MarketsFarm — The highs may be in for old-crop canola contracts on the ICE Futures platform, with attention in the market turning to the new crop. “I think the market has probably defined the upside potential and the acute demand rationing that needed to occur is done,” said Jerry Klassen, an independent commodity trader and […] Read more

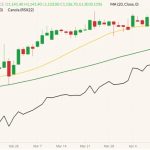

ICE weekly outlook: Highs might be in for old-crop canola

New crop in 'a very uncertain stage'

ICE weekly outlook: Conditions a challenge for Prairie canola

MarketsFarm — Wet conditions throughout much of the eastern half of the Canadian Prairies continued to delay spring planting this week. Meanwhile, the western half of the region remained mired in drought and in need of rain to help recently-seeded crops get off to a good start. “Get it in the ground and get some […] Read more

ICE weekly outlook: Jittery spring market for canola

MarketsFarm — ICE Futures canola contracts saw a sharp downward correction in early trading days of May, after setting all-time highs in April. While the correction was long overdue, underlying supportive influences remain in place and the market could be due for some sideways trade as participants now wait to get a better handle on […] Read more

ICE weekly outlook: Canola books steep rise in prices

MarketsFarm — Canola prices, along with other edible oils, received a strong boost on Wednesday due to sharp upticks in Malaysian palm oil values. Canola futures have also received support from a bullish forecast this week from Statistics Canada on planted acres for this spring. Despite the Indonesian government stating Monday its export ban on […] Read more

ICE weekly outlook: Trend remains pointed higher for canola

MarketsFarm — The ICE Futures canola market climbed to fresh contract highs once again during the week ended Wednesday, although profit-taking at those highs did slow the advances. While additional corrections are possible, both the underlying fundamentals and technical remain supportive. “This is the bull market of all time in canola,” said analyst Mike Jubinville […] Read more

ICE weekly outlook: Canola seen as teetering, likely to tumble

'A lot of emotion and tension' in market

MarketsFarm — ICE Futures canola values sit high atop a precipice, tittering toward a steep drop. One recourse for canola is to bank on prices for soyoil and soymeal on the Chicago Board of Trade (CBOT) to rise sharply in the near future — or take that step off its perch to what would be […] Read more

ICE weekly outlook: Overvalued canola market due for correction

MarketsFarm — ICE Futures canola contracts climbed to fresh contract highs during the first week of April, but ran into profit-taking resistance and could be due for more losses as the market looks overpriced. “We’re starting to see canola give back some of the extra premium it’s been putting on,” said Ken Ball of PI […] Read more

ICE weekly outlook: Canola in its own world, analyst says

MarketsFarm — To market analyst Wayne Palmer of Exceed Grain, canola “has been in a world of its own for about the last month,” and he expects that will remain the case for some time. Canola, he explained, has generally done the opposite of the Chicago soy complex — which the Canadian oilseed normally follows. […] Read more

ICE weekly outlook: Strong canola market to ‘see both sides of rainbow’

MarketsFarm — ICE Futures canola contracts climbed to their highest levels ever during the week ended Wednesday before running into some profit-taking resistance. Its general uptrend remains intact for the time being, but a downturn is also inevitable. The nearby May canola contract hit a session high of $1,177.80 per tonne on Wednesday, before backing […] Read more

ICE weekly outlook: Canola lower, but expected to climb

MarketsFarm — Although canola prices closed lower on Wednesday, the Canadian oilseed is seen as still likely to grind higher in the coming weeks. “The charts and the patterns that have developed, and are still in place for canola, have been kind of the same for the past few months. The longer-term trends are still […] Read more