MarketsFarm — There is presently little upside to new-crop November canola on ICE Futures, according to analyst Errol Anderson of ProMarket Communications in Calgary. Anderson pointed to losses in Malaysian palm oil and weakness in China’s soymeal market as weighing on ICE canola values, with more pressure coming out of South America. “The [soybean] production […] Read more

ICE weekly outlook: New-crop November canola set to step back

StatCan not expected to sway futures much

Louis Dreyfus expanding Yorkton canola crush plant

New expansion would more than double plant's capacity

Louis Dreyfus’ Yorkton, Sask. canola crushing plant is about to undergo another major expansion. The project, announced Tuesday, is expected to add an additional canola crushing line and more than double the plant’s annual capacity to over two million tonnes upon completion. Construction is due to begin later this year. The crush plant, built in […] Read more

Canola fund short position shrinking

Managed money is net long on corn, soy

MarketsFarm — Managed money fund traders continued to cover their large short positions in canola in early April, according to the latest Commitments of Traders report from the U.S. Commodity Futures Trading Commission (CFTC). As of April 4, the net managed money short position in canola futures came in at 49,470 contracts (70,671 short; 21,201 […] Read more

Bidding open for Merit Foods for two more weeks

Stakeholder Burcon plans to put up 'compelling bid'

The fate of Winnipeg pea- and canola-based protein processor Merit Functional Foods won’t be confirmed until the end of April at the earliest. Merit, whose major shareholders include Vancouver plant-based protein firm Burcon NutraScience, U.S. agrifood firm Bunge and former executives of Hemp Oil Canada, was placed into receivership March 1. According to the first […] Read more

Palliser Triangle: It’s hot and dry — and the next frontier for canola

With crush capacity soaring, canola council looks to the brown soil zone

Reading Time: 4 minutes The canola industry has its eyes on the Prairies’ most inhospitable regions and knows potential growers will need support. The Canola Council of Canada is setting up research it hopes will drive sustainable canola growth in the brown soil zones of the Palliser Triangle, one of the hottest, driest regions of the Prairies. With canola […] Read more

ICE weekly outlook: Not a matter of when, but where canola peaks

Prevailing trend remains downward

MarketsFarm — As the rally in canola on ICE Futures continued Wednesday, an analyst stressed it’s not when this upswing ends, but where. David Derwin of PI Financial in Winnipeg spoke of when canola prices were falling, and they broke through that psychological barrier of $800 per tonne on their way down. “That was the […] Read more

Canola fund short position still rising

Managed money net long in soybeans

MarketsFarm — The size of the fund short position in continued to rise in early March, according to the latest Commitments of Traders data out from the U.S. Commodity Futures Trading Commission (CFTC). As of March 7, the net managed money short position in canola came in at 46,222 contracts (61,998 short/15,776 long), an increase […] Read more

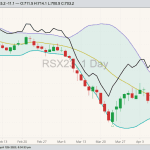

ICE weekly outlook: Canola continues its collapse

Limited demand, more farmer selling seen

MarketsFarm — After losing $62 per tonne the week before, the May contract on the ICE Futures canola market extended its losses for the week ended Wednesday with little relief on the horizon. Winnipeg-based trader Jerry Klassen of Resilient Commodity Analysis said the massive selloff is the result of farmers realizing there wouldn’t be a […] Read more

ICE weekly outlook: No floor in sight for overdone canola

'A lot of money playing around in canola right now'

MarketsFarm — The ICE Futures canola market was in freefall mode through the first half of March, hitting its weakest levels in over a year. While the losses may be looking overdone, the bottom remains to be seen. “This has been a brutal drop in canola,” said Bruce Burnett, director of markets and weather with […] Read more

Canola crush of 2022 smallest in five years

Meanwhile, soybean crush rose on the year

MarketsFarm — Statistics Canada (StatCan) reported that 2022 had the smallest domestic canola crush for a calendar year since 2017. As well, 2022 marked the smallest canola oil production in five years and the least amount of canola meal produced in four years. The sharp reduction of canola being crushed was due to the 2021 […] Read more