MarketsFarm — ICE Futures canola values sit high atop a precipice, tittering toward a steep drop. One recourse for canola is to bank on prices for soyoil and soymeal on the Chicago Board of Trade (CBOT) to rise sharply in the near future — or take that step off its perch to what would be […] Read more

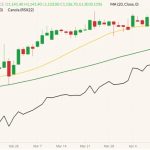

ICE weekly outlook: Canola seen as teetering, likely to tumble

'A lot of emotion and tension' in market

ICE weekly outlook: Strong canola market to ‘see both sides of rainbow’

MarketsFarm — ICE Futures canola contracts climbed to their highest levels ever during the week ended Wednesday before running into some profit-taking resistance. Its general uptrend remains intact for the time being, but a downturn is also inevitable. The nearby May canola contract hit a session high of $1,177.80 per tonne on Wednesday, before backing […] Read more

ICE weekly outlook: Canola lower, but expected to climb

MarketsFarm — Although canola prices closed lower on Wednesday, the Canadian oilseed is seen as still likely to grind higher in the coming weeks. “The charts and the patterns that have developed, and are still in place for canola, have been kind of the same for the past few months. The longer-term trends are still […] Read more

ICE weekly outlook: Canola’s contract highs still underpriced

MarketsFarm — The ICE Futures canola market posted solid gains during the week ended Wednesday, hitting fresh contract highs in many months. The most active May contract hit a session high of $1,143.70 per tonne on Wednesday, but settled off that mark at $1,125.20 per tonne. While canola may be trading in uncharted territory, there […] Read more

2021 was a very robust year for Canadian ag

Reading Time: < 1 minute Canadian farmers contribute nearly $140-billion to the economy, says a new snapshot of the sector from AgCanada. “Despite COVID-19, the drought in Western Canada, the flood in British Columbia and other trade disruptions, the overall agriculture sector saw growth in 2021 and is expected to continue to perform well in 2022,” the department said. It […] Read more

ICE weekly outlook: Canola finding plenty of support

MarketsFarm — ICE canola futures climbed to fresh contract highs during the week ended Wednesday, as activity in outside markets and canola’s own tight supply situation provided support. “Outside forces help it, but there are also things unique to the canola market that are supportive,” said David Derwin, commodities investment advisor with PI Financial in […] Read more

Adjustments minor in latest AAFC crop balance sheets

MarketsFarm — Only minor adjustments to the old- and new-crop balance sheets were reported by Agriculture and Agri-Food Canada in their February supply/demand report, released Friday. New-crop production estimates were left unchanged for all of the major grains, oilseeds and pulses, with a return to average yields across the Prairies expected to lead to increased […] Read more

ICE weekly outlook: Rangebound canola market consolidating

MarketsFarm — ICE Futures canola contracts moved lower during the week ended Wednesday before uncovering some support, as the commodity remained stuck in a range after trending higher for most of the past year. “Canola is caught in a rangebound, consolidation phase,” said MarketsFarm Pro analyst Mike Jubinville. The relative stability in canola, he said, […] Read more

ICE weekly outlook: No independent strength left in canola

MarketsFarm — At a little more than halfway through the 2021-22 marketing year for canola, a trader asserted the Canadian oilseed now lacks the ability to move independently. Rather, it will follow the ups and downs in oil and meal markets. “[Canola] did its thing months ago,” trader Ken Ball of PI Financial in Winnipeg […] Read more

Corteva CEO bullish on grain, oilseed prices for 2022

Reuters — Corteva expects prices for grains and oilseeds to remain high this year on record demand levels, its CEO said Thursday, following the insecticide and seed company’s upbeat sales outlook a day earlier. Global agriculture demand and prices for crops picked up pace in the fourth quarter of 2021, thanks to economies reopening and […] Read more