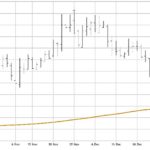

CNS Canada — ICE Futures Canada canola futures find themselves at a bit of a tipping point from a chart standpoint, with the most active March contract settling right at the $500 per tonne mark on Tuesday. In addition to being a psychological benchmark, $500 is also within 30 cents of the 200-day moving average […] Read more

Tipping point seen for March canola

ICE weekly outlook: Canola stuck in downward trend

CNS Canada — A downward trend in oilseed markets is likely to weigh on canola, one analyst says, as year-end trading has already scaled back prices. Since last week, ICE Futures Canada canola has lost $5.10 per tonne in its March contract, closing Wednesday at $503.60. “The big issue is we’ve got some year-end factors […] Read more

ICE weekly outlook: Canola chops around waiting for New Year

CNS Canada –– ICE Futures Canada canola contracts chopped around major support during the week ended Wednesday, as steady demand was countered by large supplies of oilseeds. Most traders rolled out of the January contract and into March, a move evidenced by the massive volumes on Monday and Tuesday. “People holding contracts may get nervous; […] Read more

ICE weekly outlook: Canola to notch lower in holiday trade

CNS Canada –– ICE Futures Canada canola contracts are likely to edge lower, short-term, in sluggish holiday trading. “It’s just kind of a quieter time of year for fundamental news, so you’re just kind of taking direction from outside markets,” said Jon Driedger of FarmLink Marketing Solutions. Canola prices will likely see pressure moving into […] Read more

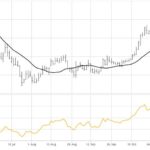

ICE weekly outlook: ‘Toppy’ canola could still go higher

CNS Canada — Canola futures have trended higher in the most active nearby contracts in recent weeks, but still remain underpriced compared to soybeans. From a chart perspective, ICE Futures Canada’s January contract is trading at the highest levels for the front month in two and a half years. However, while “the charts may be […] Read more

ICE weekly outlook: Farmers look for rallies

CNS Canada — As the last remaining days of harvest tick down, farmers are beginning to look for rallies to sell into, according to an analyst in the market. “The farmer continues to struggle out there, but seems content to sell into the rallies. I don’t think they’re selling into the breaks,” said Keith Ferley […] Read more

Canola nearing chart resistance

CNS Canada –– ICE Futures Canada canola contracts have trended higher for the past two weeks, with a rally in Chicago Board of Trade soyoil providing an added boost on Wednesday. While the nearby technical signals may be pointing higher, canola is also nearing major chart resistance. The January contract closed Thursday at $527.40 per […] Read more

ICE weekly outlook: Traders look to StatsCan, U.S. veg oil

CNS Canada — With questions about the size of Western Canada’s canola crop remaining, ICE Futures Canada traders are looking to an upcoming Statistics Canada report for indications on where to move next. Sharp advances in the Chicago Board of Trade soyoil market underpinned canola on the week, and investors are waiting to see if […] Read more

ICE weekly outlook: Rangebound canola watches U.S., China

CNS Canada –– ICE Futures Canada canola contracts find themselves trading within a rather narrow range, with a downturn more likely than a move higher in the near term. “We have a bull and a bear that are yanking each other right now, and (canola) is quite flat,” said analyst Errol Anderson of ProMarket Communications […] Read more

ICE weekly outlook: Canola loses ground, could fall further

CNS Canada — The ICE Futures Canada canola market declined on the week, and those losses are likely to continue, one Winnipeg-based analyst says. “This is going to be dominated by yesterday’s reversal in the canola, and the weather,” said Ken Ball of PI Financial Corp. Canola on Tuesday lost between $8 and $9 in […] Read more