Renewable diesel production is poised to take off in the next five years and the coming boom is great news for canola growers, says the Canadian Oilseeds Processors Association.

“For canola crush, in terms of possible capacity growth in the years to come, we could see almost six million tonnes of increased capacity based on facilities that are either under construction today or have been announced,” Chris Vervaet, the association’s executive director, told attendees at Canola Week here.

“That’s significant growth from the current capacity – a 50 per cent increase, in fact.”

Read Also

Rural Alberta gets further boost to internet connectivity

The province and feds join forces to help remote/rural Albertans get connected to reliable high-speed internet through its Broadband Strategy.

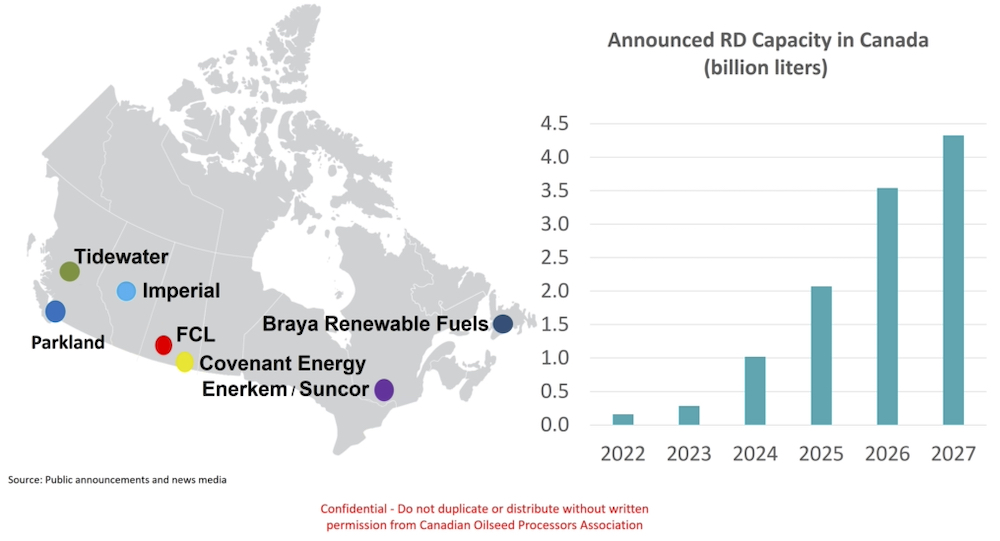

While Canadian production of renewable diesel is low now, it should reach one billion litres by 2024, two billion the year after, and almost 4.5 billion by 2027, Vervaet said during an online presentation.

There are a number of projects poised to come on stream, he said.

Parkland Corporation is expanding its renewable diesel production at its refinery in Burnaby, B.C.; Imperial Oil is proceeding with a renewable diesel complex at its refinery near Edmonton that will produce more than one billion litres annually; Federated Co-operatives Ltd. says its similar-sized facility at Regina will be in operation by 2027; Tidewater Renewables is building a facility in Prince George, B.C. able to produce 150,000 litres annually; and a Saskatchewan company called Covenant Energy announced last year that it plans to build a 300-million-litre facility in that province.

Production capacity is growing even faster south of the border, and so is demand for renewable diesel. Unlike biodiesel, it is chemically identical to fossil diesel and can be used in its place, even in cold weather.

Depending on the feedstock and production method, renewable diesel can reduce greenhouse gas emissions by 80 per cent or more, and that’s leading governments to push the green fuel, said Vervaet.

“There are a lot of biofuel policies that are driving demand over the next decade or so,” he said, adding that has already led to a production boom in the United States.

“Two years ago, there was 2.5 billion litres of production capacity. This year, that’s already roughly tripled. We see it now at 7.6 billion litres.”

Feedstocks can be vegetable oils (including soyoil and used cooking oils) and animal fats, but Vervaet predicted there will be a major expansion of canola production in North America, possibly by 50 per cent or more. Some of that could come from expanding into the brown soil zones of Canada and growing winter varieties in the U.S., he said.

“We have a lot of opportunities for productivity gains and acreage expansion. We have a high degree of optimism that we will see canola production grow in North America. Renewable fuels and the demand for renewable fuels is going to grow as well.

“We think there’s a lot of room to grow production and it will keep pace for the canola used in biofuels and the rest of canola will be used in the traditional markets such as food and feed.”

Producers haven’t seen the impact yet but they will, said Charles Fossay, president of the Manitoba Canola Growers Association.

“It’s probably three years away before we will see the full effect of renewable diesel and biodiesel as these fuel standards kick in,” said the grain farmer from Starbuck, southwest of Winnipeg. “As these new crush plants come online and they start using canola oil to be part of the refining process to produce diesel fuel, it’s another market for producers.

“In the long run, it will maintain good canola prices and add a bit more to the prices that farmers receive from the crops they grow.”

Alberta producer John Mayko echoed those comments.

“Definitely, I think it’s a good news story,” said the grain farmer from near Mundare. “I’m not sure how much extra demand will be from the biodiesel side of it. I guess it will depend on what the market forces us to do, whether the processors decide to put the canola oil into renewable diesel or biodiesel. Either of them is good news for us.”

Renewable diesel will also create more stable demand for canola, since producers will be able to sell to the North American market rather than relying on overseas buyers such as China, said Mayko.

Renewable diesel will also enhance the green credentials of farmers, said Fossay.

“I think it’s also showing how agriculture is helping to deal with climate change by reducing nitrous oxide and carbon dioxide emissions,” he said. “It’s just one of the many ways that agriculture is helping deal with those issues.”

And the push to lower greenhouse gas emissions isn’t going to let up, Vervaet said during his presentation.

“Renewable fuels are a proven and viable solution to decarbonize transportation fuels.”

“Transportation fuels in Canada, the United States and globally account for a quarter of all greenhouse gas emissions. It’s a very significant footprint in terms of emissions from transport fuels.

“Renewable fuels are part of that solution, especially renewable fuels from crops like canola, because they have a lower carbon footprint.”

A key hurdle was passed this summer when the federal government released details on its Clean Fuel Regulations. The canola sector had been concerned about the methodology that Ottawa would use to calculate how green a fuel source is, as well as the possibility that canola would require audits or certification. But those fears were largely allayed because the regulations acknowledge farmers’ stewardship efforts such as no-till and minimal till, which contribute to canola’s lower carbon footprint.

When the new clean fuel standard starts coming into effect next summer, the push for greener fuels will intensify, Vervaet said.

“This is a regulation that will mandate lower carbon intensity for the fossil fuels sold and used in Canada,” he said. “The federal Clean Fuel Regulations mandate a 15 per cent lower carbon intensity by 2030.”