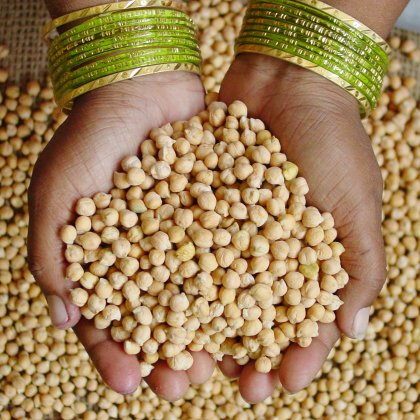

Glacier FarmMedia | MarketsFarm – The size of many chickpeas in Western Canada’s 2024-25 crop is leading to lower prices.

Jake Hansen, general manager of Mid-West Grain Ltd. in Moose Jaw, Sask. explained there was a greater proportion of the eight-millimetre variety of Kabuli chickpeas grown this year compared to the nine mm variety than in other years. With the eight mm-sized chickpeas being more common worldwide, adding to the supply has pressured prices.

“We had a decently large crop from a volume perspective, but calibre-wise, it wasn’t very big,” Hansen said. “It’s not as big as we would usually produce on a percentage of eights and nines.”

Read Also

Pulse Weekly: Spike in yellow peas slowing

Although the price increases for Canadian yellow peas have started to slow, there could be more of the peas planted come spring, said Kress Schmidt, broker with Johnston Grains in Calgary.

He added that most Kabuli chickpea-growing countries can produce the eight mm variety well, while only a few can grow nine mm at the same scale and quality. Currently, demand for eight mm chickpeas is not as high as those at nine mm, which is widening a price gap between the two.

“For farmers and producers who have a higher percentage of nine mm (chickpeas) in their samples, they are getting higher premiums today versus those that have smaller numbers in their samples,” Hansen said.

Just like Canada, two of its main competitors in the global chickpea market, Turkey and Argentina, didn’t produce a lot of nine mm Kabulis. However, the United States produced more of the nine mm variety this year, he added.

The price gap between eight mm and nine mm Kabuli chickpeas could further widen in the next month or two if the World Food Programme issues a tender asking for a greater amount of the larger-sized variety. Prices may start to soften in February when India enters the market.

“If (the WFP) comes to market in December and January in need of a bunch of nine mms, that would drive the market up,” Hansen said. “We don’t have a lot of nine mms. (No guarantees) but it could widen the gap going into December and January.”