We may be heading into a prolonged period of high grain prices. Many analysts say world grain stocks are so low that strong prices are likely for the next two or three or even five years.

“Don’t talk about it because you’ll just jinx it,” some will say. Certainly, there have been many occasions in the past when analysts predicted a return to the golden years in the grain business, but the good times didn’t last.

The longest spell of sustained profitability ran from about 1972 to the early 80s. There was a short blip in the mid-90s that got people excited and things got interesting in 2007-08 before cooling off in 2009.

Read Also

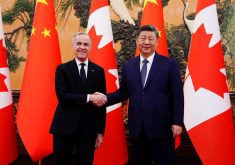

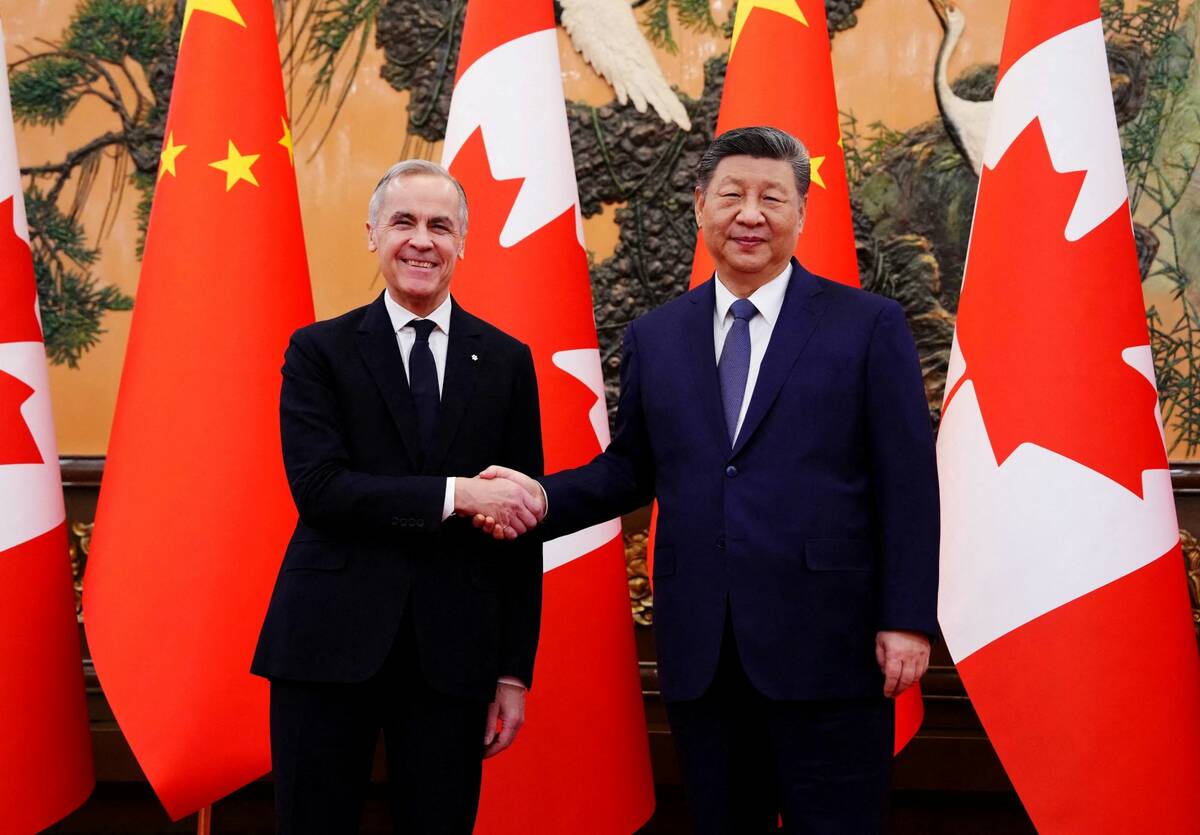

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

In total, there have been many more years of surpluses than shortages and there have been lots of years with producers looking to government for assistance.

If the analysts are right and if world demand doesn’t get side-swiped by another severe economic downturn, the years ahead could be a great time to be a farmer. However, not all the consequences will be positive.

If grain prices go too high too fast, watch out for food riots in less-developed nations. This happened in 2008 and has been reported again recently in countries such as Algeria.

The Russian drought last summer prompted a grain-export ban. Countries like India routinely change policies in order to maintain an adequate food supply. If grain becomes critically short, it could prompt all sorts of international nastiness, even wars.

About 30 years ago, Canada actually had a two-price system for wheat. The price for domestic users was set at a higher level. This was a method by which Canadian consumers could support farmers.

The policy became impractical in a world with freer trade, but you could see countries try to implement the policy in reverse should grain prices get out of hand. The domestic price could be held lower than the world price to subsidize consumers.

In recent years, there has been a push for sustainable agriculture systems. Buyers, particularly in Europe, are asking questions on how food products are produced. On this continent, Walmart has been leading the sustainable food charge. The local food movement has become a force in the marketplace.

In a world of relative food scarcity, will buyers be so discerning? Will they care as much about how and where the food is produced?

Maybe the irrational fear over genetically modified crops will fade. In fact, the technology might finally be heralded for helping to feed the world while decreasing the need to bring ecologically sensitive land into production.

Sky-high grain prices will reignite the food versus fuel debate over ethanol production. The U.S. ethanol policy gets more difficult to defend as corn rises above $7 a bushel. Nearly 40 per cent of the American corn crop goes to ethanol production.

High grain prices inevitably lead to higher prices for inputs. While this cuts into profitability, there’s little doubt that high grain prices also provide an opportunity for strong returns for producers.

In the past, that has caused farmland prices to escalate. Corporate farms have always been a bogeyman, but the worry has been largely groundless. Many, if not most family farms are incorporated entities, but large outside corporations have not jumped into farming in a major way. They have been content to sell inputs and buy grain. If grain farming becomes lucrative for an extended period, might that change?

If the market analysts are even close with their projections, a lot of paradigms are going to shift in the years ahead.

KevinHurshisaconsulting agrologistandfarmerbasedin Saskatoon.Hecanbereachedat [email protected]