The holiday season didn’t leave some feedlot operators with a lot of cheer.

Jerry Klassen, a commodity market analyst at Resilient says he has heard stories about margins being negative $500 to $700 per head in a pen close-out in early December.

WHY IT MATTERS: Even in a booming cattle market, industries within the supply chain have to navigate the waters properly for maximum profit.

Read Also

Alberta boosts investment in wetland restoration

The province plans to add 67 hectares of new wetlands to strengthen natural flood and drought defences and improve water quality.

Learning from history can keep producers ahead of the curve with emerging trends to plan accordingly, he told a recent cattle market analysis meeting in Lethbridge.

He said the U.S. steer-heifer slaughter this year will be down by approximately one million head from 2025. Beef cow slaughter is expected to be down 200,000 head and dairy cattle are expected to be static, making for tighter supplies as demand increases.

Live prices in Alberta are expected to be $345 to $355 per hundredweight in the peak periods between June and August, while dressed prices are expected to reach $560 to $580.

“Wholesale beef prices are currently at seasonal lows. January and February are usually the two lowest months of demand. But we’re looking for wholesale beef prices to make historical highs in June, July, August,” said Klassen.

Prices are expected to soften in the latter part of 2026, and North American restaurant purchasing will be a strong indicator of overall demand.

“We know that restaurant spending increases from March through June. It peaks in the summer months. U.S. market-ready cattle supplies will decline from February through June, so we have lower supplies coming in the summer, with lower fed cattle supplies and stronger demand. During the summer, you are at a sharp premium to the Alberta market, so that enhances exports fed cattle.”

Klassen said he prefers not to look too closely at retail beef prices because the commodity is often used as a loss leader for discounts to get shoppers in the store. Plus, alternative proteins such as chicken are artificially boosted in Canada by supply management.

Business cycles that transition from recession to recovery eventually find themselves at a peak with the highest point of economic spending.

The COVID-19 pandemic in 2020 featured record government stimulus in North America, including in Canada, where the federal government infused $271 billion and the Bank of Canada dropped its interest rates and spent $370 billion in quantitative easing (buying bonds). This led to unprecedented demand and a profitable period for cattle feeding in 2021-22.

The U.S. fed rate is currently hovering around 3.6 per cent, pushing borrowing costs to its lowest levels since 2022.

“Besides COVID and the sub-prime recession, this is the loosest monetary policy we have had in the last four years,” said Klassen, adding that the Bank of Canada rate of 2.25 per cent is more than half its peak rate of five per cent.

Trump’s “Big Beautiful Bill” is promising more stimulus with larger child tax benefits and moderate income Americans receiving $2,000 for a cost of $600 billion.

Canada is expected to run a deficit of $265 billion over the next four years.

Klassen said the “unprecedented” value of assets is encouraging borrowing and spending, while the Dow Jones and Canadian Stock index are at historical highs. This is fuelling higher demand, which when coupled with lower supply should help keep prices high.

“A one per cent increase in consumer spending equates to a one per cent increase in beef demand,” said Klassen.

“When the equity markets are at historical highs, typically the unemployment rate starts to go down. Disposable income increases, wages continue to increase. This is positive for consumer spending, and it’s positive for beef demand.”

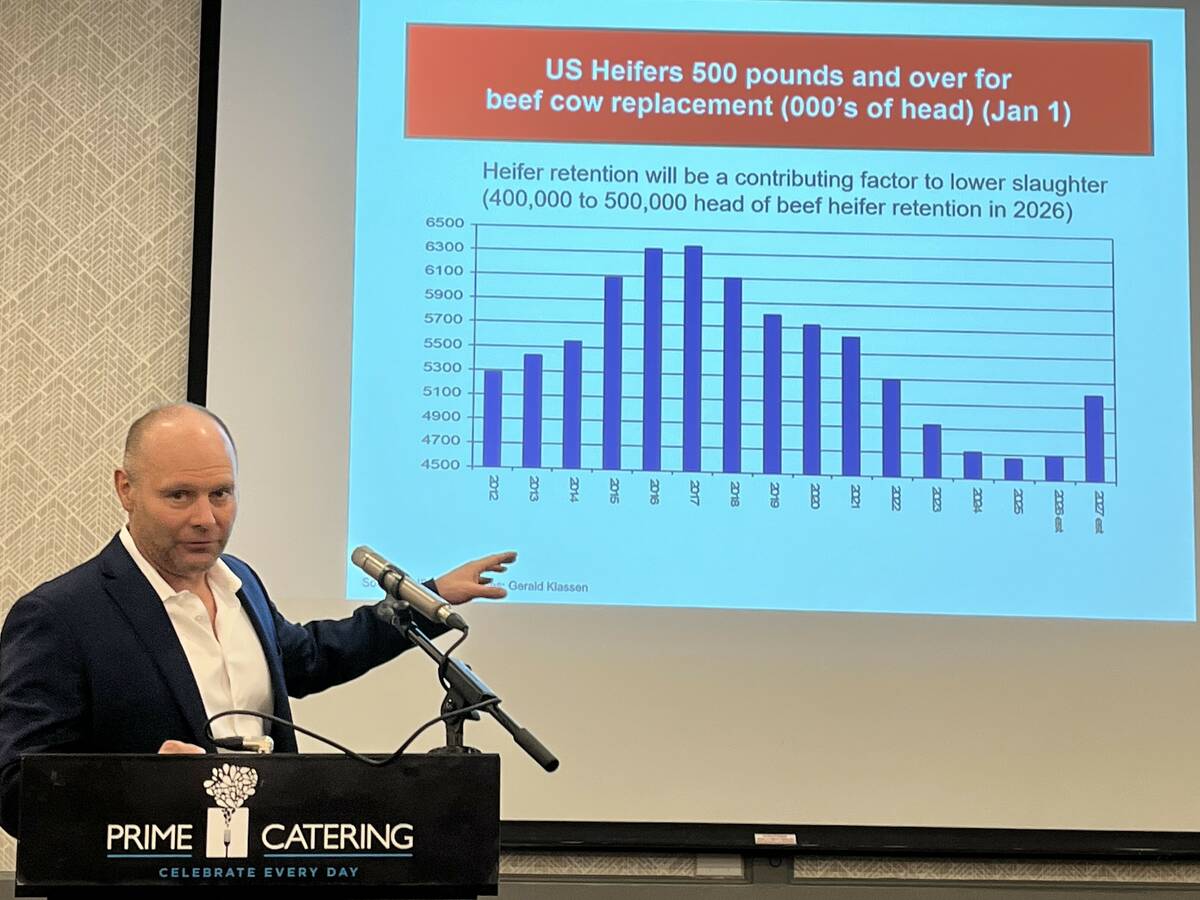

He said history has shown that there needs to be a year of historically high prices before heifer retention occurs in the cow-calf sector. Then it takes one-and-a-half years for the for those calves to come on the market.

“Some initial expansion of the cattle herd is happening. There is likely going to be a small increase (in 2026),” said Klassen.

The first big wave of heifer retention will show up as the calendar flips into 2027, which tightens feeder supplies further before any real increase in calf crop shows up.

“When there is that first big round of heifer retention, the feeder market overextends to the upside, because there is less heifers. Usually, when the price for corn or a normal commodity market, you have higher prices, you increase acreage, six months later, you have a bigger crop.”

Klassen encouraged people in the market to pay close attention to the Commitment of Traders report, often indicating the top/bottom of the market.

“When the packer is full, he can’t buy any more cattle. The elevator is full and there’s no vessel coming in,” said Klassen.

Four companies (Tyson Foods, JBS, Cargill and National Beef Packing) buy 75 to 85 per cent of the fed steers and heifers.

The feeder market needs to move high enough when supplies are tight so that finishing feedlots endure one round of negative margins.

In the fall of 2026, feedlots should be fine with snug margins through the summer because that will be when the fed cattle market will be at historical highs.

Producers should be wary of the next round, he added.

“In the fall, you will be buying calves and yearlings right at the roof, so you have to postpone it or manage it accordingly. When you have to reload is going to be the challenge.”