CNS Canola values on the ICE Canada trading platform moved lower during the week ended April 5 with declines a function of chart-related speculative liquidation orders as well as the downward price action experienced in the CBOT soybean complex.

The continued declines seen in Malaysian palm oil and European rapeseed futures during the reporting period also added to the bearish sentiment in canola. The advancing harvest of a record-size soybean crop in South America also didn’t do canola any favours. Added pressure came from news that the port congestion that had been preventing soybeans from leaving Brazil has started to clear. Underlying support in canola came from a major drop-off in farmer selling to the commercial pipeline on the Canadian Prairies. The turning off the taps, so to speak, by farmers, came in view of the uncertainty facing the planting and development of new-crop canola.

Read Also

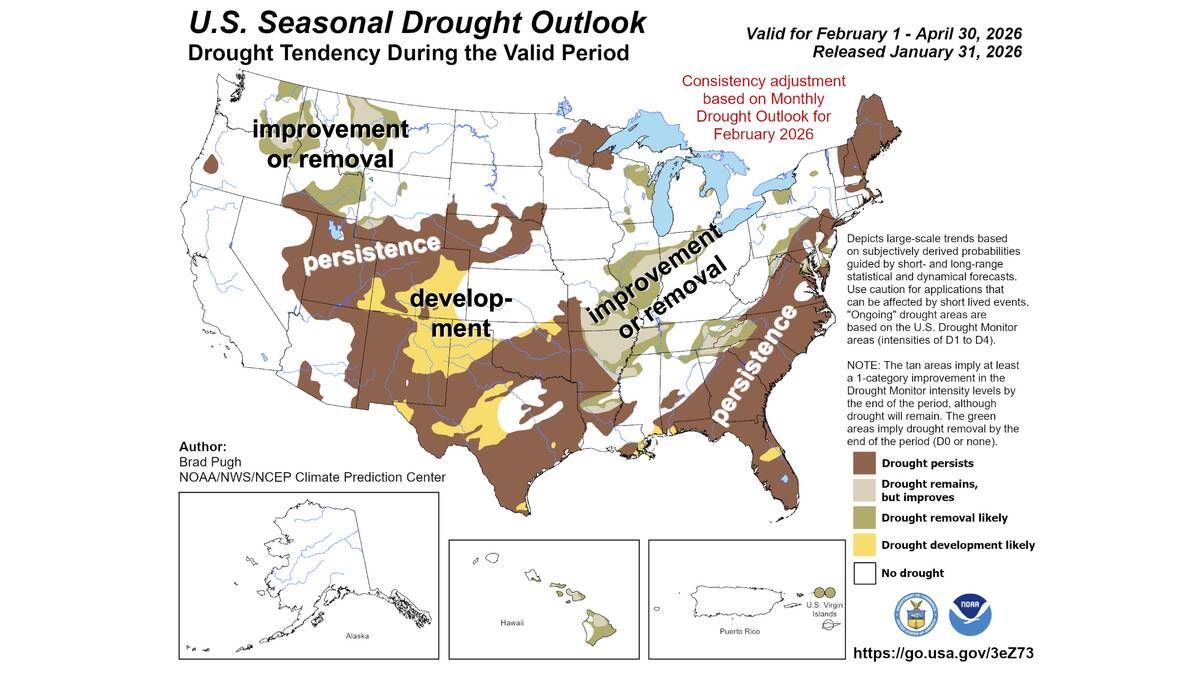

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

Weather has helped to keep a bit of a floor under values, as there are already concerns that excess moisture and cold temperatures could delay seeding operations this spring across Western Canada. The seasonal spring seeding concerns should help to keep that firm price flood under canola with steady demand from the commercial sector also likely to generate some strength.

There were suggestions circulating in the oilseed sector that canola processors will be crushing nothing but vapour based on the rate of usage. Normally that would be considered supportive for values, but some participants feel that a lesson can be learned from the recent USDA stocks report.

U.S. analysts had predicted that old-crop stocks of soybeans in the U.S. would be extremely tight and that the March 28 USDA report would even show tighter-than-anticipated supplies. Instead the report showed much-higher-than-expected stockpiles of U.S. soybeans.

Some participants as a result feel Statistics Canada may also come up with extra supplies of old-crop canola in its May 3 grain stocks in all-positions report. The reasoning for the jump in old-crop canola comes amid the fact that Canada’s canola export and domestic crush pace doesn’t seem to be slowing much. If stocks were believed to be as tight as the industry expects, exports would be the first to see a decline.

Canada’s canola crush pace continues to be running at a strong, if not record pace with exports also not that far behind. Adding to the bearish price scenario in canola were ideas that with speculators holding a large long position in the May canola future, a flush of those contracts has begun.

With open interest in the May canola future sitting around 80,000 contracts, the speculative sector was believed to be holding roughly 35,000 of those. Non-existent activity was once again the feature in the milling wheat, durum and barley market on the ICE Canada platform. No open interest exists in any of those contracts.

Soybean futures at the Chicago Board of Trade experienced declines during the week with old-crop months leading the downward price slide. Much of the selling in old crop was attributed to the USDA’s larger-than-anticipated stockpile of soybeans.

The downward price push in CBOT soybeans also came on news of a bird flu problem in China’s poultry sector. The concern was that as China takes measures to control the situation, demand for animal feed, particularly U.S. soymeal, will drop significantly and help add to the domestic supply base.

The increased availability of cheap soybeans from Brazil and Argentina on the global market only contributed to the depressed oilseed price situation. The uncertainty heading into spring seeding in the U.S. was also expected to help slow any further downward movement in values, but that didn’t stop some participants from speculating that should weather and yields for soybeans remain favourable, that values for the crop could easily drop into the US$9- to US$10-per-bushel area at harvest time.

That is certainly not what any farmer in the U.S., or Canada, wants to hear, but the fact the industry is already having those thoughts, should be taken as a cautionary note.

Corn futures on the CBOT also continued their downward price trek, with the nearby months again suffering most of the downward price push. The larger-than-anticipated supply of old-crop corn in U.S. stockpiles, as reported by the USDA on March 28, maintained its bearish impact on values.

The absence of export and domestic demand for U.S. corn added to the price weakness. Firmness in the U.S. dollar further undermined values.

Some support, however, was derived from the fact that values had reached oversold levels and were in need of a correction to the upside.

Wheat futures on the CBOT, MGEX and KCBT managed to post small to modest advances during the week with concerns about the drought-plagued U.S. Winter Wheat Belt behind some of the price strength.

Sentiment that values were oversold and in need of an upward correction also influenced some of the gain. Positioning ahead of some new USDA supply-demand tables on April 10 was also evident. The lack of precipitation in the U.S. Winter Wheat Belt and its potential impact on production will likely continue to be a feature in the wheat market at least in the near term.