ICE Futures Canada canola contracts posted good gains during the week ended March 22, as solid end-user demand, the weaker Canadian dollar, a slowdown in farmer selling, bullish technical signals, ongoing concerns over tightening old-crop supplies, new concerns over possible planting delays this spring, and logistical issues moving soybeans out of South America all served to keep the path of least resistance to the upside.

However, while the nearby bias may be higher, canola remains range-bound overall, awaiting a larger catalyst to push it out of the $20-per-tonne range it’s been in for the past month.

Read Also

The Italian Job: New Holland reimagines its roots with ‘Il Trattore’ concept

New Holland’s ‘Il Trattore’ concept tractor blends modern T5 power with the legacy of the 1918 Fiat 702 to celebrate over a century of Italian agricultural heritage.

That catalyst could come with the release of the U.S. Department of Agriculture’s prospective plantings report on March 28. The report will include the first official survey-based estimates from the government agency on the size of this year’s soybean crop. After seeding 77.2 million acres in 2012, pre-report trade guesses are generally anticipating a new record-large acreage base for the oilseed. How much larger remains to be seen, but a bearish or bullish surprise from USDA could lead to some volatility ahead of the Easter weekend.

CBOT soybean futures dropped to their softest level in a month during the week, before uncovering some technical support and recovering to post small gains overall. Soybeans also find themselves trading sideways overall, and positioning ahead of that acreage report will likely keep that directionless trend intact until there is something new to drive the market. In addition to the acreage numbers, soybean traders are following the news out of South America closely. Farmers in Brazil are said to be over half finished bringing in their potentially record-large crop, but logistical issues in the country have hampered export movement so far. There are reports that over 100 boats are waiting to load beans at some port facilities — and while that bottleneck sorts itself out, some business is being diverted north.

For corn and wheat in the U.S., the trend was mostly higher during the week. Both commodities were said to have reached price points recently that brought in some new end-user demand. Short-covering off of those nearby lows was another supportive feature.

Corn traders will be following the USDA acreage estimates closely as well, with pre-report opinions divided as to whether there will be an increase or decrease on the 97.2 million seeded in 2012. If corn acres go up, some of that area would likely come from land already seeded to winter wheat that was abandoned.

Possible delays

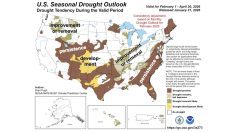

North American supply/demand issues will become more important in the grains and oilseeds over the next few months, as spring seeding starts up in the southern U.S. and works its way into Canada. With much of the Canadian Prairies still covered in a layer of snow, concerns over a wet spring and possible seeding delays have started to gain traction. However, there is still plenty of time to go before anyone starts writing off this year’s crop.

Aside from the concrete fundamentals, the shaky global economic situation reared its head again during the past week, providing a reminder that grains and oilseeds don’t trade in a vacuum.

The tiny Mediterranean island nation of Cyprus found itself as the latest euro-zone country at the brink of collapse and in need of a bailout. The country represents only 0.2 per cent of the entire European Union economy, but there is a legitimate concern that a failure with the banks there would snowball into problems elsewhere — and the shifting reports on the situation caused volatility in the international financial and commodity markets during the week.

A plan that would see the European Union, European Central Bank and International Monetary Fund provide a 10-billion-euro bailout failed to gain approval of the Cyprus government, as it would have seen an unpopular levy placed on all savings accounts in the country to drum up more money. Russia is also in the mix, as a large portion of money held in Cyprus’s banks was put there by Russian investors as a safe haven.

Banks in Cyprus were closed all week as the politicians and bankers tried to work out a “Plan B.” A solution will inevitably be found, but the question over how long the EU can keep plugging its proverbial dike before it breaks remains to be answered. Such a development would definitely have repercussions in the agriculture sector here in North America as well.