Scott Keller is pretty impressed with the latest crop profitability outlook from Manitoba’s Ag Department — but he’s not buying its prediction that oats will be this year’s No. 1 money-maker.

Canola is still king and its reign isn’t going to end any time soon, said the grain farmer from New Norway.

“Nothing will even come close to canola, even if it is a 40-bushel crop,” said Keller.

Still, he said he was surprised by the accuracy of the Manitoba report (a detailed accounting of both fixed and operating costs) and said its cost estimates were, for the most part, close to what he encounters on his operation.

Read Also

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

Keller, along with Rumsey producer John Kowalchuk and agronomist Carol Holt, were asked by Alberta Farmer to look at the Manitoba cost-of-production report and offer their thoughts on the upcoming growing season.

The report (available at www.tinyurl.com/4shpehpk) details 12 operating costs (from seed and fuel to storage and loan interest) for 17 grain and oilseed crops and then factors in fixed costs, the farmer’s labour, prices and yields to produce a net profit figure.

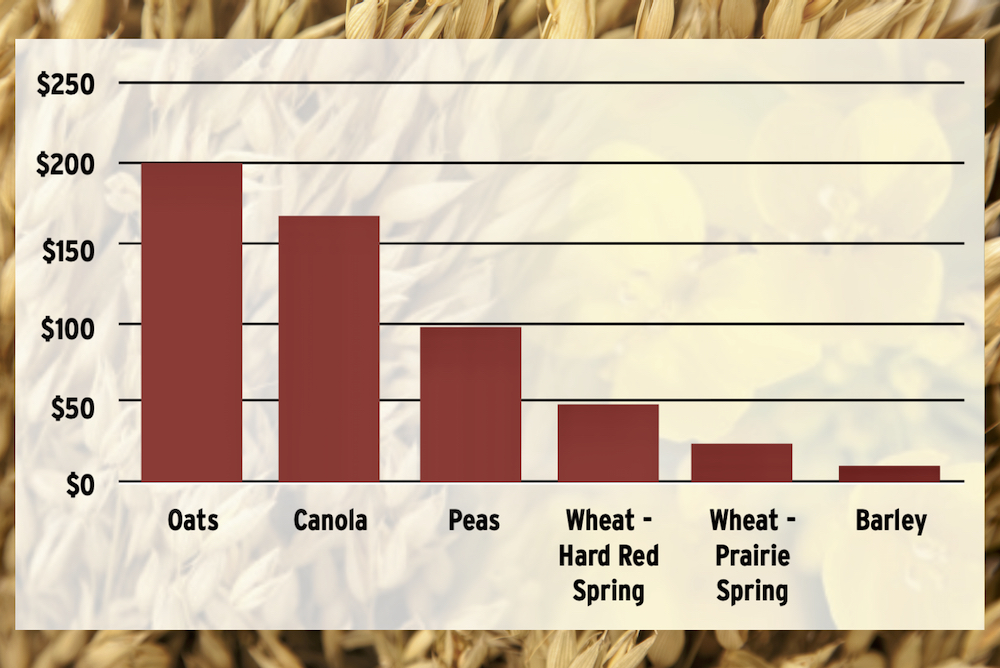

For 2022, it predicts plain old oats will mop the deck with everyone — delivering a net profit of $200 an acre with canola in second spot (at $167 an acre) and peas a distant third (at $97).

There are, of course, a lot of assumptions in those numbers. For peas, for example, you’ll need to get 46 bushels an acre, a price of $13 a bushel and keep your costs to $500 an acre to hit the forecast profit in the Manitoba report.

Keller’s costs will be higher from the get-go.

“I’m buying all certified seed on my peas,” he said, adding land rents in his area are a good $20 an acre more than those listed for Manitoba.

Still, he’s planning to grow oats for just the second time ever.

But like Keller, most producers still view canola as the best money-maker, said Holt, an independent agronomist with Crop Doc Solutions.

“I know a lot of guys are talking that canola is going to be a major cash crop,” said Holt, who resides in central Alberta. “Canola looks really promising. There are other crops out there, that financially look very strong.”

But when it comes to crop planning, price isn’t everything, she said.

“In the end, the agronomy drives it as much as what each crop is going to provide for a revenue,” she said.

So she urges producers to have a sensible rotation plan and stick with it in order to minimize disease or other production issues.

“If you change the rotation and you slip a crop in for next year to get more money, or to build up your finances a little, you’re going to have to pay for it a year down the road,” she said.

However, like Keller, Holt has been thinking about oats, noting the market for milling oats grew by about 10 per cent last year and is poised to grow more.

The rapidly growing plant-protein market is also boosting demand for pulses but disease potential should be top of mind, she said.

“Peas and aphanomyces really scare me,” said Holt. “I’ve got guys who are looking at fababeans because of the surge (in demand) for protein. There are always alternatives out there. It doesn’t have to be peas.”

Kowalchuk will be growing peas because they are part of a rotation that he strongly adheres to.

“It’s a fairly good one to have in the rotation, for a lot of reasons,” he said. “Not only does it make money, it’s good for the land, too.”

Prices for peas are strong but it’s canola prices that are wowing Kowalchuk.

“Canola is a big one with $19 (a bushel) pre-pricing for new crop for September/October,” he said. “It’s unprecedented.”

But as he has for many years, Kowalchuk is eyeing the other side of the ledger and trying to keep costs down. He said he is glad to have purchased all his fertilizer back in September, when prices were lower.

“That was the biggest thing. I wanted that peace of mind by having it on farm,” he said.

His costs are lower than those in the Manitoba cost-of-production report, particularly when it comes to equipment.

“My stuff is older. I don’t have high payment costs on equipment. I’m in the part of my farming career where I am trying to wind down and get in a position where I am not owing money. That can really affect how you farm because your budget is different.”

One of the crops that doesn’t fare well in the Manitoba forecast is barley. At a forecast price of $7.25 per bushel with a yield of 76 bushels an acre, growers will barely break even, says the document.

But Keller disagrees. He grows malt barley, and has contracted it for $8.50 a bushel (with an Act of God clause). And while that’s well below the “insane” $11 price seen last fall, “$8.50 is pretty good, too.”

“We’ve never had an opportunity to contract malt that high before,” he said.

“I think there’s still going to be good barley prices next year. Barley should be a good profit-maker for malt, but even for feed in Alberta.”

Holt also sees that as a good market.

“I do have quite a few clients who are growing malt barley consistently,” she said. “If you get the quality, you can sell it. Barley will coincide with calf prices, and calf prices are starting to move.”

Keller employs a one-in-eight-year rotation and sticks to it, and like Holt, says that pays off in the long run.

And with so many crops seeing high prices, there’s no reason to roll the agronomic dice this year, he said.

“There are so many opportunities to grow crops that can make money. There is no reason why any guy should be pushing his rotation too hard.”