Nearly three decades ago, a study of farmers’ work priorities found — to no one’s surprise — that record-keeping ranked well behind field work; buying and selling machinery and crops; and equipment repair.

Only 16 per cent hired outside help for record-keeping, 50 per cent did it themselves and 20 per cent named their spouse as the primary record keeper.

Those findings are probably still true today, says a provincial farm business management specialist.

“There are many reasons why farmers’ financial management skills and literacy have been slower to develop compared to other industries,” said Dean Dyck. “Although financial institutions require up-to-date statements, many farmers’ primary reason for record keeping is for Canada Revenue Agency reporting. Since cash basis accounting provides farmers with significant advantages in managing their tax liabilities, there is little incentive for them to prepare accrual financial statements, a primary management tool in other industries.”

Read Also

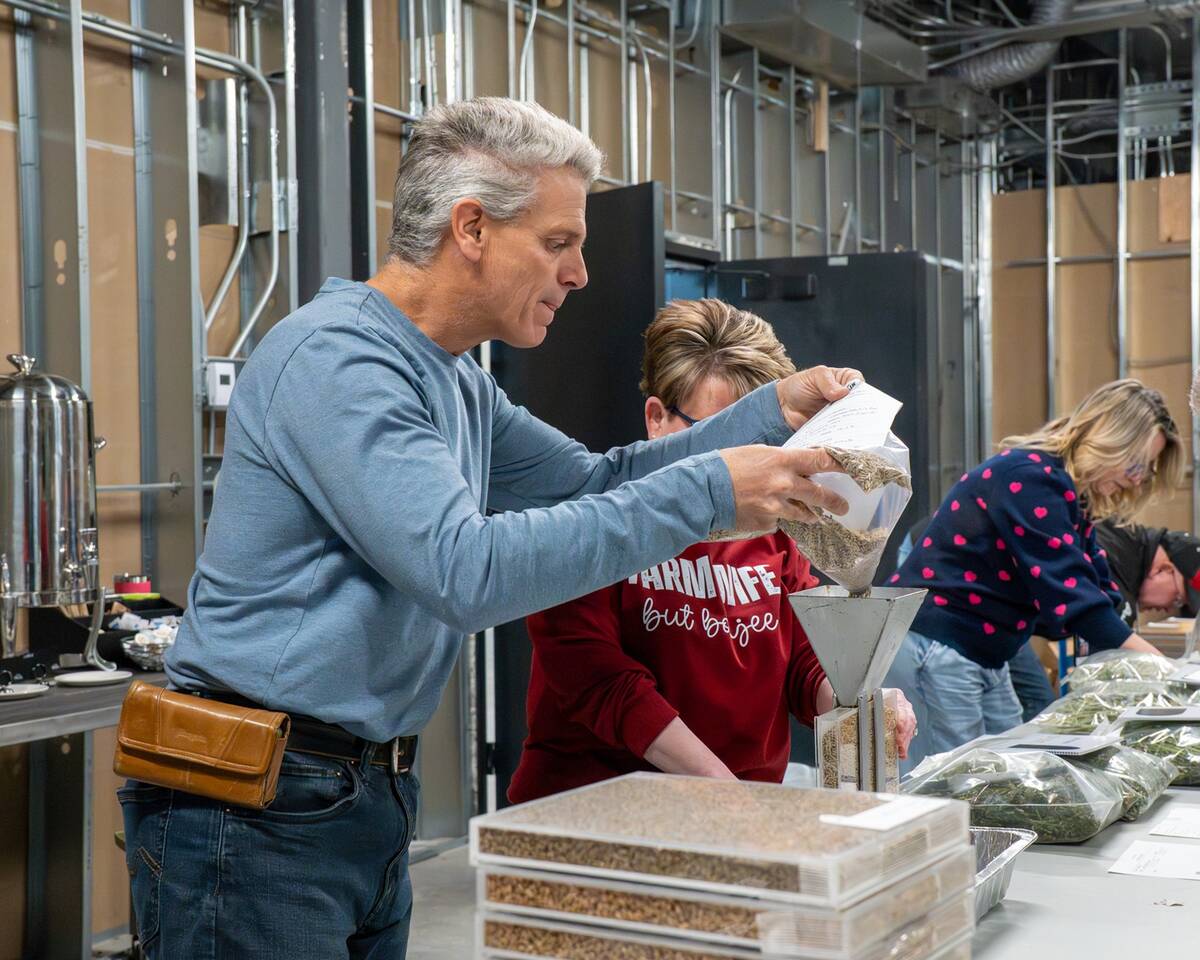

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

Accrual accounting identifies profitable crop or livestock enterprises and provides direction for future management decisions, he said.

Dyck said a strong farm financial plan should answer three questions: Where am I? Where am I going? and, How do I get there?

“There are two key financial statements that every farm should prepare to answer those questions: a balance sheet and a cash flow,” he said. “A balance sheet will give you the power to manage working capital and debt repayment capacity. Projecting a cash flow budget for 2016 is essential, particularly if you sold off livestock in 2015; lost part of your land base in a rental competition; or paid too much to win that land rental competition. This budget will keep you focused on variable expenses (seed, fertilizer, chemical or feed) as well as fixed costs.”

And if you get stuck or have questions about things such as a balance sheet and cash flow statement, help is only a phone call away, he added.

“If you have any questions on farm financial planning, give us a call at the Ag Info Centre at 310-FARM (3276).”