The Grain Growers of Canada is making some novel suggestions for what should be in the next federal budget. Like groups from all sectors, they are taking part in the pre-budget consultation.

Usually farm groups concentrate their lobby efforts on more money for safety net programs or some ad hoc assistance to meet the particular farm crisis du jour. The suggestions by the Grain Growers take a more business-oriented approach.

The Grain Growers of Canada claims to represent the interests of 80,000 Canadian grain, pulse and oilseed producers. Farm groups such as the Western Canadian Wheat Growers are members, giving the organization a more right-wing perspective than other umbrella farm groups such as the Canadian Federation of Agriculture.

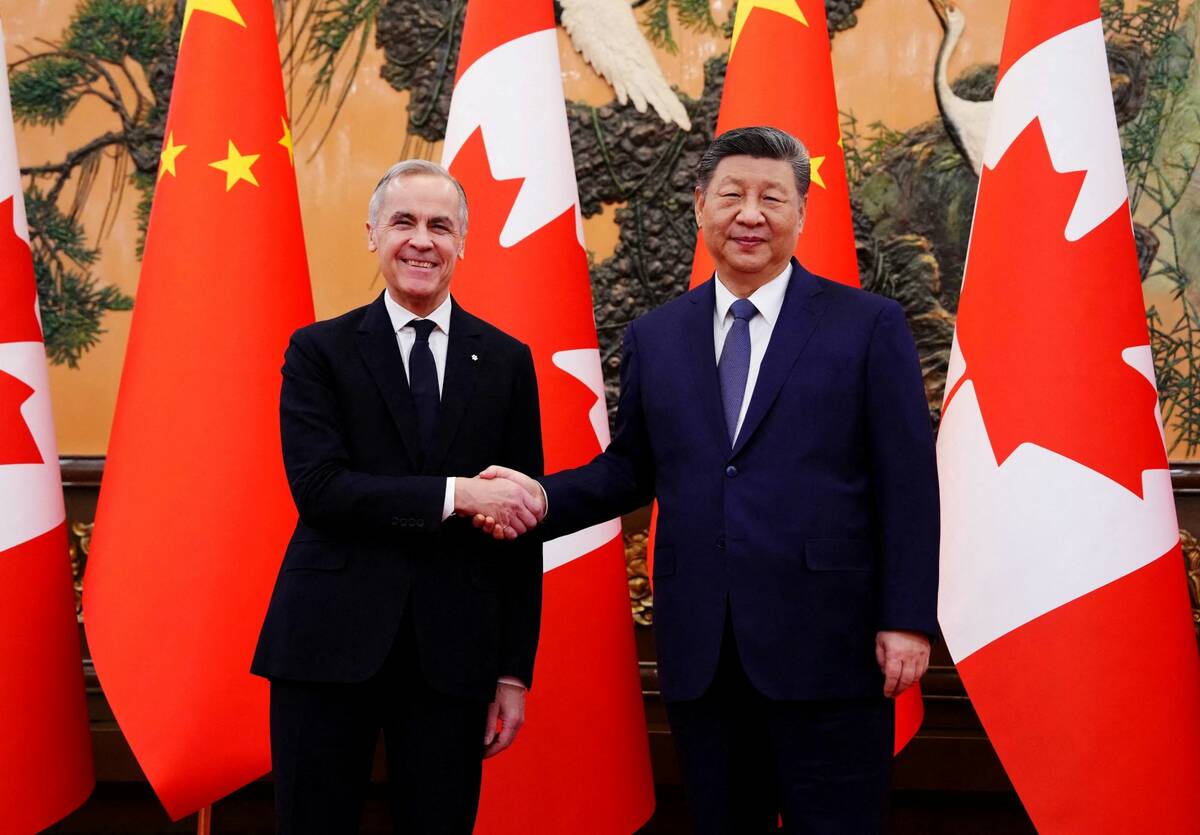

Read Also

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

Invest in public research, say the Grain Growers. On this point, they echo what many other farm organizations are also saying, but they are giving it more emphasis and providing more specifics.

They point out that real government dollars for basic agronomic research have fallen dramatically since 1994. If you need evidence, just consider that Agriculture and Agri-Food Canada has far fewer plant scientists and breeders than it once did.

The GGC recommends doubling of the research budget in AAFC to $560 million, along with a succession plan to replace retiring scientists.

While private research has an important role in the industry, there’s no clear return on investment in areas like cereal crop breeding or basic agronomic research. Those are areas where publicly funded research must continue to play a role.

The GGC also advocates a certified-seed tax incentive. The idea is to encourage the use of more certified seed, especially on cereal crops, so that private industry has a reason to invest in cereal breeding.

On cereal crops, most producers save their own seed, only buying certified seed if they want a new or different variety. A tax incentive would make it more attractive to buy certified seed more often.

Another recommendation is to adjust capital cost allowance (depreciation rates for tax purposes) to spur investments by farmers in three categories – on farm fertilizer storage, farm machinery upgrades for precision applications, and improved on-farm grain storage that helps preserve crop quality.

The encouragement for on-farm fertilizer storage would enable producers to buy more fertilizer in the off-season when it should be cheaper. The rational for improvements to grain storage is the increased testing for mycotoxins which can grow within stored grain. To limit this problem, it would be a great strategy to have aeration systems as an integral part of more grain bins.

The argument for adjusted capital cost allowance for precision application farm machinery is tougher to justify since cost sharing for much of this is already available through environment farm planning.

The recommendation is to increase the lifetime capital gains exemption on the sale of farm assets from the current $750,000 to a million dollars. The GGC argues that farm retirement savings are mostly tied up in farm equity for many producers.

It further argues that if retiring farmers could retain more of their life savings (in other words, pay less tax), it would help them pass on their farm to the next generation at a lower price, thereby increasing success for many young farmers.

As a farmer, it would be great to have an increase in the lifetime capital gains exemption, but there’s little evidence for how much benefit would actually trickle down to the next generation.

Still, it’s refreshing to see federal budget requests that treat farming as a business rather than a welfare case.

———

It’srefreshingtosee federalbudgetrequests thattreatfarmingasa businessratherthana welfarecase.