Forget that old farm dog — options are a farmer’s best friend.

“If you don’t have options in place, your tool box is not quite complete,” said David Derwin, an investment adviser with PI Financial.

“If we can add a few more newer, sharper, better tools like options into the tool box, we’ve got a much more complete tool box to work with.”

Unlike other grain-marketing tools, options give producers the opportunity — not the obligation — to sell their crop at a certain price or before a certain date, said Derwin, who spoke at FarmTech in late January.

Read Also

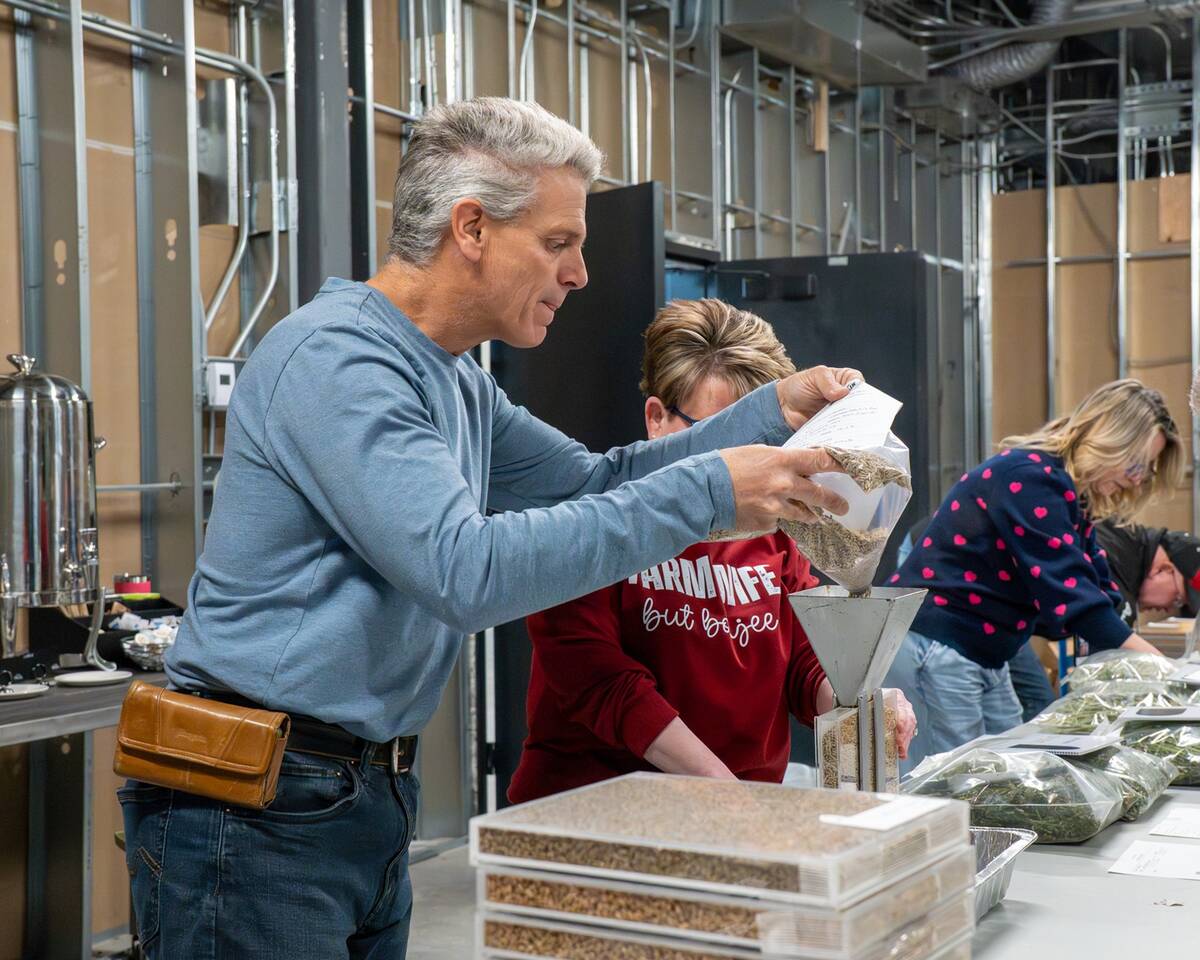

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

“Options provide protection on one of your biggest assets out there — your grain,” he said.

“Options are really just like insurance. You pay a premium, and your asset is protected.”

But despite the flexibility that options offer, only five to 10 per cent of farmers use them, said Derwin. He chalks that up to bad experiences with other types of grain-marketing tools, like hedging.

“There’s always been an issue with hedging — rightfully so — because you don’t really know at the end of the crop year what you’re going to have coming off the field,” he said.

“If you’ve priced something and all of a sudden you have hail or you just don’t have the same yields, you don’t have that grain there for delivery. That’s what causes people to be a little more hesitant to hedge properly.”

Not so with options.

“There’s no requirement for you to deliver your cash or physical grain into the contract,” he said.

“You don’t have to worry about delivery risk or production risk. You can have the ability to contain some downside, but you’re not worried about what’s going to come out of the ground for delivery.”

Bragging rights

Price is another issue with hedging. Once the grain hits the target price, that’s it — even if the price goes up the next day.

“We’re all human. We all want to sell at the high,” said Derwin. “But that’s the nice thing about options. You’re not locking in a price. All you’re doing is putting some downside protection in place.

“It gives you that downside protection so you can sleep at night, but it still gives you that upside so you can brag to your neighbour that you got a much higher price.”

But like any grain-marketing tool, options need to be part of an overall marketing plan.

“Everything has its place. It’s all about fitting it in with your marketing decisions,” said Derwin.

“At the end of the day, it’s really about balancing it to put money in your pocket. It’s not just about managing risk. It’s also about protecting revenue.”

And in order to do that, producers need to put measurable marketing goals on paper.

“There’s that saying that ‘what gets measured gets treasured,’ and I think that’s absolutely right,” said Derwin.

“If you’ve got it written down somewhere — even just a goal to have a process in place for the upcoming crop year — that makes a big difference.

“Have the goals in place. Know what you want to do. Know what your target levels might be.”

When margins are slim, it’s doubly important to spend more time on grain marketing, he added.

“We’re still going to have another couple of tough years in agriculture,” said Derwin.

“It’s not going to go straight down — there’s still going to be lots of opportunities. But I think that makes the idea of capturing more revenue for the farm and taking advantage of a spike in prices all the more important.

“We’ve got to adapt and adjust accordingly. And one way to do it is by being much more progressive and active by spending much more time on the marketing side.”