Chicago | Reuters — China bought at least 14 cargoes of U.S. soybeans on Monday, two traders with knowledge of the deals said, its largest purchase since at least January and the most significant since a summit between President Donald Trump and President Xi Jinping in October.

China is buying U.S. soybeans to meet the pledges it made to Washington at the trade summit in Busan, South Korea, even though the cargoes are priced higher than rival Brazilian offers, two Asia-based traders said.

“This bigger round of U.S. soybean buying is no longer a goodwill gesture but a manifestation of China’s commitment to the Busan terms,” said a Singapore-based trader.

Read Also

Prairie Wheat Weekly: CWRS slips, as CPSR, durum rise

Spring wheat cash prices were mixed while those for durum were a little higher across the Canadian Prairies for the two-week period ended Jan. 6.

China’s state-owned grain trader COFCO bought at least 840,000 metric tons for shipment in December and January, the two traders with knowledge of the deals told Reuters.

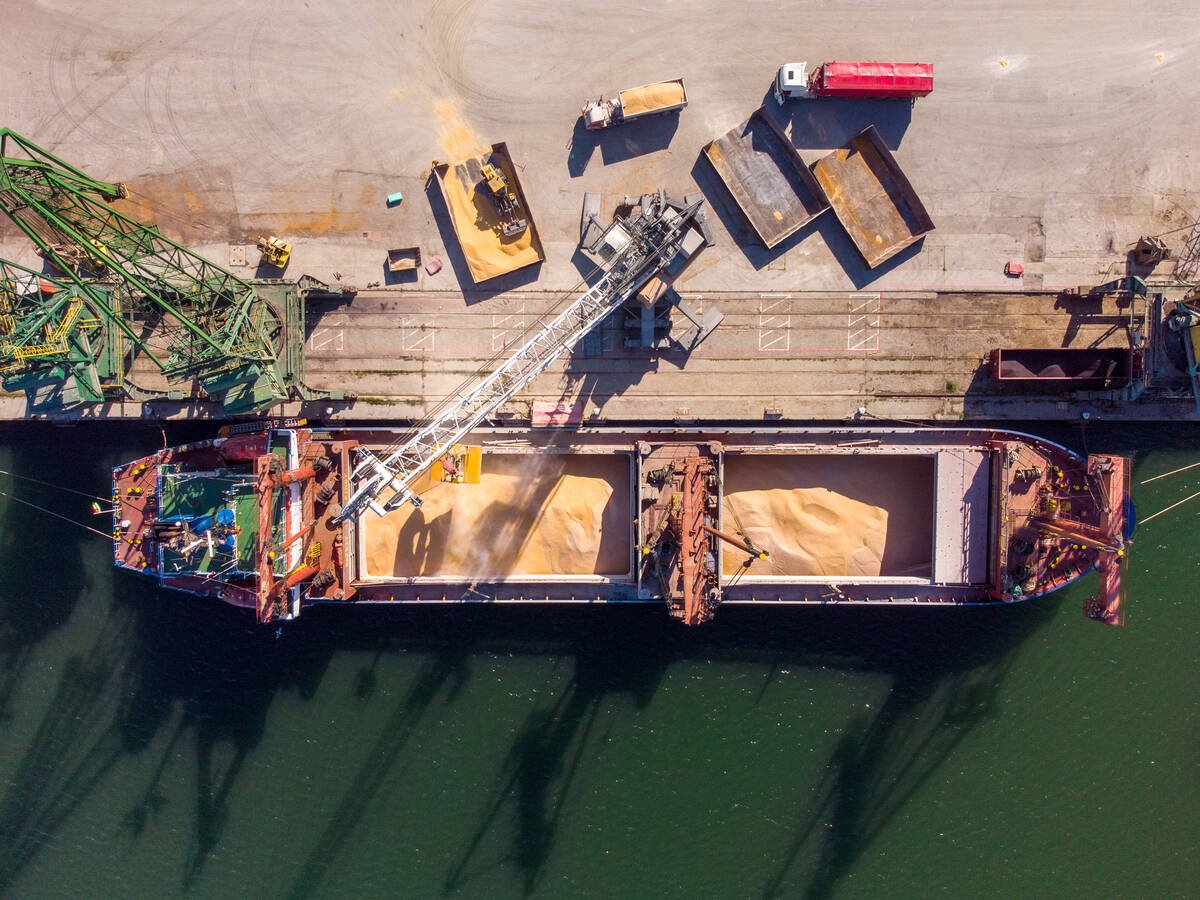

Eight of the vessels were for shipment in December and January from U.S. Gulf Coast terminals, while the rest were for shipment in January from Pacific Northwest ports, one trader said. A second trader estimated around 75 per cent of the sales were for Gulf shipment, with the remainder from the Pacific Northwest ports.

The sales total may ultimately be larger if more deals are finalized, traders said.

COFCO did not immediately respond to a request for comment.

All four traders declined to be named due to the market sensitivity of the issue.

The White House said China had agreed to buy 12 million metric tons of U.S. soybeans this year, but only a small volume of sales had occurred before Monday. China imported nearly 27 million tons of U.S. soy last year, according to U.S. government data.

Expensive U.S. beans a ‘political move’

Asian traders estimated COFCO paid $2.35-$2.40 per bushel over the January Chicago contract for shipments from Gulf terminals and a premium of $2.15-$2.20 per bushel from Pacific Northwest ports, well above the prices for Brazilian new-crop soybeans, which are around $1.25 per bushel over CBOT futures.

“It is a political move, as prices being paid by COFCO are much higher than Brazilian prices,” said a trader at a company which runs soybean processing plants in China. “Chinese companies are just doing it as a commitment to buy U.S. soybeans.”

Trump said on Friday sales would be on track by the spring.

“It is good to see the hard work of our U.S. trade negotiators and their Chinese counterparts turning into business for U.S. soy farmers and exporters. We look forward to this continuing as trade lanes are restored,” said Jim Sutter, chief executive officer of the U.S. Soybean Export Council.

China had largely shunned U.S. soybeans this season due to a heated trade war with Washington, sourcing supplies from export rivals Brazil and Argentina instead.

The absence of their top customer dragged U.S. soy prices to near multi-year lows this summer and heaped strain on a farm economy already struggling from rising costs for inputs like fuel, fertilizer and seeds.

Farmers and trade groups have been working to open new markets for U.S. soy, but those efforts to replace Chinese demand have been difficult.

The most active U.S. soybean futures on the Chicago Board of Trade rallied nearly three per cent on Monday to a 17-month high on the China trade optimism.

Cash premiums for soybeans delivered to Gulf Coast and Pacific Northwest terminals in the coming months and loaded for export jumped by 10 cents a bushel or more, traders said.

— Additional reporting by Ella Cao in Beijing and Naveen Thukral in Singapore