In November, Chinese inspectors were taking a look at Canadian packing plants. That visit was all part of an industry goal to ship more Canadian beef under 30 months of age into mainland China. China is on the same page when it comes to Canadian trade and has stated it hopes to increase import trade from Canada to $60 billion by the year 2015. Beef will play a part in the growing demand for product from outside of China. Despite the internal challenges within the country such as transportation, lack of refrigeration and social class division, China is opening her doors and coaxing Canadian beef imports. In a ground-breaking decision late last summer, China stated it would begin accepting boneless beef less than 30 months and tallow for manufacturing from Canada.

Read Also

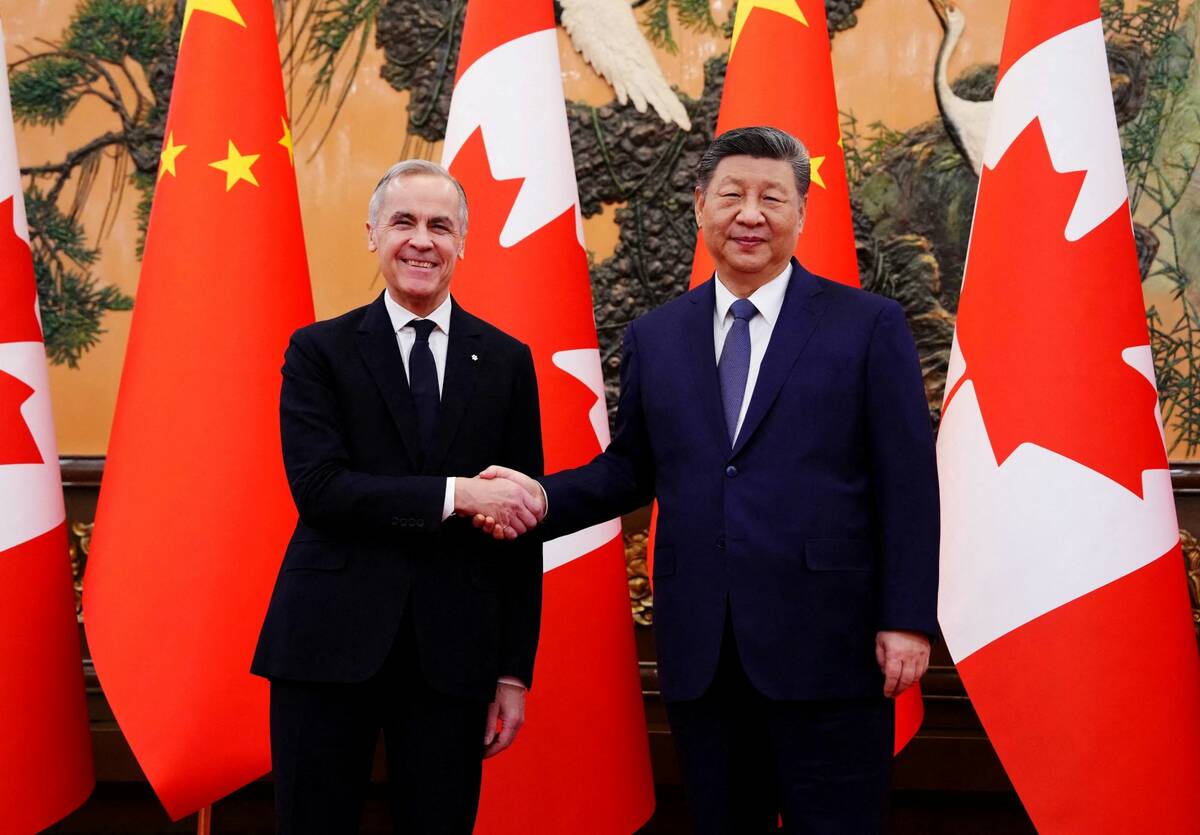

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

China is not a fragile doll when it comes economics and is a global warrior at trade. Its trade balance is healthy at plus 182.9 per cent compared to the UK at minus 641.4 per cent or Canada at minus 5.1 per cent. It is the only country in the world with an expected growth in GDP of nearly 10 per cent and a strong monetary policy.

Often, China is associated only for its exports and thus the label “Made in China” comes to mind. But China is a country of both exports and imports – a consumer as well as a trader. It is true that most exports from China go to North America. But as an importer, China buys largely from Brazil, Australia, the European Union (EU), Japan, South Korea, the U.S., Indonesia, Malaysia, Taiwan, India, South Africa, and Saudi Arabia.

As a consumer, China uses 46 per cent of the world’s coal, zinc and aluminum. The use of steel in China alone outpaces the EU, U.S. and Japan combined and this year the Chinese will buy more phones and cars, including luxury cars, than anyplace else on Earth.

Despite the anxiety they have caused the U.S. with their currency policy, the two largest banks in China, the Bank of China and the Agricultural Bank of China both reported profit earnings of 30 per cent.

America may have the world’s largest economy, but does not have the most robust. While the Americans wallow in debt that equates to 200 per cent

of GDP, China’s total debt is a manageable 20 per cent of GDP. They trump the U.S. in fiscal management and are stiff competition in terms of consumption.

Beef export independence

The message is clear; the Chinese can be a global economy without leaning on the U.S. It is in this spirit that Canada seeks independence from the U.S. in beef sales. With most Canadian export beef going into the U.S., it has been a long time coming to diversify into alternative markets that will take volume in terms of fed beef and credits, and have the ability to pay.

With the exception of vegetarian Buddhists, China is a market with a growing taste for beef.

Although the majority of rural folks will never see Canadian beef in their hot pot, 160 accessible cities have a population of over one million people (the largest city is Chongqing which has a population of 32 million). With a total population of 1.3 billion, there is ample room to negotiate cut, quality and price and that includes value-added product. In June of this year the demand for further-processed meats in China climbed by 16 per cent and while that in itself may not be news, it is all part of a bigger story. In the eight years leading up to 2008, demand for processing beef increased by 345 per cent. Further-processing of meat is the fastest growing sector in the meat industry in China.

At some point, China will get its order together. Canada will be there to fill it and that leaves us with several questions. Will we have enough beef to satisfy such a significant order? Will diverting beef destined for the U.S. eliminate our unfavourable selling basis and be a long-term economic driver in beef production or will it cause other trade wars? What will we have to buy from China in order to sell more beef into it? Regardless, the dragon is firing its beefy breath and a great deal for our industry may be the one that is made in China.

BrendaSchoeppisamarketanalystandtheownerandauthorofBeeflink,anationalbeefcattlemarketnewsletter.Aprofessionalspeakerandindustrymarketandresearchconsultant,sheranchesnearRimbey,Alberta. [email protected]

———

Withatotalpopulationof1.3billionpeople,thereis ampleroomtonegotiatecut,qualityandpriceand thatincludesvalue-addedproduct.