The United States Department of Agriculture has dropped a report painting a grim picture of the Canadian beef industry in 2024.

And according to an Alberta market analyst, most of its forecasts check out.

The Canada: Livestock and Products Annual report predicts an ongoing contraction of the Canadian cow herd driven by a dwindling heifer herd created in part by producers sending them to feedlots in response to drought. High cattle prices may help, but there are challenges in that respect as well, said Anne Wasko.

Read Also

Scientists discover cause of pig ear necrosis

After years of research, a University of Saskatchewan research team has discovered new information about pig ear necrosis and how to control it.

“We know we’re going to have record strong cattle prices. That’s going to lead to some profitability that we haven’t seen in the industry for a long time. It’s a key peg to incentivize cow-calf producers to start retaining heifers,” said the market analyst with Gateway Livestock Marketing in Taber.

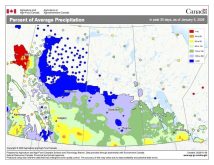

The question, said Wasko, is how producers are going to benefit from those prices with the prospect of ongoing drought and struggles to find feed. Some cattlemen are pinning their hopes on the possibility of an El Nino event that may bring some moisture.

“You’re still looking at high feed costs; there’s a lack of availability in many areas. And so again, it’s water and feed: if you can’t put those two pieces together you just can’t keep cows, you can’t grow your herd.”

If there’s good news in any of this, said Wasko, it’s that the heifer population offers a bellwether for the health of the rest of the beef industry.

“We can watch the number of heifers getting placed (in feedlots), then we can watch the number of heifers our packers are processing as heifer slaughter, so we’ve got some pretty good data points to tell us what’s going on with heifers.”

The U.S. has an advantage over Canada thanks to this year’s rainfall, which saw moisture increase in all of the key cattle-producing states except for Texas. This suggests the States have a head start in building its cow herd before Canada.

“They had a 2021 drought as did we but their moisture conditions substantially improved in 2023 along with record cattle and calf prices,” said Wasko.

“Most of the analysts that I work with in the U.S. are suggesting that some of the 2023 heifer calf crop will be retained.”

Even if Canada suddenly sees an increase in heifers that aren’t placed in feedlots, it will still be some time before it makes an impact on the national cow herd, she said. The U.S. will likely tell a different story in 2024-25.

“The U.S. will start to retain heifers this winter and breed them next year, which will produce a calf in 2025. So they appear to be making that first start, but it’s because they had moisture along with the profitability.”

But that doesn’t mean U.S. producers are necessarily breaking out the hats and party favours. For one thing, Texas — which among the cattle-producing states suffered the most from drought — generally has the biggest beef cow herd of any state in the country.

“It’s not like all of them are out of out of the woods in terms of drought,” said Wasko.

Where the USDA report falls apart, said Wasko, is its forecast that Canadian beef production will be “stable” in 2024. As much as she wishes this could be true, the numbers do not bear it out.

“We’re down six per cent in total tonnage produced, mostly because we’re so down in steer and heifer numbers,” she said. “And I would argue that 2024 will be down at least a couple of per cent.”

And it will take time to rebuild a herd that will produce profitably again.

“When we do start to see some moisture and when cow-calf producers decide to start to retain some heifers, it actually shrinks the supply,” said Wasko.

“You keep those heifers away from slaughter, harvest or production and it actually decreases it even further. So I would argue that we’ve got some declines in production ahead versus stable or static.”

And it looks like a significant amount of heifer replacement will be needed to build back to sustainable rates.

“In (Canfax’s) heifer replacement data — and especially looking at June, July and August, the last month for which we have data — heifer replacements in the feedlots in western Canada — most of which are in southern Alberta — are up 54 per cent from last year,” said Wasko.

“They’re making their way into feedlots pretty aggressively in the last three months.”

The USDA report predicts Canadian fed cattle numbers will be “propped up” by importing U.S. feeder cattle. Wasko agrees; stats show feeder cattle imports from the U.S. into Canada in 2023 are running 38 per cent more than 2022.

If production is down, it stands to reason exports will be down as well. Not surprisingly, this would create a bigger market in Canada for imports. Wasko said beef exports are down five per cent in 2023 so far, which is in line with the beef sector’s production deficit of six per cent.

“As we go forward in the next few years, I would expect beef exports to be down and beef imports to be up. That’s how we keep the equivalency in the prices among trading nations.”