Canola carry-over is a moving target but the situation has improved considerably, says provincial crop analyst Neil Blue.

“The Canada Grain Commission provides weekly updates of bulk crop deliveries, exports and domestic use,” said Blue. “The CGC numbers need to be adjusted to account for on-farm and other feeding. However, for crops like canola, little of which is used for feed or seed, the CGC numbers provide an accurate estimate of deliveries, movement from elevators, domestic use and exports.”

China suspended the canola export permits of Richardson-Pioneer and Viterra in March 2019, and that suspension continues today. Canola seed shipments to China have fallen to about 30 per cent of last crop year. Canola carry-over at the start of this crop year (on Aug. 1) was estimated to be at a record-high level of nearly four million tonnes.

Read Also

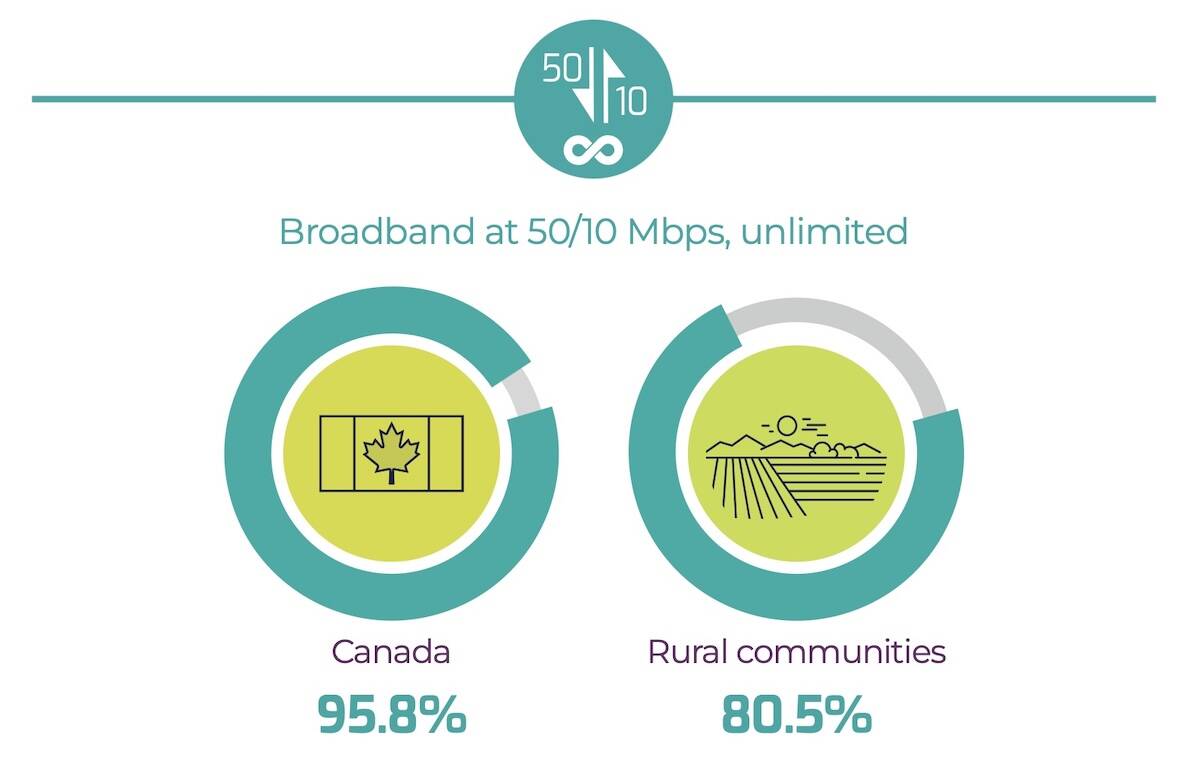

Rural Alberta gets further boost to internet connectivity

The province and feds join forces to help remote/rural Albertans get connected to reliable high-speed internet through its Broadband Strategy.

Canola supply-demand estimates made last fall projected canola exports during this crop year to be — at best — just above nine million tonnes, said Blue. That’s similar to the prior crop year and down from the record 11 million tonnes in 2016-17.

“Domestic canola use, almost all for crushing, was estimated unchanged from the last two years — nearly 9.3 million tonnes,” he said. “Early estimates were for canola carry-over to rise to a new record 4.5 million tonnes, quite possibly a price-depressing level. However, with as much as two million acres of Prairie canola yet to harvest as of December, the estimates became uncertain.

“Then came demand.”

Grain commission statistics (as of April 19) show that exports for the current crop year were 7.05 million tonnes — up 318,000 tonnes from the same point a year earlier. And crush totals were up 860,000 tonnes (to 7.48 million tonnes).

One result of China’s slowing of Canada’s canola exports was stronger domestic crush margins, said Blue.

“Canola seed prices fell relative to canola oil and canola meal values,” he said. “With more incentive to crush and an expanded crush capacity in recent years, the canola crush level is now headed for a record.

“Exports of canola seed are doing well so far, with increased exports to Belgium, France, Germany, Greece, Portugal, Bangladesh, Pakistan and the United Arab Emirates, offsetting much of the lower exports to China.”

Recent estimates of canola carry-over at the July 31 crop year-end have fallen to 3.2 million tonnes, with some estimates as low as 2.5 million, he added.

“Uncertain quality and quantity of spring-harvested canola, together with additional demand leaves the last quarter of the crop year to determine that carry-over result,” said Blue.

“Whatever that level is, it will be a great improvement over last fall’s estimate and one more likely to enhance the pricing opportunities during this growing season.”