One thing for sure about the cattle and beef industry — you don’t have to wait long for news on some issue or other, and it can vary from hopeful to depressing.

For months, the industry has been troubled with fallout from the country-of-origin labelling (COOL) law battle with the U.S. The market consequences are becoming real as some plants near the border are planning to stop importing Canadian fed cattle. However, a resolution to that issue seems far off as it crawls through the U.S. court process and WTO appeal protocols.

Read Also

Deep cuts to ag research jeopardize Canada’s farming future

The huge cuts to ag research at Agriculture Canada are being widely panned by farm organizations, but there seems to be little hope of the government reversing its decision.

Then there is the controversy that erupted surrounding a fast-food chain’s decision to engage in mischievous advertising that could reflect negatively on Canadian beef. Then there was another E. coli outbreak attributed to burgers in Ontario.

But then some rays of hope appeared that could dampen some of the bad news — at least in the long run.

One hopeful development is the acquisition of the defunct Rancher’s Beef plant in Balzac by an American buyer. That plant can process 800 head per day and could become a significant medium-size cattle buyer in the Alberta market. No doubt feedlot operators would welcome any competition in a market dominated by the two big dogs. When the Balzac plant was originally opened there was a lot of hope, as it was financed mainly by cattle producers and feedlot operators. However, it faltered and closed as it encountered capitalization and liability concerns.

Those problems seem to bedevil almost every packing plant scheme in Canada that involves significant investment from cattle producers. I expect there is a message in that perspective. However, the new owner of the plant seems to be backed by private investment and has considerable experience in the meat-packing business. I am sure producers wish him every success.

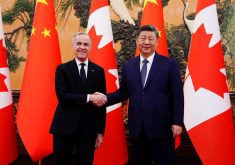

On another positive front, a deal has been struck to finalize the Canada/EU free trade agreement. Considerable mention was made that additional market access for Canadian beef and pork has been achieved, but at the expense of the domestic cheese industry. If new beef exports can be attained that could help mitigate some of the losses that COOL is inflicting on Canadian cattle and hog exports to the U.S.

However, as with most complex trade agreements, the devil will be in the details. From past experience, the initial suspicion is that crafty EU negotiators will lay technical and logistical traps that will effectively derail or stall any significant increase in Canadian beef imports. A previous deal on more EU quota access was ultimately proven unusable when logistical tactics by some market players made any beef exports to the EU too costly for Canadian exporters. So it may be premature to celebrate new beef market access that will later be thwarted by clever EU bureaucratic roadblocks.

The most obvious hurdles would be to erect onerous and complex labelling, tracing and testing standards. The fear is that Canadian negotiators in their eagerness to achieve an agreement have left too much detail to be settled later by protectionist EU bureaucrats.

Another concern is how the impending U.S./EU free trade discussions will ultimately impact the Canada/EU deal. The Americans will also be seeking vastly increased beef and pork quota access to the EU. It’s almost guaranteed that those clever Yankee traders will not be getting less than Canada. I expect further complications will arise and it may take a long time to resolve.

One hopes for the best for the beef export sector with the EU deal. But for pork, it may not be as great an opportunity. Unlike beef production, the European pork industry is large, sophisticated and robust. The Danes and Dutch invented intensive hog production and are big worldwide exporters. New EU member states such as Poland have the ability to significantly modernize and increase pork production. However, much of the EU is a high-cost production area with onerous environmental regulations. That may offer an advantage for Canadian pork exporters.

The downside for agriculture in the deal is that EU cheese imports could well increase significantly as tariffs are decreased and quotas increased. But trade-offs were inevitable and all sides were well aware of that reality. Cheese and other processed dairy products were the one food export that the EU could increase. However, I expect new quotas will be carefully managed and hopefully used as a stick to make sure that the EU realistically allows actual Canadian beef exports to occur, and not be derailed by devious protocols. Also, as EU cheese tends to be high end and expensive to produce, I expect the majority of our cheddar and processed cheese production will be mostly unaffected.

Not much has been said about how GM commodities like corn, canola and soybeans will be treated in the Canada/EU trade deal. There are exceptions in place for some corn varieties, but the EU prohibits GM canola imports. Curiously, under certain circumstances canola meal and canola oil that has been processed from GM canola can be exported to the EU. Go figure.

The GM prohibition may well continue as EU countries have the unilateral ability to make such prohibitions. That issue may have been put aside for another day. I expect the U.S. will be pursuing the GM commodity access issue in their upcoming free trade talks with the EU.

I also expect producer and industry apprehension and suspicion will continue until the Canada/EU trade details are fleshed out and exports actually happen. The underlying fear is that further wrangling and scheming over the details is sure to follow.

And least I forget, the EU has that nasty habit of using thinly disguised export subsidies to get rid of surplus products. Will this deal stop that scheme? I guess for now we can be hopeful.