By Terryn Shiells and Dave Sims, Commodity News Service Canada

WINNIPEG, Feb. 20 – The ICE Futures Canada canola market ended lower on Friday, following the losses seen in outside oilseed markets, including Chicago soybeans and soyoil.

Profit-taking after the market moved to fresh seven month highs earlier in the week was also bearish. Farmers were also routine sellers at the highs, analysts said.

However, the Canadian dollar was showing weakness on Friday, which helped to limit the declines.

Steady commercial demand for Canadian canola supplies was also supportive.

Read Also

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

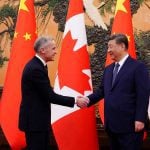

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

About 30,186 contracts changed hands on Friday, which compares with Thursday when 32,205 contracts traded. Spreading accounted for 25,950 of the trades.

Milling wheat, durum and barley futures were all untraded, though the Exchange moved wheat prices lower after Friday’s close.

SOYBEAN futures in Chicago finished six to nine cents per bushel lower Friday, as lukewarm demand and large world stockpiles compelled traders to take profits before the weekend.

A USDA report says US inventories will increase to 430 million bushels for the 2015/16 crop year, the highest they’ve been in nine years. It also comes as the South American harvest, which is expected to be record large, ramps up.

However, on the bullish side of things, US basis levels have reportedly improved on the heels of this week’s rally.

SOYOIL futures in Chicago finished 35 to 37 points lower Friday, following soybeans and also taking direction from the softness in Malaysian palm oil.

SOYMEAL futures ended slightly lower following soybeans.

CORN futures in Chicago finished three to five cents per bushel lower Friday on profit-taking and spillover selling from other commodities.

Firmness in the US dollar also weighed down values, participants said.

However, the USDA said US stockpiles are expected to drop 8% to 1.687 billion bushels for the 2015-16 crop year which is lower than what was initially projected. Positive weekly export sales data was also supportive.

WHEAT futures in Chicago drifted 10 to 17 cents per bushel lower Friday, and six to 11 cents per bushel lower on the Kansas City Board of Trade. Strength in the US dollar index pressured exports, sending values lower.

US Wheat stockpiles are expected to grow by 10 percent in 2015/16 to 763 million bushels, according to a report. Sales for the 2014/15 crop year are down 35 percent from the previous week.

Wheat also saw some follow-through selling on the heels of Thursday’s losses, traders said. Egypt’s decision to back away from an order of US wheat due to its price and the US Midwest crop’s resistance to cold temperatures were also bearish for values.

– Ukraine’s grain exports up to this week have topped 23 million tons, with wheat at nine million tons, according to the Agriculture Ministry.

– China experienced a dramatic decline in pulse exports between January and October, with net imports of pulses rising to record levels, according to a report.

– The US Department of Agriculture says world trade in wheat will be up 16% over the next decade.

ICE Futures Canada settlement prices are in Canadian dollars per metric ton.