With the sharp drop in Alberta fababean acres in 2016, has the clock struck midnight for last year’s Cinderella crop?

Maybe, maybe not, says a provincial pulse expert.

“I just can’t see them going away,” said Mark Olson, Alberta Agriculture and Forestry’s pulse crops unit head. “I don’t think the acres are going to go down to 1,000 (acres) or even 5,000. We did take a drop this year, but I think we’re going to gradually build the acres.”

Alberta fababean acres exploded over the past five years, climbing from just 8,000 acres in 2012 to about 20,000 acres in 2013, and then 80,000 in 2014. But after peaking at around 100,000 acres in 2015, acreage fell by half this year.

Read Also

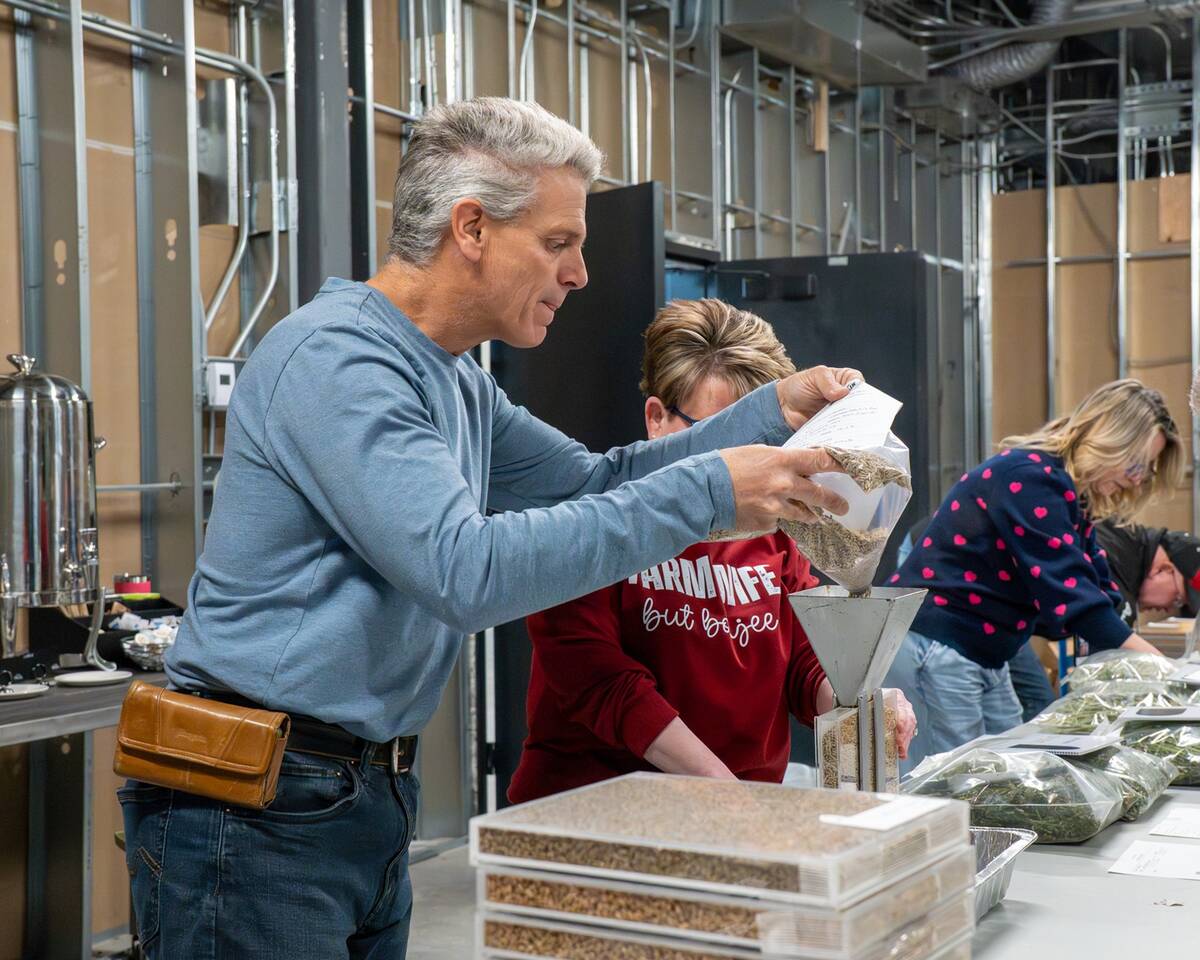

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

Last year’s drought is partially to blame, he said.

“It was no secret. We told farmers that, if you’re in a drier area of the province, you’re better off to grow lentils or peas,” said Olson, adding faba yields plummet when it’s dry.

“You’ll see yields in the mid- to high 20s bushels per acre when you don’t have the moisture, and when you have the moisture, you get upwards of 60 to 70 bushels per acre.”

As well, other pulse crops were more attractive at the start of the year, said Chris Chivilo, president of W.A. Grain and Pulse Solutions.

“Producers switched away from fabas after a poor year into crops that were a little more reliable and higher priced,” he said. “Peas were far more attractive price-wise to put in the ground this past spring, as were lentils and chickpeas, for anybody who could have seeded fababeans.

“The risks of growing fabas compared to peas in most cases just weren’t enough to justify seeding fababeans.”

Global competition

Producers who did seed fababeans this year saw average yields, said Chivilo, but those yields were still less than that of peas.

“Peas probably averaged 55 bushels per acre, and fababeans likely averaged 50 bushels per acre, which also isn’t a big help in increasing acres,” said Chivilo.

But quality was up from last year.

“We had a longer grower season and the crop matured, so we’re seeing nice, good-quality seed,” said Olson.

Despite that, fababean producers “aren’t selling a lot” so far.

“We’ve got about the same amount at this time as we did last year,” said Chivilo. “We’re being shown a lot of samples, but with the quality being better, we expected more selling. Pricing is not as attractive at this time as producers would want, so they’re tending to sit on them right now.”

But there’s “very little potential” for higher prices, he said.

“You might see an extra $10 or $20 (a tonne) throughout the winter, but there’s not a lot on the horizon to tell us that we’re going to see a price pop up $30 or $40.”

Prices are largely set by Egypt, which imports more than half of all food-grade fababeans traded annually.

“You’re kind of hung out to dry with one customer, and they can buy cheaper from the Baltic states — which have become very competitive over the last two years — as well as Great Britain, France, and Australia, which has higher-quality beans than all of the rest of the countries,” said Chivilo. “Unless there’s a bad crop in a couple of the competing nations, we’re really price dependent on Egypt.”

On average, Canada exports about 6,000 tonnes of fabas — a drop in the bucket compared to other producers that are closer to major customers in northern Africa and the Middle East. As a result, prices will fluctuate from year to year, and so will acreages, said Chivilo.

“We’re a small, small supplier compared to almost everybody else, so we don’t really have any impact on pricing at all,” he said. “I’d like to say that we should see a gradual trend toward higher prices over time, but it’s totally dependent on these other countries. If the Baltic states decide to grow something else, our price will go up. If Australia cuts back on acres, our price will go up.

“But we have no impact whether we seed 100,000 acres or 50,000 acres.”

Other markets

The feed market for fababeans is also hurting Canada’s export market — “but that’s not necessarily a bad thing,” said Chivilo.

“Most of last year’s crop went into feed, and it got a lot of new users using fababeans because of the protein benefits compared to peas,” he said, adding a reliable feed market has been helping increase acres over the past five years.

While faba prices could drop this year with the abundance of feed grains hitting the market, livestock feeders still need a protein source, and fababeans fit the bill.

“They need some kind of a feed protein, whether it’s soybean meal or canola meal, and fababeans and feed peas replace that to a certain extent,” said Chivilo. “The main competition to fababeans and feed peas is soybean meal. If soybean meal goes up, the feed fabas and the feed peas will go up.”

There are also plans for fractionation plants in Alberta, which could help boost acres.

“If you break it into its protein, starch, and fibre, fababean has got some really nice qualities about it,” said Olson. “We were hoping that the fractionation of the crop would really help with the market. The plants that were on the books are progressing, but not as quickly as we had hoped.”

Global demand for plant-based protein is set to double by 2024, and as high-protein ingredients, fababean fractions work better than pea fractions to replace cereals in baked goods, pastas, and other food products where wheat or barley are traditionally used.

“We have a huge world population to feed, and they need protein,” said Olson. “I think it’s going to be a no-brainer. We’re very well situated. I don’t have a crystal ball, but I just can’t see fababeans going away.”

But Alberta producers shouldn’t hang their hats on a fractionation plant, which would increase fababean acres in the province only marginally, cautioned Chivilo.

“If someone built a fractionation plant for fababeans, that could increase the acreage, but it likely wouldn’t impact things more than 10,000 or 20,000 acres overall,” said Chivilo.

“We could probably support 200,000 acres if we had a half-decent export program and maintained or grew the feed side of things even marginally, but that would be the limit right now.”