Lamb producers in Alberta are facing a sea of uncertainly after a company that hailed itself as the future of the sector went into creditor protection owing more than $50 million.

The two big questions are whether the massive flock owned by North American Lamb Company (NALCO) will flood the market and send prices into a tailspin and whether its lamb processing plant at Innisfail, the only federally inspected one in the West, will stay in business.

[READ MORE] Lamb company had big ambitions but was never profitable

Read Also

Farmfair International boosts accessibility with weekend schedule shift

Farmfair International is changing its scheduling format to include the weekend and hopefully attract even more attendees.

“Right now, it’s essentially going to cause price fluctuations,” said Alberta Lamb Producers chair Brittany Walker, who has a flock of 300 sheep near Strathmore.

“About 35,000 head could flood the market unless they go as breeding stock. There is a potential for prices to decrease.”

The company was given creditor protection last month but all of its facilities — its Innisfail processing plant (formerly known as SunGold Specialty Meats); a breeding unit and large feedlot in Iron Springs; and sheep and breeding operations at four locations in Manitoba — are still operating. Ernst & Young, the court-appointed monitor, is overseeing the company while it is under creditor protection.

“The best hope would be to spread the sale of the flock over an extended period of time to not oversupply the market in the fall run period,” said Walker. “With so much uncertainty surrounding the outcome of NALCO and its subsidiaries, this creates an unpredictable future market for the sheep industry.

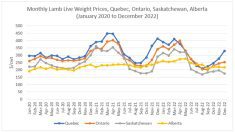

“Typically, prices are worse in the summer, … but they are dropping quite a bit more than they have in previous years.”

Efforts are being made to protect the small Canadian lamb market, said Neil Narfason, one of two Ernst & Young officials overseeing operations of the troubled company.

“We’re trying to be careful about not killing the market,” he said. “The (breeding) ewes are the toughest part. Feeder lambs and lambs are pretty straightforward.

“We need to be careful about how to sell animals and that we aren’t depressing the market. We need to sell at good pricing and have enough interest at buying, so there will be a recalibration as you redistribute the number of animals through a number of different producers.”

Big plans went south

When launched in 2018, the company’s president criticized the way the lamb sector operated and said NALCO would revolutionize it by offering a consistent product (lambs with the same genetics raised the same way) on a year-round basis. The latter would be accomplished by breeding ewes continuously in indoor facilities, it said.

The Iron Springs feedlot and SunGold plant were merged with the New Zealand company’s Manitoba facilities but the joint venture never made money. And in its final few months, the members of the divided board as well as the company president resigned amid bitter wrangling.

Since the news broke in early August, Walker and her association have fielded numerous calls and emails from worried producers.

“At this point, Alberta Lamb Producers is not really certain about what is going on,” said Walker.

“They are operating to a certain date. That date might change, but it’s business as usual at this point. That comes with a lot of uncertainty.”

There are fears about the future of the Innisfail plant, the only federal lamb processing facility in Western Canada and the only one able to process large numbers of animals.

“There are other processors, but they aren’t doing the same volume by any means,” said Walker, adding there are about 30 provincial plants that process lamb, but they are generally small and also process other livestock.

“Depending on what happens to the plant, that will have an impact on producers, but until that is dealt and sorted with, we can’t say if it will be a negative or a positive. If it’s maintained, that will be better for producers, because we will have a competitive market.”

Sending animals to a federally licenced processing plant in Ontario, so the lamb products can be sold nationally, is an option but not a great one.

“If there’s no domestic market and no (domestic) processing, then we’re sending them to Ontario and we are at the mercy of the Ontario price,” she said. “They can set it at what they want. It costs a lot to ship lamb out to Ontario.”

‘Lots’ of buyer interest

Narfason said the sale of the plant is a priority, and they would like to sell all the operations together, if possible.

“Once we have all these bids in, we would negotiate,” he said. “If we have a buyer for everything, that’s easy. If we have multiple buyers and components, we will negotiate agreements and go back for court approval and close these deals. The idea is to try to close everything to new buyers before Christmas.”

Walker said she is hopeful a new owner will be found.

“There would be a concern if there were no buyer for sure, but they are pretty confident they will find a buyer,” she said.

“But there’s no reason to believe that we cannot continue operating,” added Narfason. “It’s a restructuring, so no employees have left the plant. They’ve got a great team and it continues to hum along. Producers are selling lamb to the plant.”

Narfason said Ernst & Young has received calls from producers concerned about what would happen if the plant shut down, but the signs are good.

“We are confident the plant will continue,” said Narfason. “We already have lots of interest from potential buyers for the plant, and we haven’t started the sale process yet.”

For now, sheep farmers in the province, and Western Canada, wait to see how things play out, said Walker.

“Producers should keep an eye on it, and keep track of it and what is going on because they are a large producer with about 35,000 head,” she said. “Being that large, there is going to be an impact on the industry, negative or positive.

“It’s an evolving situation and producers should be watching this, and make informed decisions on marketing for next year and breeding timelines.”

The court materials — including an affidavit from the former company president — can be found here. Alberta Lamb Producers is also posting information on the producers section of ablamb.ca.