MarketsFarm — After covering bearish bets for four straight weeks, managed money fund traders were back on the sell side of the canola market in late April, covering longs and putting on new short positions. According to the latest Commitments of Traders report from the U.S. Commodity Futures Trading Commission (CFTC), as of April 25, […] Read more

Fund short position in canola grows for first time in a month

Corn moves from net long to net short

ICE weekly outlook: StatCan’s canola area estimate questioned

Traders predict significant increase ahead

MarketsFarm — Statistics Canada on Wednesday released its first survey-based seeding intentions report for the 2023-24 marketing year, reporting an anticipated 0.9 per cent rise in canola acres, to 21.6 million. The figure occupied the lower end of trade expectations, but StatCan recently adopted a new methodology of conducting the survey last December and January, […] Read more

ICE weekly outlook: Weather to influence canola price movement

Short-covering seen supporting front months for now

MarketsFarm — Canola contracts on the ICE Futures platform held relatively rangebound during the week ended Wednesday, trading within a $20 per tonne range in most months as market participants wait to get a better handle on new-crop prospects. “There’s some concern developing on seeding delays,” said Jamie Wilton of RJ O’Brien in Winnipeg, adding […] Read more

ICE weekly outlook: New-crop November canola set to step back

StatCan not expected to sway futures much

MarketsFarm — There is presently little upside to new-crop November canola on ICE Futures, according to analyst Errol Anderson of ProMarket Communications in Calgary. Anderson pointed to losses in Malaysian palm oil and weakness in China’s soymeal market as weighing on ICE canola values, with more pressure coming out of South America. “The [soybean] production […] Read more

ICE weekly outlook: Not a matter of when, but where canola peaks

Prevailing trend remains downward

MarketsFarm — As the rally in canola on ICE Futures continued Wednesday, an analyst stressed it’s not when this upswing ends, but where. David Derwin of PI Financial in Winnipeg spoke of when canola prices were falling, and they broke through that psychological barrier of $800 per tonne on their way down. “That was the […] Read more

Canola fund short position still rising

Managed money net long in soybeans

MarketsFarm — The size of the fund short position in continued to rise in early March, according to the latest Commitments of Traders data out from the U.S. Commodity Futures Trading Commission (CFTC). As of March 7, the net managed money short position in canola came in at 46,222 contracts (61,998 short/15,776 long), an increase […] Read more

ICE weekly outlook: Canola continues its collapse

Limited demand, more farmer selling seen

MarketsFarm — After losing $62 per tonne the week before, the May contract on the ICE Futures canola market extended its losses for the week ended Wednesday with little relief on the horizon. Winnipeg-based trader Jerry Klassen of Resilient Commodity Analysis said the massive selloff is the result of farmers realizing there wouldn’t be a […] Read more

ICE weekly outlook: No floor in sight for overdone canola

'A lot of money playing around in canola right now'

MarketsFarm — The ICE Futures canola market was in freefall mode through the first half of March, hitting its weakest levels in over a year. While the losses may be looking overdone, the bottom remains to be seen. “This has been a brutal drop in canola,” said Bruce Burnett, director of markets and weather with […] Read more

Confirmation of large canola short position slowly appears

CFTC data flow slowly resuming

MarketsFarm — The size of the fund short position in canola rose in February and likely grew even larger in March, as weekly Commitments of Traders data slowly trickles out from the U.S. Commodity Futures Trading Commission (CFTC). CFTC data has stalled since a ‘cyber-related incident’ delayed the release of the data for weeks. As […] Read more

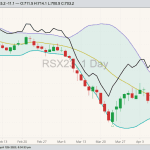

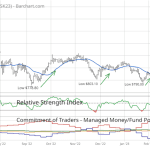

Reading between the lines: Oversold canola due for correction

Technical signs point to possible recovery

MarketsFarm — Canola futures posted sharp losses over the past week, with the May contract touching its weakest level in six months. While damage was done from a chart standpoint, there are technical signs that a recovery is possible. RSI The relative strength index (RSI) is a technical indicator that provides insight into whether a […] Read more