year, due to a 15 per cent drop in exports at 1.43 million tonnes. However, Indian palm oil imports increased by 4.6 per cent month-to-month in November at 630,000 tonnes.

All three March contracts for U.S. WHEAT varieties were lower today, with Minneapolis spring wheat below its 50-day average.

Ahead of Statistics Canada’s principal field crop estimates on Thursday, the Reuters survey came to an average estimate of 38.49 million tonnes compared to StatCan’s September number of 36.62 million.

Ukraine’s farmers union said the country has planted 4.74 million hectares of winter wheat, or 99.3 per cent of its expected area, as of Dec. 1.

India’s Wheat Products Promotion Society said the country is on track for its largest wheat crop ever at 117 million tonnes and government stocks may exceed 50 million by June 1.

Kazakhstan has exported 390,000 tonnes of wheat to Algeria in 2025 so far.

Bangladesh is set to buy 220,000 tonnes of U.S. wheat after the U.S. agreed last July to export 700,000 tonnes of wheat per year to the South Asian country.

A South Korean importer purchased a total of 30,300 tonnes of wheat in a tender overnight.

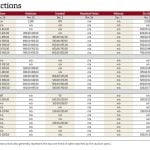

To access the latest futures prices, go to https://www.producer.com/markets-futures-prices/

Stay informed with our daily market videos. Each video quickly covers key futures moves, price trends, and market signals that matter to Canadian farmers. Get clear, timely insights in just a few minutes. Bookmark https://www.producer.com/markets-futures-prices/videos