With the fall calf run underway, cow-calf producers are rejoicing over this year’s dramatic improvement in prices. They have been many years with heavy losses and lots of producers have said “to heck with it all” and have sold off their herds.

Unfortunately, the big improvement in prices doesn’t necessarily mean that profitability has arrived.

The Western Beef Development Centre has been doing an extensive cost-of-production analysis and has just published results for 2008.

When the WBDC held cost-of-production workshops last winter, 40 producers attended. When incomplete or inaccurate data sets were removed from the study, 18 Saskatchewan producers ended up in the analysis.

Read Also

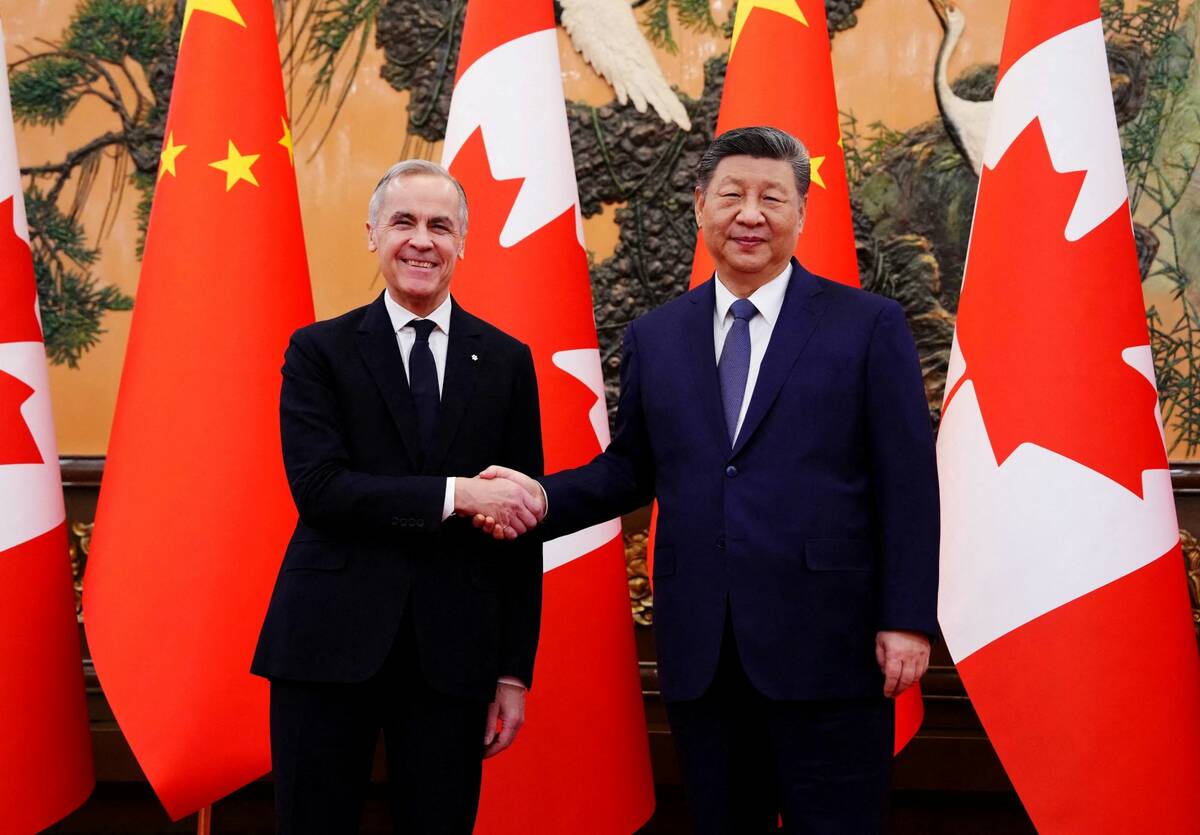

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

The average herd size was 241 cows with an average of 214 calves weaned (89 per cent). The average weaning weight was 545 pounds and the average price back in 2008 was only 97 cents a pound.

It should be noted that many of the producers in the study retained their calves after weaning and fed them to a heavier weight before selling. Since the purpose was a cost-of-production analysis on cow-calf production, all the calves were valued at weaning time even if they weren’t sold.

After considering all the costs including a value for unpaid labour, the breakeven point was $1.21 a pound, generating an average loss of $110 per cow. Taking unpaid labour out of the mix, the loss per cow was still over $70.

You can check out the cost-of-production analysis on the website of the Western Beef Development Centre (www.wbdc.sk.ca).

The average herd in the province is much smaller at somewhere between 70 and 80 head. It seems likely that a lot of smaller herds would have a higher cost of production and therefore even higher losses.

Prices this fall are substantially better than they were in 2008, but assuming the costs are similar, producers are on average making a profit of only a few cents per pound. Highercost producers will still be losing money.

Lack of scale

It’s an industry that suffers from a lack of scale.

Consider a grain operation that grows 30 bushels per acre of wheat with the wheat worth $5.50 a bushel. It takes about 1,500 acres to have a gross return of $250,000.

On canola, assuming a value of $10.50 a bushel and a 30-bushel per acre crop, a gross return of $250,000 is reached with only 800 acres.

Whether wheat or canola, those are small acreages compared to what most producers are farming.

In a cow-calf operation, let’s assume weaned calves at 550 pounds and a price of $1.25 per pound. To reach a gross return of $250,000, you’d need to sell more than 360 calves, which implies a cow herd of about 400.

If you’re running 400 cows, you’re considered a pretty big cattle producer. If you have 1,000 to 1,500 crop acres, you’re considered small fry.

Gross returns and profitability are very different measurements, but they are related. A profit of $100 per cow might seem like a dream come true and maybe we’ll get there in the years ahead with the contraction that the North American beef herd has seen. But $100 per cow profit is only $40,000 on 400 cows. It’s only $10,000 on 100 cows.

While there’s a perception that the economic situation for cow-calf producers is again rosy, the truth is that producers need far better prices to be sustainable.

Kevin Hursh is a consulting agrologist and farmer based in Saskatoon. He can be reached at[email protected].