Canada is exporting more wheat than the U.S. for the first time in decades.

After decades of playing second fiddle to its southern neighbour, the low Canadian dollar and other factors have this country’s exports edging ahead in what some industry observers consider a new trend.

Last crop year, Canada exported 23.9 million tonnes of wheat, including durum, narrowly surpassing the U.S. with exports of 22.3 million tonnes, according to International Grains Council figures. Canada is forecast to export 21.9 million tonnes of wheat in the current crop year (2015-16), compared to 20.5 million tonnes from the U.S.

“Obviously the exchange rate matters, there’s no question about that, but I do see this as part of an ongoing trend,” said Cereals Canada president Cam Dahl. “Now, I’m not going to say this will happen all the time, but I think this is the trend. We are going to see Canada take more and more of this (world) market.”

Kevin Auch, chair of the Alberta Wheat Commission, can’t say for certain if this signals the start of a new trend — but says it’s positive for Alberta’s wheat industry regardless.

“It’s very positive. It shows we’ve had some good sales,” said Auch, who farms near Carmangay.

“Canadian wheat is very consistent in quality, and because of that, it’s very desirable for our buyers. We’re trying to make sure the wheat we’re growing is what the world wants.”

One factor has been finding new markets for Canadian wheat, such as Bangladesh.

“They are very loyal to Canadian CWRS (Canada Western Red Spring) wheat in particular and buy over a million tonnes (a year),” Dahl said. “We have markets like that, that 10 years ago we wouldn’t have thought of.”

The U.S. has dominated world wheat trade since the Second World War with Canada running second until European Union exports increased late in the last century. In the last crop year, the EU was the world’s top wheat exporter at 35.4 million tonnes followed by Canada, the U.S. and Russia (at 22.8 million tonnes).

Since the collapse of the Former Soviet Union, wheat exports from former members, including Russia and Ukraine, have risen sharply.

Read Also

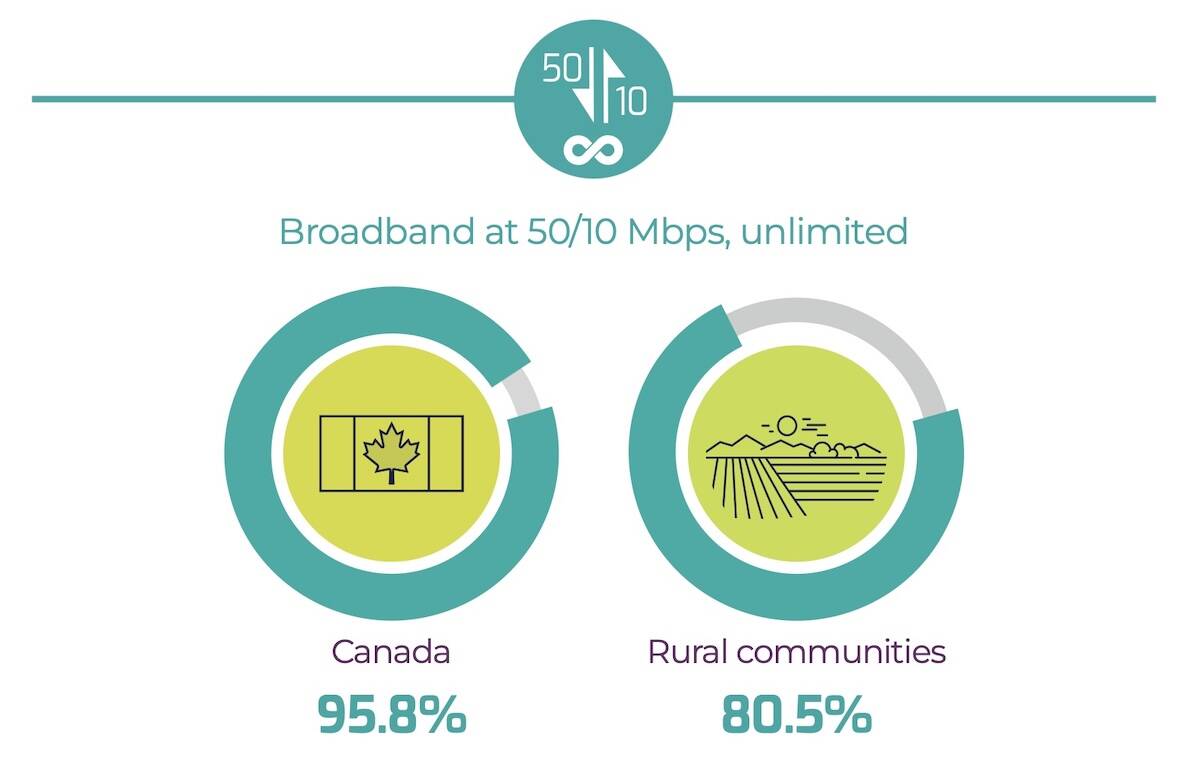

Rural Alberta gets further boost to internet connectivity

The province and feds join forces to help remote/rural Albertans get connected to reliable high-speed internet through its Broadband Strategy.

During the 1920s and 1930s Canada dominated world wheat exports, and was the largest global supplier 16 out of 18 years (see graph) between 1921-22 and 1938-39.

Although American farmers have been shifting away from wheat to grow more corn and soybeans, its wheat-producing capacity still dwarfs Canada’s. The U.S. plants around 63 million acres to wheat annually, compared to 24 million in Canada. In 2014-15 Canada produced 29.4 million tonnes of wheat versus 55.1 million in the U.S.

In Alberta, where canola is king and corn can’t compete, wheat is a “natural fit” in the rotation, said Auch.

“It’s great to have it in the rotation agronomically, but it’s better if we can get a decent price for it too,” said Auch, adding that with increased production over the past two years, more Alberta farmers are considering wheat as part of their rotations.

But logistics play a part too, and right now, Canada is lagging behind in that regard, he said.

“It’s not just one factor that makes for higher sales in the world,” said Auch. “You have to have the production for sure, but you have to have people selling it and you have to have the transportation system to get it there too.”

Low loonie

In many of the last nine crop years, the U.S. carried over more wheat than Canada exported. During that period, Canadian wheat exports averaged 19.4 million tonnes, compared to 28.6 million for the U.S. In the last crop year, Canadian wheat exports were well above average, while it was reverse for the U.S.

“This trend is underpinned by favourable exchange rates for Canadian exports,” the USDA says. “A strong U.S. dollar is hampering the United States’ ability to compete in traditional markets, much less in a global market awash in lower-priced wheat. The U.S. dollar has appreciated 32 per cent against the Canadian dollar since the start of the 2013-14 trade year.”

In February, Canadian wheat was earning an extra $1.50 a bushel ($55 a tonne) over American due to the exchange, said John Peterson, Richardson International’s assistant vice-president wheat marketing and hedging.

“It’s not just Canada, it’s other countries that are taking market share from the U.S. and in some cases much more aggressively than we are,” said Neil Townsend, G3’s director of market research.

“A good case in point is Nigeria, which used to be exclusively a U.S. market, but it’s taking more and more Russian and Ukrainian wheat.”

Industry analysts say Canada’s grain-handling and transportation system has just been humming since the Canadian government ordered the railways to meet minimum weekly shipping targets following the grain backlog in 2013-14 following record grain production.

U.S. wheat carry-over stocks are expected to be well over 27 million tonnes, while Canada’s, excluding durum, is forecast at around four million.

“Currency has made the U.S. uncompetitive and more of a residual supplier in the world now,” said market analyst and ProFarmer Canada president Mike Jubinville.

But don’t expect higher prices as a result.

“Canada does not dictate world wheat prices,” Jubinville said. “We are price takers. We are never price makers. The world is still flush with wheat and looking at the largest carry-outs in human history, so that’s the overriding wet blanket situation. Until we have some type of real and credible threat to next year’s production… I don’t think there is anything on the horizon to suggest a sustained up trend at this time.”

And while the low loonie is helping today, it is a “a short-term variable,” he said.

Moreover, a low dollar doesn’t always mean good times for Canadian producers.

“The best prices we’ve ever seen on canola ($14 a bushel) was when our dollar was at par or better relative to the U.S. dollar,” said Jubinville. “And the very worst canola prices ($6) we’ve ever seen have been when we were at a 65-cent dollar.

“When the Canadian dollar is strong it is usually when commodity prices are strong and we’re selling at prices that are the most profitable. And that’s the oddity that never gets talked about.”