It wasn’t only a bad year for growing wheat in Canada and the U.S. — poor weather in other major producers has sharply reduced the world’s exportable supplies.

In a recent webinar held in conjunction with Alberta Wheat and Barley, Jade Delafraye of London-based Argus Media said the U.S. Department of Agriculture has dropped its estimate of supplies in the top eight exporters to 297 million tonnes compared to 392 million in June.

This represents the largest in-season drop in wheat production since 2010, Delafraye said.

Read Also

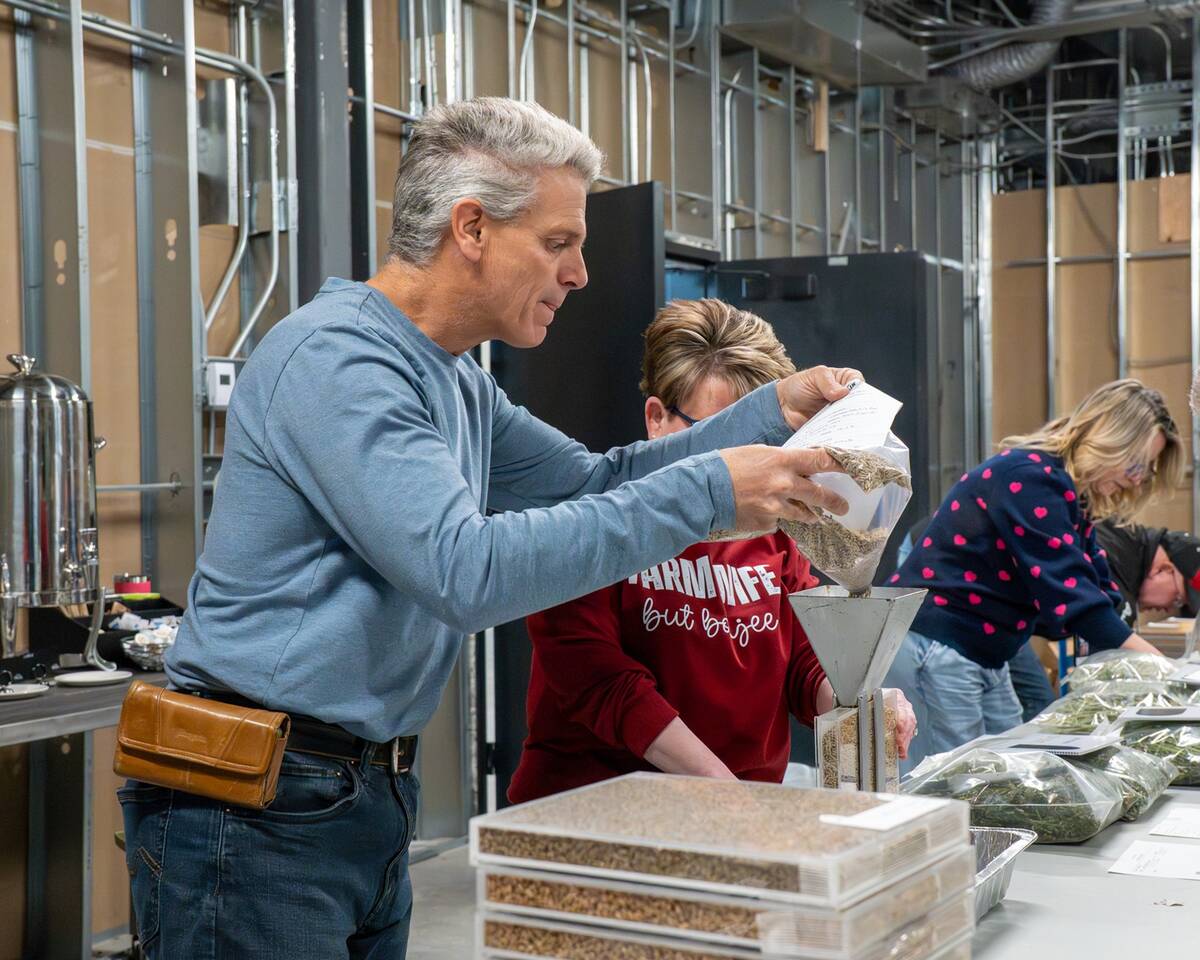

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

“If we compare this season to the revisions which have happened in previous years, this is one of the sharpest drops we’ve seen this early on in a season. In terms of trends, we are almost as sharply revised down as we were in 2010. It’s a once-in-a-decade-type situation.”

Hot/dry, cold/rainy

Quality also suffered in several areas.

“The North American and Russian stories were similar (to Canada) in that they faced above-average temperatures with below-average rainfall,” Delafraye said.

“Western Europe on the other hand faced colder weather. But the big thing that happened in Western Europe was rainfall, which generally speaking was well above average in June, July and a little bit into August. That month things dried up but they had accumulated a lot of rainfall in July which they never really recovered from.”

The rainy summer led to a late harvest and high dockage.

“They just couldn’t get the wheat out of the fields at the pace we had anticipated.”

Most of the production cuts were in countries that produce high-protein wheat, including Canada, Russia and the U.S., Delafraye said.

Forecasts for Canada’s crop were around 32 million tonnes in June but dropped to 23 million in September. Projections for Russia went from a little over 85 million tonnes to 73 million in the same period. The U.S. drop was less severe — from 51 million tonnes in June to 46 million in September.

“We will face a tight situation on high-protein wheat,” Delafraye said.

Vessel shortage

The problem of short supply is compounded by a shortage of ocean vessels and higher freight rates. Although demand has slowed recently, the last crop year’s heavy grain and oilseed shipments to China required more vessels, pushing up rates. “Not only are we shipping new volumes of agricultural products but we’re also taking those volumes on longer routes so we’re keeping the vessel occupied for longer,” Delafraye said.

“So what we’re seeing here is the availability of vessels being absorbed by stronger exports of grains and oilseeds that are taking up some of these dry bulk vessels, in the process limiting more cargoes.”

In spite of lower production, wheat exports are still looking stable after domestic consumption, Delafraye said. That means high freight rates may continue. “Wheat isn’t going to ease up demand of vessels and certainly with the corn and the soybeans we’re probably looking at more vessels being utilized in the coming crop year.”

Delafraye said the market is also tight for container vessels.

“The container ship segment is seeing extremely strong rates and that has provided a floor to some of the other dry boat vessels because some of the cargo that could have otherwise been loaded on containers is going to be loaded on smaller dry boat vessel classes. That’s keeping the whole dry boat complex supported from the bottom.”

So are high freight rates here to stay? That depends, Delafraye said.

“Now that we’ve seen some of the reasons behind the sharp freight rates we see that some of these reasons may not go away overnight. And so it remains to be seen how long the freight rates will stay supported. For sure there is some level of support that is likely to continue in the coming months.”