Dermot Hayes, a respected livestock economist from Iowa State University, is admittedly flummoxed over the question of whether it will be grain producers or the livestock sector benefiting from the growing demand for protein in emerging economies.

Hayes was in Winnipeg to deliver the annual Kraft Lecture, a memorial to the late University of Manitoba agricultural economist Daryl Kraft. In a nutshell, his presentation went something like this: Trends in international trade will either create a boom or a bust for the North American livestock sector — depending what happens.

Read Also

Deep cuts to ag research jeopardize Canada’s farming future

The huge cuts to ag research at Agriculture Canada are being widely panned by farm organizations, but there seems to be little hope of the government reversing its decision.

If emerging economies continue to buy feed grains to develop their own livestock sectors, they are a competitor for North American meat producers. If they decide to buy the meat instead, they become a customer.

His assessment of the opportunities and the risks of exports for the North American livestock sector was in many ways a sobering outlook, particularly for those in the livestock sector banking exports as a path to prosperity.

There’s a lot we don’t yet understand about those markets and the cultural dynamics driving them.

Hayes, who has travelled extensively in China and other countries where wealth and food demand are simultaneously rising, points out that the parts of the animal we like to eat — the so-called premium cuts such as boneless chicken breasts and pork loins — are too blasé for the nouveau middle and upper classes in China, one of our largest target markets.

To illustrate his point, he popped up a slide of a young woman in an upscale restaurant, ready to chow down on a chicken head. Deep-fried pork skins and pigs feet are other delicacies, as are chicken lungs and blood in Vietnam.

Some of these products actually sell at a premium to boneless chicken breasts.

Once you’ve got over your “ick” response, consider the value-added implications. That’s a well-paying market for parts you can’t give away in North America.

But will North America be producing the animals and selling the parts to the emerging economies or will it be selling the grains to produce those animals?

On virtually every economic measure — transportation, production efficiency, manure management costs — Hayes believes it makes sense for North America to be feeding and slaughtering livestock and exporting the meat and products.

The people in China, the most arable land and the livestock are compressed into the coastal regions — which raises the spectre of disease outbreaks. Its productive land base is about 275 million acres, compared to 300 million in the U.S. and 100 million in Canada. But it is faced with feeding four times the population of the U.S. and Canada combined.

Economically speaking, China gets more value from importing the meat than it does the grains. For example the 3.5 million tonnes of corn it has imported so far this year equates to about one million acres of production.

However, since the fall of 2011, China has also been importing the meat from more than a million pigs each month. That’s equivalent to 5.5 million tonnes of corn.

More than half of China’s pork production today is produced in small-scale “backyard” operations, in which productivity is low and disease outbreaks are high. But that system is disappearing quickly as more people acquire a car and find employment.

Keep in mind that China is a country in which the CPI, known as the consumer price index in Canada, is dubbed the China Pork Index because the cost of pork figures so prominently in the rate of inflation. In 2011, for example, it accounted for 20 per cent of the inflationary pressure, which if running rampant, creates political instability.

In Hayes’ view, building a modern pig industry in China “is a huge waste of grain, energy and people.” Yet China continues to import feed grains, a clear indication it prefers to expand meat production.

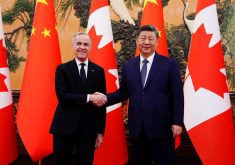

Chinese officials inked deals for another 8.6 million tonnes of soybeans during a February visit to the U.S.

All of this has led this imminent economist to conclude it’s not a question of economic policy. “The future depends on disease,” he said. Specifically, it’s whether authorities there will be able to manage the risk without compromising production. But the same applies here.

Whereas disease outbreaks in Asia would cut into production, an outbreak in North America could kill its export markets indefinitely, such as was the case with bovine spongiform encephalopathy.

The rhetorical question of “Who will feed China?” is easily answered: China. The uncertainty for suppliers is how.