It’s not fully paved and sinkholes abound, but upgrades to BR-163 has made it a ‘viable roadway’ and opened a new gateway for soybean exports

Reuters / A new northern front is opening in the battle for a share of Brazil’s burgeoning soy and corn exports as a highway decades in the making finally opens, offering a shortcut through the Amazon jungle to northeastern waterways.

The BR-163 connects Mato Grosso state’s Soy Belt to two key river ports and will boost grain exports by three million tonnes next year, offering a bit of relief to congested ports in the southeast.

One of those northern ports boasts a new Bunge terminal and another is a decade-old facility run by rival Cargill, which is angling to quadruple exports through the area.

Read Also

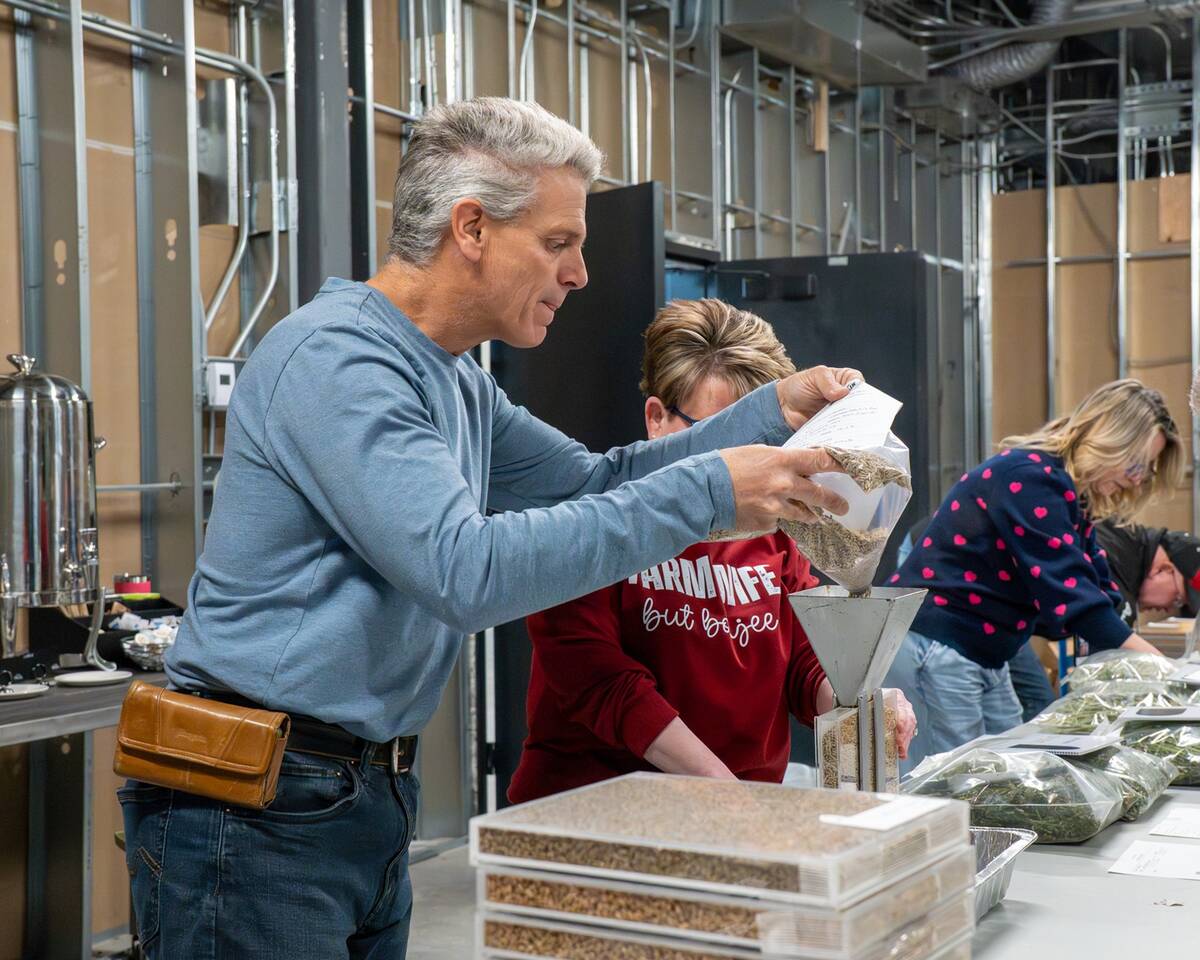

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

Both look set to face even more competition as other companies make plans to build terminals across the sprawling northern waterways, using a mix of road and barge logistics to get Brazil’s expanding harvests to market.

To be sure, BR-163, long behind schedule, offers only modest relief for the moment. The 1,385-kilometre stretch of road won’t be entirely paved for a few more years and sinkholes already abound, making it a fraught journey, even for truckers accustomed to Brazil’s rutted roads.

But it is now considered passable, and for the first time in years, Brazil’s overstressed transport grid has a new route.

“We’ve been exporting through the wrong route, to Santos and Paranagua,” said Carlos Favaro, president of Mato Grosso’s soybean association Aprosoja, referring to the ports on the southern coast. Ships there had to wait for 60 days to load grains last year and some frustrated buyers cancelled orders.

Northern flows are already gathering pace. In August, 14 per cent of the corn shipped from Mato Grosso, or 280,000 tonnes, left through the Port of Santarem on the Amazon River according to Mato Grosso state’s farm research institute, up from next to nothing in all of 2012.

The benefits are easy to calculate — a journey that’s 600 kilometres shorter and a freight savings of 40 reais (C$19) per tonne.

Cargill advantage

Many farmers have been waiting for the BR-163 to be paved for more than 30 years, and the government has acknowledged that shipping through the southeast is no longer viable. Last year roads were so clogged that some chose a 1,600-kilometre detour to the far southern port of Rio Grande. To solve the problem, in May Congress passed legislation to allow private firms to invest in public ports.

No one knows the area’s potential and challenges better than Cargill.

Until recently, it trucked almost all of its soy west from Mato Grosso, away from the eastern seaboard, 1,500 kilometres to the small river town of Porto Velho, Rondonia, where it is loaded on barges that then sail east to Santarem, and on to the Belem port on the coast.

But the BR-163 will give the company a more direct route north to Santarem.

“The BR-163 has some traffic, even though 400 kilometres still need to be paved,” said Clythio Buggenhout, Cargill’s port director. “The road is now relatively viable.”

Usually, Cargill moves about 1.3 million tonnes of grains through Santarem, but in 2014 that amount could be about two million tonnes due to the increase in road capacity from Mato Grosso, he said. The eventual goal is five million tonnes, one-fifth arriving directly by road and the rest barged from a port south of Santarem, which shaves nearly 300 kilometres off the drive.

For Mato Grosso’s farmers, the opening of new routes next year is a long overdue sign of hope.

“It’s not going to solve the problem because this is just the beginning — but the important thing is that shipments are definitely being made through the north of the country,” said Favaro of Aprosoja.