Glacier FarmMedia – Canada is facing stiff competition from Australia in many canola export markets.

“They’re here to stay,” said Jarrett Beatty, an exporter with Parrish & Heimbecker, during the Canola Council of Canada’s Canola Utilization Forum earlier this year.

“Unless they have an environmental issue, they’re going to continue to be a bit of a thorn in our side in terms of capturing market share.”

Read Also

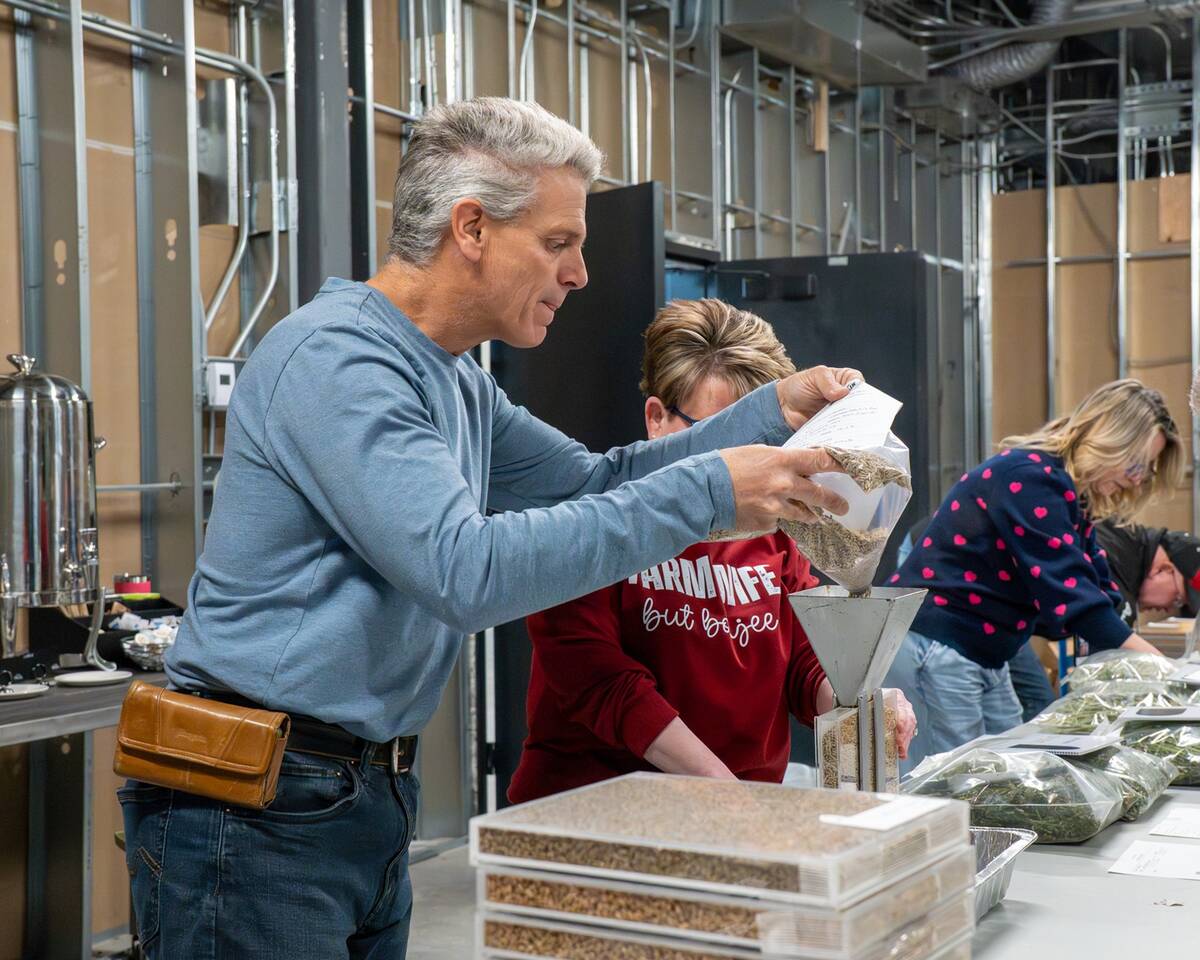

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

Australia is expected to export 4.4 million tonnes of the oilseed this year, down from 5.87 million tonnes last year and 5.91 million tonnes the year before that. Those figures are about double the annual volumes it historically shipped out.

Beatty said Australian canola is selling at a C$50-$60 per tonne discount in markets such as Mexico and Japan. The discount was as high as $100 per tonne last year when Australian growers harvested an eye-popping 8.27 million tonnes of the crop.

“The fact that Japan took any seed from Canada (that year) is a testament to their loyalty and their love of our product,” he said.

However, there is one market where Canada still rules due to a phytosanitary constraint.

“We have been more competitive in China because of their dockage regulations of one per cent and Australia’s inability to meet those regulations,” said Beatty.

Canadian exporters have long complained about having to clean to one per cent dockage to access the Chinese market.

“It has actually ironically given us a great advantage into China,” Beatty said.

Australia does not typically clean its canola, as its dockage off the combine is lower than Canada’s. It would have to invest in port cleaning facilities to access the Chinese market.

Beatty forecasts that China will buy 4.07 million tonnes of Canadian canola in 2023-24, which would be 61 per cent of total sales for the year. Exports to other markets, such as Japan, Mexico, United Arab Emirates, Pakistan, the United States and the European Union, are well below normal volumes.

“We are not competitive on prices (versus) Australia into those marketplaces,” he said.

Poor export performance is why the trade believes Canada’s ending stocks will be 3.74 million tonnes, almost double the two million tonnes Agriculture and Agri-Food Canada is forecasting.

“Growers were slow to engage as the prices were coming down and China was slow to ramp up,” Beatty said. “And again, we had this major pressure from Australia.”

The good news is domestic crushers are usurping more of the canola supply, consuming an estimated 10.93 million tonnes of the crop in 2023-24 compared to 6.67 million tonnes of exports.

Beatty said Richardson International’s new plant in Yorkton was recently commissioned and is now processing canola. Cargill’s plant is expected to open in 2025 and the Louis Dreyfus plant will follow in 2026.

Each of those facilities is capable of consuming 1.12 million tonnes of the oilseed annually, potentially spiking crush volumes in the next few years.

Jeff Pleskach, a trader with Cargill, said that will reduce Canada’s seed exports, while canola meal exports will rise.

China will be the target market for what is expected to be about three million tonnes of additional Canadian canola meal production. The country has a rapidly expanding aquaculture industry and canola meal has been underused in its dairy sector, the trader said.

There is also an anticipated drop in Chinese canola crushing as that capacity relocates to Canada.

Canola meal sales into the United States, however, will face stiff competition from expanded U.S. soymeal production, at least in hog and poultry rations.

Canola quality

Beatty was asked how Australia’s canola stacks up to Canadian canola on oil content.

It typically higher, he responded; in the range of 46-47 per cent compared to Canada’s 43-44 per cent, since it is grown as a winter crop in Australia. That makes Australian canola even more competitive, especially in the past few years when Canada’s oil content has been lower than normal.

Curtis Rempel, vice-president of crop production and innovation with the Canola Council of Canada, said the Western Canada Canola/Rapeseed Recommending Committee sent a signal to breeders a while ago to increase protein content.

That has come at the cost of oil content. If the industry wants the focus to shift back to oil, it needs to inform breeders.

“They can’t do it on a dime, but certainly over a five-year period, they can start edging levels up,” he said.

Rempel also noted that genomics research shows it is possible to increase both oil and protein at the expense of fibre.